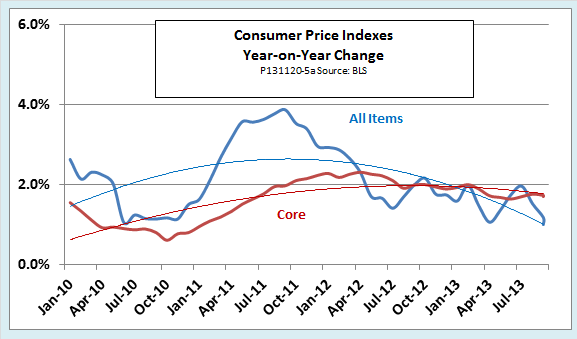

A big drop in gasoline prices brought the US inflation rate for October, as measured by year-on-year change in the consumer price index, to just 0.95 percent, its lowest level in four years. The y-o-y inflation rate for the core CPI, which excludes food and energy, was 1.69 percent. As the following chart shows, trends for both the all-items and core CPI have turned downward over the past two years.  Year-on-year data give a good picture of medium-term trends, but it is also worth looking at monthly data, which tell us what is happening right now. The latest monthly data reveal not just a slowing of inflation, but an actual fall in the price level for October. As the next chart shows, the seasonally adjusted CPI decreased at a .71 percent annual rate in October. Without seasonal adjustment, the CPI fell even more sharply—an annual rate of decrease of 3.05 percent.

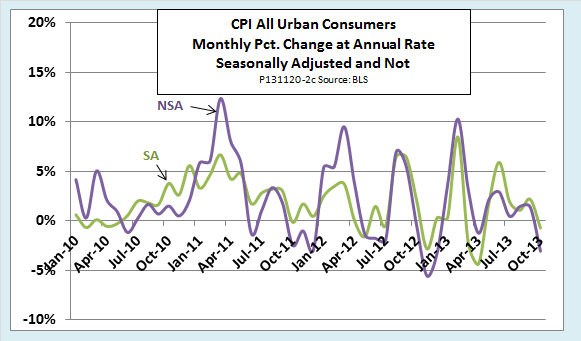

Year-on-year data give a good picture of medium-term trends, but it is also worth looking at monthly data, which tell us what is happening right now. The latest monthly data reveal not just a slowing of inflation, but an actual fall in the price level for October. As the next chart shows, the seasonally adjusted CPI decreased at a .71 percent annual rate in October. Without seasonal adjustment, the CPI fell even more sharply—an annual rate of decrease of 3.05 percent.  The unusually large difference between the SA and NSA numbers was largely due to the price of gasoline, which alone has a weight of about 5 percent in the CPI. The price of gasoline usually decreases by about 2 percent in October, but this year the change was -4.9 percent. That was enough to pull the whole unadjusted index down sharply.

The unusually large difference between the SA and NSA numbers was largely due to the price of gasoline, which alone has a weight of about 5 percent in the CPI. The price of gasoline usually decreases by about 2 percent in October, but this year the change was -4.9 percent. That was enough to pull the whole unadjusted index down sharply.

Any way you look at it, there is not much inflation in the U.S. economy at present, nor is much expected. The Cleveland Fed’s estimates of inflation expectations, based on the prices of Treasury Inflation-Protected Securities (TIPS), stands at just 1.6 percent for a 5-year time horizon and 1.7 percent for a 10-year horizon. Both measures have fallen slightly over the past two months.

On the other hand, despite the drop in the October CPI, there doesn’t seem to be much risk of deflation either. The Atlanta Fed uses TIPS prices to calculate indexes of deflation probabilities over various time horizons. The latest readings suggest that there is essentially no chance that the CPI for 2016 through 2018 will be lower than it is at present. As recently as two years ago, the estimated probability of deflation was more than 15 percent, despite the fact that the actual inflation rate was higher then than it is now.

Original Post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Falling Gasoline Prices And U.S. Inflation

Published 11/20/2013, 02:12 PM

Updated 07/09/2023, 06:31 AM

Falling Gasoline Prices And U.S. Inflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.