Famous Dave’s of America, Inc. (NASDAQ:DAVE) reported mixed second-quarter fiscal 2017 results on Aug 14, after the market closed. While, earnings surpassed the Zacks Consensus Estimate, revenues lagged the same.

Shares of the company gained 11.4% in the first full-trading session following the results.

Earnings and Revenue Discussion

Famous Dave’s fiscal second-quarter adjusted earnings of 16 cents per share surpassed the Zacks Consensus Estimate of 9 cents by 77.8%. However, the bottom line declined 15.8% year over year due to lower revenues.

Revenues of $25.3 million were down 8.8% year over year as company-owned net restaurant sales as well as franchise royalty and fee revenues declined. Also, the top line came below the Zacks Consensus Estimate of $26 million by 2.9%.

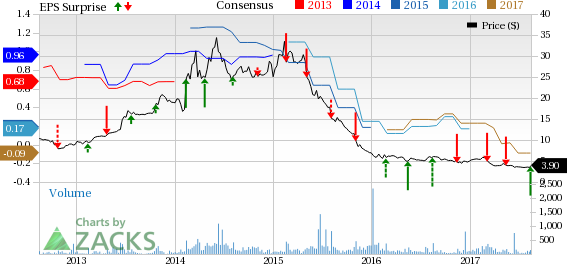

Famous Dave's of America, Inc. Price, Consensus and EPS Surprise

Behind the Headline Numbers

System-wide comps fell 3% due to a decrease in comps at both company-operated and franchise restaurants.

Company-operated restaurant sales were $21 million compared with $23 million in the year-ago quarter. The decline of nearly 9% in the sales was fueled by the decrease in comps and the net closure of five restaurants since the end of second-quarter fiscal 2016.

Notably, comps at company-operated restaurants decreased 2.2% comparing favorably with the prior-year quarter decline of 6.4%, and the previous quarter’s decline of 3.3%.

Meanwhile, franchise royalty revenues decreased about 9% year over year, driven by the net closure of seven franchise restaurants since the year-ago quarter, and a decline in comps. This was partially offset by franchise fee revenues earned from the opening of one franchise-operated restaurant in the reported quarter.

It is to be noted that comps at franchise restaurants were down 3.2% in the quarter. This reported figure was better than a 4.3% decline recorded in the prior-year quarter, and 4.8% decrease in the previous quarter.

Restaurant-level operating margin for company-owned restaurants fell 130 basis points year over year to 8.2%. This lower margin was mainly driven by sales deleverage on fixed labor and operating costs, partially offset by lower food and beverage costs.

Remarkably, general and administrative (G&A) expenses declined to $3.5 million from $4.5 million in the prior-year period. This year-over-year decrease was a result of the company’s continued optimization of its G&A structure to be commensurate with that of a dedicated franchisor, a decline in professional fees and reduced costs incurred for franchise-related matters.

Notably, given the challenging sales environment in the U.S. restaurants space as well as prevailing inflationary pressures across the industry, Famous Dave’s is focused on tightly managing all the costs and expenses in its immediate control.

Refranchising and Restaurant Optimization Plan

On May 2, Famous Dave’s announced plans to accelerate the refranchising and optimization of its company-operated restaurants over the next 12 to 24 months. In keeping with this strategy, it has closed six underperforming restaurants to date.

According to the company, this initiative is likely to “permit the company to shift its resources and energy to the growth and support of its franchise system, which are paramount to the company’s success”.

Zacks Rank & Peer Releases

Famous Dave’s currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other restaurant stocks, McDonald's Corp. (NYSE:MCD) reported second-quarter adjusted earnings per share of $1.73, beating the Zacks Consensus Estimate of $1.62 by 6.79%. The bottom line also increased 19% year over year.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) second-quarter 2017 adjusted earnings were $2.32 per share, which outpaced the Zacks Consensus Estimate of $2.16 by 7.41%. Also, earnings compared favorably with the year-ago quarter figure of 87 cents per share, given a substantial rise in revenues.

In second-quarter 2017, Domino’s Pizza, Inc. (NYSE:DPZ) posted earnings of $1.32 per share, which outpaced the Zacks Consensus Estimate of $1.22 by 8.20%. Furthermore, the bottom line increased 34.7% year over year on strong sales and a lower share count.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Famous Dave's of America, Inc. (DAVE): Free Stock Analysis Report

Original post

Zacks Investment Research