Building Moroccan momentum once again

Fastnet, (FAST.L) has made another important step ahead of 2014 drilling with CPR confirmation of contingent and prospective resources at Tendrara as well as desktop studies confirming both a robust drill plan and potential development scheme. Meanwhile, the Foum Assaka farm-out process is close to completion (due in December), with Fastnet looking to beat the impressive Kosmos/BP deal secured recently. Both Moroccan targets are set to be drilled in H114, subject to rig deals, while Celtic Sea drilling is now likely to be a 2015 activity, subject to farm-out. The ball is already running in Morocco, with Cairn expecting to hit TD at Foum Draa in late December, with 10+ wells planned to drill over the next 12 months.

Tendrara CPR moves drilling closer

Three separate desktop studies have supported a CPR confirming 311bcf (116bcf net) of contingent resources at Tendrara with TE-5/Lakbir shaping up to be the preferred drill target in late H114. The success criteria for a fully funded appraisal well is well defined (sustainable rates need to be above 4mmscf/d) while 1,346bcf of prospective resources offer plenty of running room in the success case.

Foum Assaka farm-out terms eagerly anticipated

Fastnet’s partner, Kosmos, recently secured a farm-out with BP for Foum Assaka, which matches the best terms secured offshore Morocco. Fastnet is in the process of closing its own farm-out process for Foum Assaka, which we expect to conclude in early December, with drilling of the first target (the 360mmboe Eagle-1 well) set to spud in Q114, subject to rig availability. Meanwhile, investor interest in offshore Morocco will surely grow as a multi-well drilling campaign is progressed, with Cairn’s Foum Draa target the first to report, probably in late December 2013.

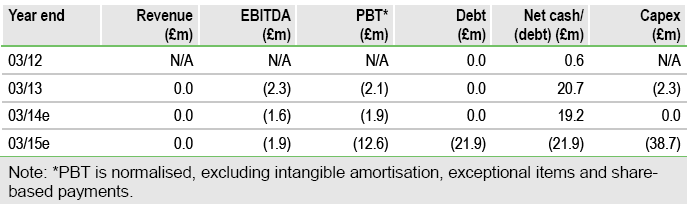

Valuation: Awaiting farm-out terms

Based on Kosmos/BP farm-out terms, our valuation currently sits at 40.5p per share, although we would expect this to increase if Fastnet can secure more attractive terms, which would not be altogether surprising. On a bottom-up DCF basis (although not adjusted for either running room or potential dilution), our RENAV sits at 50.4p, having been adjusted for both Tendrara and Eagle-1 resource estimates. Either way, there is clear potential for Fastnet to make gains in the coming months, from both its own newsflow and neighbouring drill activity offshore Morocco. In contrast with Morocco, Celtic Sea activities have been slower than expected, with drilling now likely in 2015, subject to farm-out discussions that we expect to firm up in the coming months.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fastnet: Building Moroccan Momentum Once Again

Published 11/19/2013, 06:23 AM

Updated 07/09/2023, 06:31 AM

Fastnet: Building Moroccan Momentum Once Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.