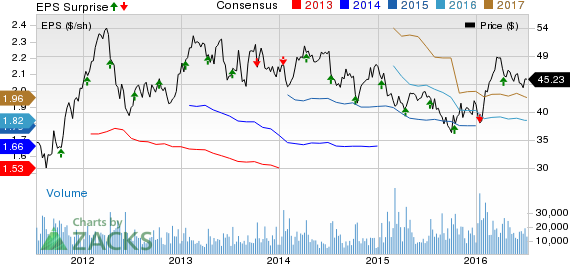

Fastenal Company (NASDAQ:FAST) reported lower-than expected results in the second quarter of 2016, missing estimates for both earnings and sales. Shares declined almost 4% in pre-market trading.

Earnings Miss

Adjusted earnings of 45 cents per share in the second quarter missed the Zacks Consensus Estimate of 48 cents by 6.25%. Earnings also declined 6.3% year over year due to weak sales and margins.

Sales Remain Weak

Net sales of $1.01 billion missed the Zacks Consensus Estimate of $1.02 billion by 0.8%. Sales increased 1.6% year over year.

Net sales at the Canadian business increased about 4% in local currency during the quarter while it was less than 7% increase in the previous quarter. Fires in Western Canada in the month of May hurt sales in the country.

Fastenal’s total average daily sales increased 1.6% in the second quarter of 2016, much lower than a 5% increase in the prior-year quarter. It was also softer than 1.9% increase reported in the first quarter. Foreign exchange dragged down daily sales growth rate in the quarter by 0.4% while acquisitions added 0.6% to sales.

Fastenal’s sales, in the past few quarters, have been affected by price deflation of fastener products, currency headwinds and lack of new products and services. The top line has been adversely impacted by lower sales to manufacturing and construction customers due to overall weakness in the industrial economy.

On a monthly basis, daily sales remained flat in June but increased 3.8% in April and 1.1% in May. The growth rates fell short of 6.1%, 5.3% and 3.7%, respectively, in April, May and June of 2015.

This industrial and construction supplies wholesale distributor serves customers in the manufacturing and non-residential construction markets.

Daily sales to manufacturing customers (representing almost 50% of revenues) rose 0.7%, down from growth of 3.8% in the prior-year quarter and 0.9% in the previous quarter.

The daily sales growth rate of fastener products (used mainly for industrial production and accounting for nearly 40% of the company’s business) declined 2.4% in the quarter, compared to flat in the year-ago quarter and a 1.7% decline recorded in the previous quarter.

Price deflation of fasteners and lower demand from the heavy machinery manufacturing customer base -- due to lower production requirements -- has been hurting fastener sales.

Non-fastener product sales (used mainly for maintenance) increased 4.7%, same as last quarter but much less than an increase of 9% in the prior-year quarter. Though the non-fastener business is doing better than fasteners driven by strong vending trends, it has nonetheless weakened in the last eight quarters due to prevailing weakness in the industrial environment.

In the non-residential construction market, daily sales to non-residential construction customers (representing 20% to 25% of revenues) declined 1.7% as against a 1.6% increase in the prior-year quarter and a decline of 0.4% in the previous quarter. Volatility and softer energy prices impacted sales in this market.

Vending Trends Continue to Improve

As of Jun 30, 2016, Fastenal operated 58,346 vending machines, up 15.3% year over year. During the quarter, the company signed 4,869 machine contracts, up 4.8% from the last quarter. The daily sales to customers with industrial vending grew 2.7% year over year. Vending machines now account for 44.6% of the company’s sales, higher than 44.5% in the prior quarter.

After remaining soft in 2013, vending trends improved through 2014 and 2015 as well as the first half of 2016, as the management’s efforts on enhancing the quality of signings/installs paid off.

Margins Decline

Gross margin of 49.5% in the second quarter of 2016 declined 80 basis points (bps) year over year and 30 bps sequentially. Gross margin was hurt by an unfavorable customer mix and product mix.

The customer mix shifted towards the large account end-market, which produces low gross margins but stronger operating profits. The product mix shifted from high-margin fastener products to non-fastener products.

Pre-tax earnings declined 7.7% to $207.8 million due to higher payroll costs. Pre-tax margins declined 210 bps to 20.5% in the quarter.

Fastenal Company has a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the building products sector include Beacon Roofing Supply, Inc. (NASDAQ:BECN) , The Home Depot, Inc. (NYSE:HD) and Lowe's Companies, Inc. (NYSE:LOW) . While Beacon Roofing Supply sports a Zacks Rank #1 (Strong Buy), The Home Depot and Lowe's Companies carry a Zacks Rank #2 (Buy).

HOME DEPOT (HD): Free Stock Analysis Report

FASTENAL (FAST): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

BEACON ROOFING (BECN): Free Stock Analysis Report

Original post

Zacks Investment Research