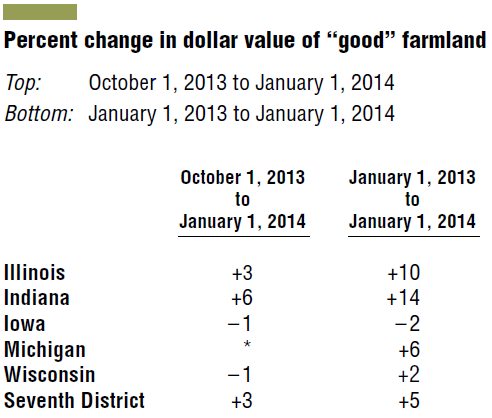

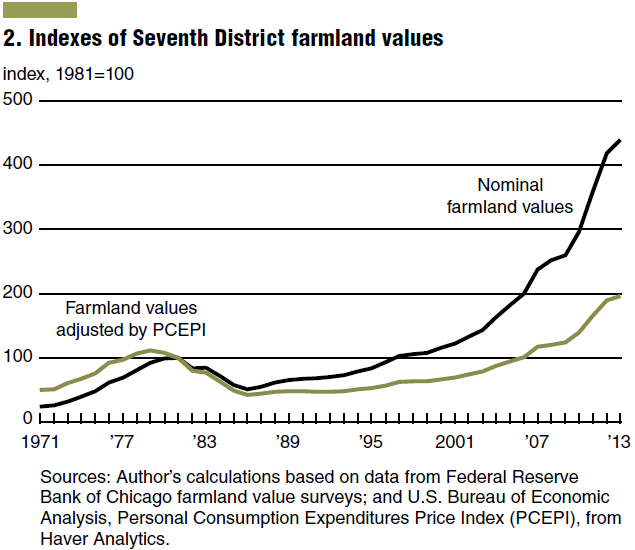

Farmland values continue their historic rise growing 3% across the Seventh Federal District in the fourth quarter of 2013. Indiana and Illinois led the district with 10% and 14% year-over-year increases in their farmland value. Overall the Seventh District grew 5% in 2013 despite grain pricing falling 40% in 2013. Farmland values in 2013 set new record highs when indexed for inflation, almost doubling the peak seen during the farmland boom of the 1970s.

Of the bankers surveyed a majority anticipated farmland values to remain stable or increase during the first quarter of 2013. Expectations are that farmland purchases by farmers will decrease in 2014 creating a less crowded buying environment for non-farmer investors with less competition and potential for lower purchase prices.

Production

Crop production for the Seventh District rebounded strong following the 2012 drought. Corn yields surged 42% to 169 bushels per acre, its third highest yield on record. Soybeans yields also increased 7.5% ti 46.9 bushels per acre. Production numbers were also well above levels seen in 2012, with both corn and soybean production increasing 36% and 8.4 % respectively. The rebound in agricultural production for the US in 2013 led to the largest corn crop and the third-largest soybean crop on record.

Credit

Credit conditions worsened in the district during the fourth quarter of 2013. The index of loan repayment rates of non-real-estate farm loans fell at the end of 2013. Farmers still struggling to recover from the 2012 drought and falling grain prices in 2013 had less cash on hand following the 2013 harvest which resulted in higher demand for non-real-estate farm loans in the final quarter of 2013. Non-real-estate farm loan demand jumped significantly, reaching levels not seen since early 2007.

Of the banks surveyed 27% tightened credit standards for agricultural loans during the fourth quarter of 2013, with 6% requiring more collateral to qualify. Interest rates for farm operating loans edged up to 4.99% in early 2014, but the interest rate level is still below levels from a year ago.

Outlook

Falling grain prices and record corn and soybean production led to a tapering of farmland value increases in 2013. Farmers demand for farmland in 2014 is expected to fall as they recover from the steep decline in grain prices seen in 2013 and tightening credit standards banks are placing on agricultural loans. In contrast from past years, the buying environment for farmland will be significantly less crowded providing investors with an opportunity to see lower prices at auction and through private sale. As banks become more restrictive with their lending farmers may be more apt to sell and lease back land than in past years in an effort to liquidate assets.

The Federal Reserve Bank of Chicago’s fourth quarter survey of Farmland Values and Agricultural Credit Conditions Report is a summary of the Seventh District’s value of farmland, farm loan portfolio performance, and on-farm income. The Seventh District consists of the entire states of Iowa, and portions of Illinois, Indiana, Wisconsin, and Michigan.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Farmland Values Reach New Heights Despite Adversity

Published 02/16/2014, 01:49 AM

Updated 07/09/2023, 06:31 AM

Farmland Values Reach New Heights Despite Adversity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.