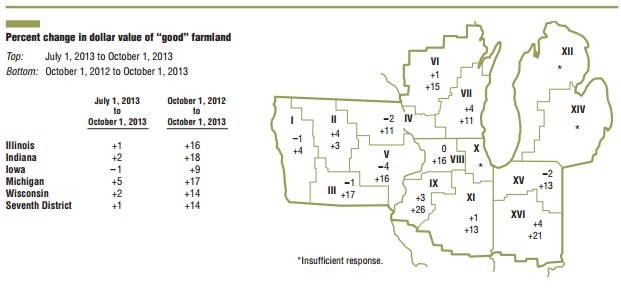

Crop prices are down double digits from last year's highs, but year over year "good" farmland values increased 14% across the Seventh Federal Reserve District. Indiana led the way with an 18% increase in farmland values over the past year. Third quarter values increased 1%, even though bankers predicted a drop in value. Four out of five states increased in value in the third quarter, Iowa was the only state to post a decrease.

The increase in farmland values is not expected to continue; 75% of bankers believe prices will stabilize in the fourth quarter. Although farmer income will not be as plentiful due to double digit decreases in year over year crop prices, bankers predict farmer demand for acquiring farmland will increase in the fourth quarter compared to last year. Subsequently, bankers expect nonfarm investor demand to decrease in the coming months.

Earnings

Despite an increase in farmland values, crop prices decreased throughout the third quarter. The average corn price was $6.13 per bushel for the quarter, down 12.0% from the second quarter and 15.0% from 2012. Soybean prices averaged $14.23 per bushel in this year's third quarter, down 3.8% on the third quarter and down 7.0% compared to one year prior.

Credit

Overall, the majority of bankers agreed that agriculture credit conditions in the Seventh District improved from the last quarter and year over year.

The average loan-to-deposit ratio was 66.9, slightly lower than last year and 11.0% below the desired level of the surveyed bankers. Year over year demand for non real estate loans decreased but the index of loan demand was 91, a four point increase from last quarter.

Interest rates for operating loans and agriculture real estate loans were, 4.94%, unchanged, and 4.68%, a slight increase.

Outlook

Although bankers believe farmer demand for acquiring farmland will increase year over year in the fourth quarter, it is difficult to justify that claim due to the expected decrease in farmer income. Analysts estimate farmer demand for land and equipment will deteriorate throughout the winter months. What does this mean for investors? Time to buy farmland. Land prices are slowly stabilizing, in the near term, and the largest buyers of farmland, farmers, could be sitting on the sideline. Primarily, farmland is typically bought and sold throughout the winter months, when the crops are out of the ground. We are starting to source more fairly priced farmland for sale and investors should prepare for a potentially opportune time to buy farmland this winter.

The Federal Reserve Bank of Chicago’s second quarter survey of Farmland Values and Agricultural Credit Conditions Report is a summary of the Seventh District’s value of farmland, farm loan portfolio performance, and on-farm income. The Seventh District consists of the entire state of Iowa, and portions of Illinois, Indiana, Wisconsin, and Michigan.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Farmland Values Increase 14% Year Over Year

Published 11/18/2013, 05:59 AM

Updated 07/09/2023, 06:31 AM

Farmland Values Increase 14% Year Over Year

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.