FBL Financial Group, Inc. (NYSE:FFG) reported fourth-quarter operating earnings of 99 cents per share, which missed the Zacks Consensus Estimate of $1.05 by 5.71%. Also, the bottom line decreased 2.9% due to lower premiums and higher expenses.

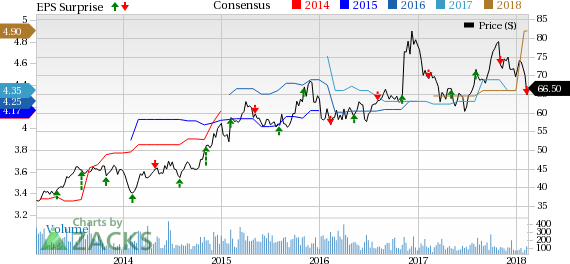

FBL Financial Group, Inc. Price, Consensus and EPS Surprise

Including benefits of $3.42 per share from the Tax Cuts and Jobs Act of 2017, gains from other investment-related income of 13 cents, lower interest sensitive product charges as well as higher benefit reserves totaling 10 cents, net income came in at $4.33, increasing more than fourfold year over year.

Behind the Headlines

Revenues of $183 million missed the Zacks Consensus Estimate of $185 million by 0.84%. The top line slipped 0.6% year over year, mainly on higher investment income.

FBL Financial’s total premiums collected were $153.7 million, down 11.3% year over year. Premiums and product charges decreased 3.3% to $75.8million in the quarter under review. Interest sensitive products charges were down 9.2% year over year to $26.3 million while traditional life insurance premiums inched up 0.1% year over year to $49.5 million.

Investment income improved 5.7% year over year to $107.3 million in the reported quarter owing to a rise in average invested assets as well as an increase in other investment-related income. As of Dec 31, 2017, 97% of fixed maturity securities in the company’s portfolio accounted for investment grade debt securities.

Total benefits and expenses increased nearly 3% to $153.4 million in the quarter, mainly due to higher interest sensitive product benefits, underwriting, acquisition and insurance expenses plus other expenses.

Full-Year Highlights

FBL Financial posted adjusted earnings of $4.32 per share on revenues of $735.5 million. While the top line improved 1.2%, the bottom line increased 1.6% over the figures recorded in 2016.

Financial Update

As of Dec 31, 2017, book value per share was $55.59 compared with $47.61 as of Dec 31, 2016. Excluding accumulated other comprehensive income, the metric was $46.09 at the reported quarter-end compared with $41.60 at 2016-end.

Cash and cash equivalents of $52.7 million at 2017-end improved from $33.6 million at 2016-end. Total investments increased to $8.6 billion as of Dec 31, 2017 from $8.2 billion at year-end 2016.

The company exited 2017 with total assets of $10.1 billion, up from $9.7 billion at year-end 2016. Debt level remained flat at $97 million compared with the level as of Dec 31, 2016.

During the quarter under discussion, the company bought back 3511 shares. It has $49.2 million remaining under its stock repurchase program.

Zacks Rank

FBL Financial carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other firms from the insurance industry that have reported fourth-quarter earnings so far, the bottom line of The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) surpassed the respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

FBL Financial Group, Inc. (FFG): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research