Fastenal Company (NASDAQ:FAST) is set to report second-quarter 2016 results on Jul 12, before the market opens.

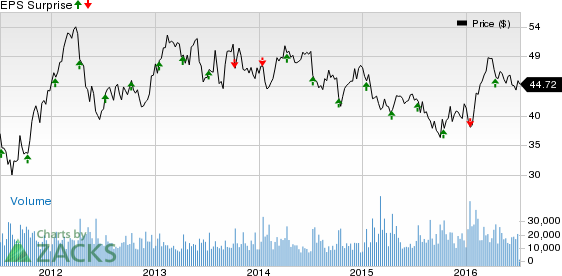

Last quarter, Fastenal delivered in line results. The company has posted two positive earnings surprises in the past four quarters. However, it has an average four-quarter negative surprise of 0.45%.

Let’s see how things are shaping up for this announcement.

Factors to Consider this Quarter

Fastenal’s revenues are being hurt by lower sales to customers in the oil & gas industry, softness in the Canadian business and overall weakness in the industrial economy. These trends are likely to impact results in the soon-to-be reported quarter.

Moreover, lack of price inflation, an unfavorable product mix, and pricing and competitive pressure are hurting gross margins. The product mix has shifted from high-margin fastener products to lower margin non-fastener products. The customer mix has shifted toward the large-account end-market, which produces low gross margins but stronger operating income.

Indeed, the company does not see any improvement in gross margin rates through the rest of 2016 as well. Estimates have been going down ahead of the company’s second quarter earnings release.

These trends are reflected in May 2016 sales figures, as the company continued to report weakness in the fasteners business.

While May net sales increased 6.2% year over year, daily sales improved 1.1%, which was softer than the 3.8% increase in April. Unfavorable currency impacted sales by 0.5% in the month, compared to a negative impact of 0.4% last month.

On a positive note, vending trends improved in the first quarter of 2016 as efforts to improve the quality of signings/installs paid off. The company intends to increase its investment in the vending program and expects it to outperform through 2016 and beyond.

Earnings Whispers

Our proven model does not conclusively show that Fastenal is likely to beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. Unfortunately, that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP is 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at 48 cents.

Zacks Rank: Fastenal’s Zacks Rank #3 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about an earnings surprise.

However, we caution against stocks with Zacks Rank #4 and #5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions momentum.

Stocks to Consider

Here are some companies in the construction sector, that, according to our model, have the right combination of elements to post an earnings beat this quarter:

Louisiana-Pacific Corp. (NYSE:LPX) , with an Earnings ESP of +4.0% and a Zacks Rank #1.

Owens Corning (NYSE:OC) , with an Earnings ESP of +9.41% and a Zacks Rank #2.

Potlatch Corporation (NASDAQ:PCH) , with an Earnings ESP of +42.86% and a Zacks Rank #2.

OWENS CORNING (OC): Free Stock Analysis Report

FASTENAL (FAST): Free Stock Analysis Report

LOUISIANA PAC (LPX): Free Stock Analysis Report

POTLATCH CORP (PCH): Free Stock Analysis Report

Original post

Zacks Investment Research