With a plethora of central bank statements ahead of us this week there’s likely to be no shortage of price movement across the majors.

The first FOMC statement of 2017 will no doubt take centre stage but rate decisions from the BoJ (Tuesday) and BoE (Thursday) are sure to add their fair share of volatility.

In what’s set to be a pivotal week for dollar bulls, let’s take a look at how the majors are shaping up…

In last week’s update we identified that EUR/USD was heading into a key ‘zone’ of resistance defined by November’s highest close and highest high. It therefore came as no surprise to see the market tap the zone and beat a hasty retreat.

Our attention now turns to the ascending support line which has been broken this morning, signalling that the bears are back in charge.

Today’s close will be significant.Failure to mount an intra-day fight back would open the door for a much larger sell-off potentially down to the 2016 lows.

Cable completed the A,B,C,D harmonic move pattern that we highlighted in last week’s update.

It is important to state that completion of the ‘measured move objective’ is not sufficient to call a top on this market. As it stands, the short-term trend remains bullish and probabilities favour an advance into the 1.2750 resistance zone.

That said, any break below 1.2400 (previous resistance / new support) would change our view on this market.

USD/JPY’s prolonged period of retracement finally came to an end last week. The market double bottomed at 112.50 and rallied higher with conviction, breaking its descending retracement line.

With short-term momentum now realigned with the dominant trend, we are back in ‘buy the dips’ mode!

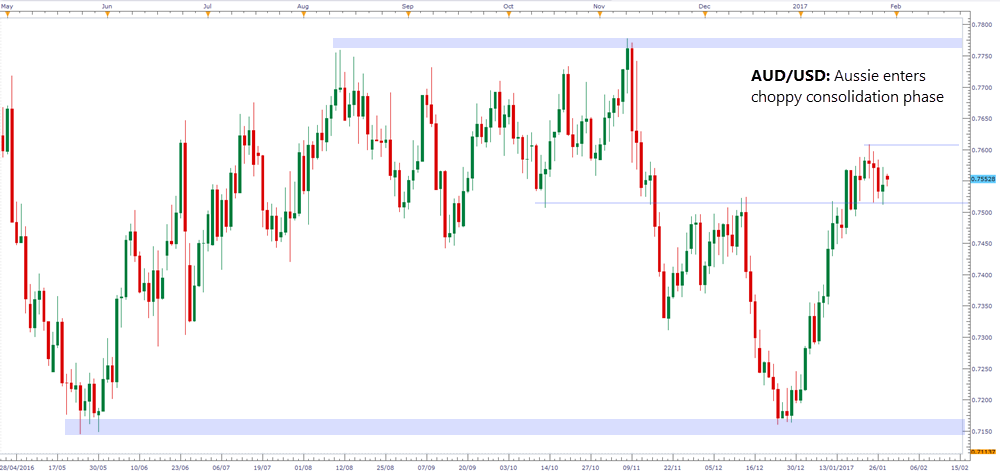

The Aussie’s run of four consecutive weeks of gains came to an end last week as the market succumbed to a re-bound in the greenback.

Prices have now entered a period of consolidation which should see the market chop sideways in a relatively tight range between 0.7500 and 0.7600. This market will only become of interest should we start to see evidence of volatility contraction (tightening ranges) we’ll keep you updated…