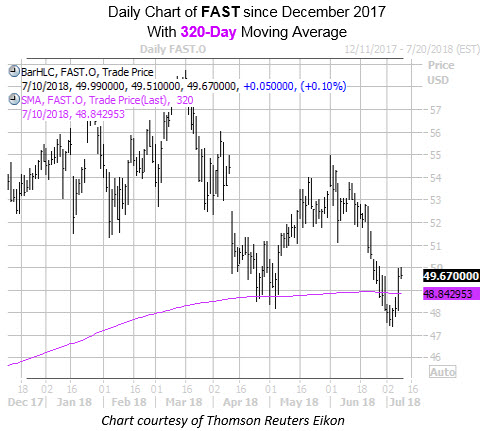

Fastenal Company (NASDAQ:FAST) is slated to report second-quarter earnings before the stock market opens tomorrow morning. FAST stock is trading up 0.1% at $49.67 at last check, on track for a second straight close above the 320-moving average, which it briefly fell below during a recent pullback to its June 5 year-to-date low. Year-over-year, the shares have gained 13%.

Digging into earnings history, FAST stock has closed lower the day after the company reports in all but one quarter over the past eight -- including the last five in a row. On average, the shares have swung 4.7% in the subsequent session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a 7.5% next-day move for Wednesday's trading.

In the options pits, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows the machinery and equipment concern with a 10-day put/call volume ratio of 1.96, ranking in the 88th percentile of its annual range. In other words, puts have been purchased over calls at a faster-than-usual clip during the past two weeks.

On the flip side, analyst attention has been optimistic towards Fastenal stock, with six of the 10 brokerage firms following the stock sporting "strong buy" ratings. Further, FAST's average 12-month price target of $55.08 sits at a 10.9% premium to current trading levels.