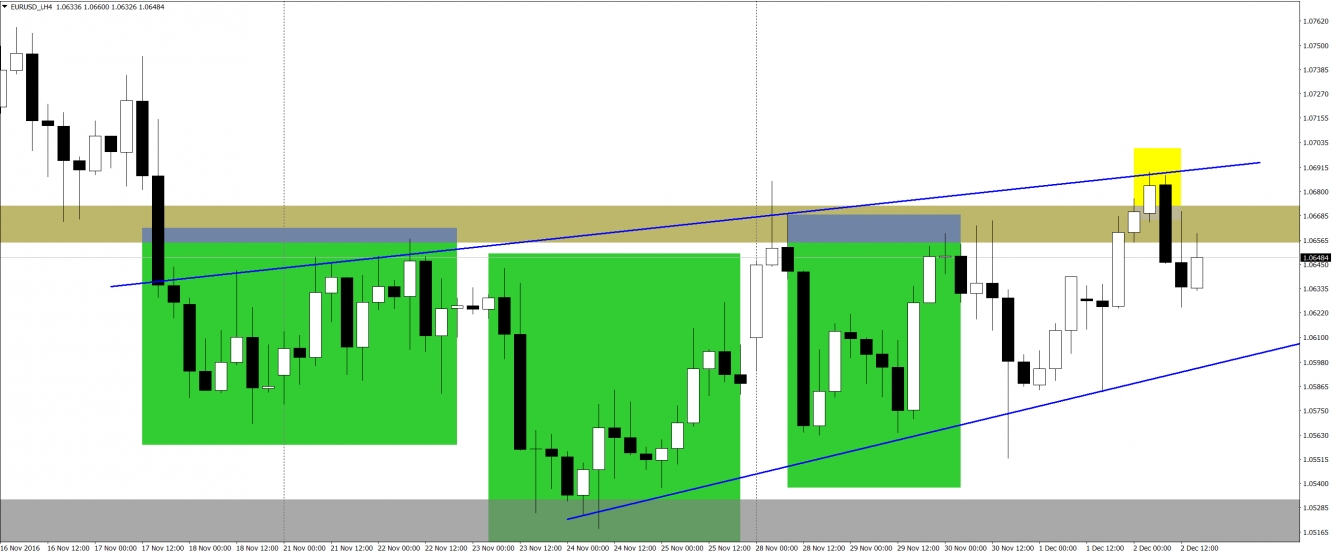

It looks like this week on the EUR/USD we will finish at the same levels where we started, although the beginning of the week looked optimistic for buyers. With the green colour, I highlighted the inverted head and shoulder pattern. On Wednesday, traders had a chance for a bullish breakout here, but they failed and were unable to perform a successful attack. Price continued in the side trend and extended H&S formation into a flag. Seems irrelevant but from the technical point of view it denies the trend reversal pattern and creates a trend continuation pattern so it affects the mid-term sentiment.

The end of today's Asian session brought us a bullish breakout of the mid-term resistance on the 1.066. Traders failed to hold the price above this level, which created a false breakout situation (yellow rectangle). According to the price action, false breakouts lead to the strong movement in the opposite direction. That combining with the flag (blue lines) give us a final bearish sentiment here.

NFP didn't change much. Odds for a rate hike are high anyway and that number could not change that. What can hurt EUR is the Italian referendum on Sunday. As always, it is hard to anticipate what to expect on Monday, but one thing is for sure: volatility will be higher than the last few days. If we had to look on this instrument from only the technical point of view, our outlook would be negative with higher odds of breaking the lower line of the flag and a further downswing.