After nine out of ten years of double digit appreciation, reaching upwards of 30% each year, farmland values are reverting back to their historical averages of 8% to 10% appreciation. Two reports produced by Farm Credit Services of America (FCS), which includes analysis of sales transactions and benchmark report, show similar trends of appreciation rates cooling down from their record highs in 2012; decreased buyer sentiment towards farmland due to falling commodity prices over the past year attributed to the leveling of farmland values.

Sales Report

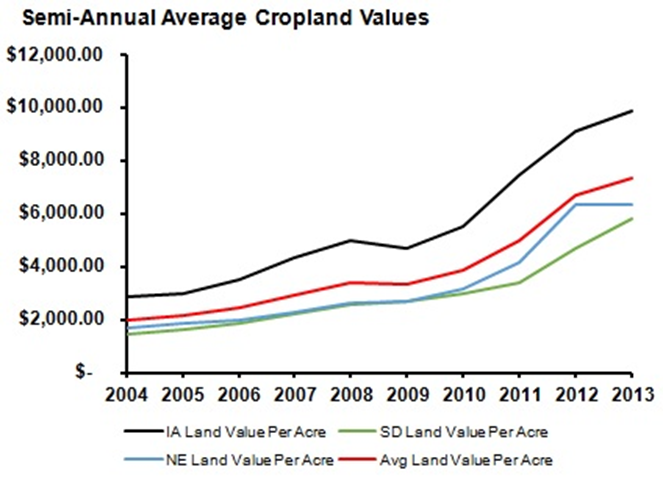

Over the past ten years land values have increased on average 16% annually for a total of 147.5% over the time period. The 10.7% appreciation reported by the FCS Cropland Value report in 2013 is consistent with the one year average reported by the USDA Economic Research Service (8.0%), who has collected the information for the past 100 years. Though the decline in appreciation is undesirable, a reversion to historical land value appreciation levels can be expected from the large returns seen in the last decade.

Farmland values in Iowa remain the highest of the states surveyed ending the year averaging $9,863.00 per acre, an 8.7% increase from the previous year. South Dakota continued with continued strong growth in cropland value ending the year at $5,800.00 per acre, a 23.3% increase from 2012. Nebraska land values increased slightly to $6,320.00 per acre, a 0.2% increase from 2012.

Mark Jensen, senior vice president and chief risk officer for farm-owned FCS, points out,” After years of a steady rise led by lower than average U.S. yields, strong domestic and international demand for commodities, low interest rates and solid profit margins, we’re seeing the rate of price increases leveling off for farmland in some areas we serve.”

Concern over market volatility will adjust buyer sentiment lower as decreased commodity prices are being forecasted for 2014. A lower number of land auctions were reported, but with a greater number of potential buyers. “Even though the number of public land auctions in 2013 was down 25-30% compared to 2012, auctions were often well-attended with multiple bidders,” said Jensen, “The number of auction ‘no sales’ in Iowa was 6.7% in 2013, an increase from 3% in 2012. Some sellers may have expected higher prices than the auction high bid,” suggesting sellers may be overvaluing their land. Local farmers continued to make the majority of these purchases.

Benchmark Study

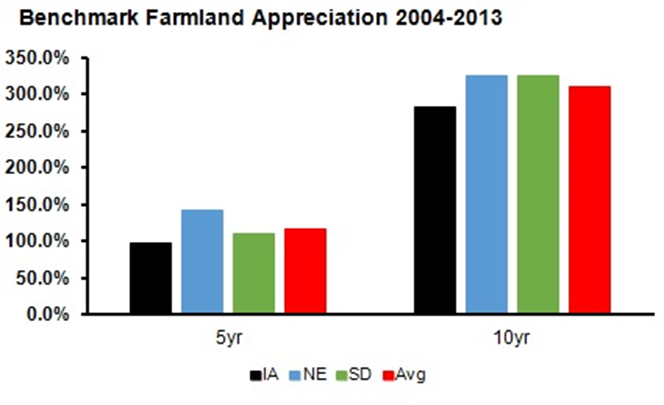

The Benchmark Land Value study shows the change in the value of 65 properties over a 30 year period. The information suggests much of the same result as the cropland value report. Falling commodity prices and uncertainty surrounding farm bill legislation have slowed the growth in land value that has been seen over the past decade. The slight decline from record highs still increases the benchmark 9.0% from 2012. The five and ten year appreciation averages are 86.8% and 252.2% respectively, further pointing out the strong decade cropland values have had.

Survey

The Average Cropland Value and Number of Sales report is a compilation of 3,500 agriculture real estate sales transactions -both auction and private sales- in all four states during 2013. To create their Benchmark Land Values study the FCS appraisal team tracks the value of 65 farms in Iowa, Nebraska, South Dakota, and Wyoming over the past three decades. FCS is a leading agriculture lender to farmers and ranchers in Iowa, Nebraska, South Dakota and Wyoming.