Regular readers of The Telegraph, arguably Britain’s only remaining decent broadsheet paper, will be familiar with the writings of Ambrose Evans Prichard, the international business editor.

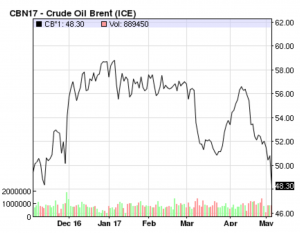

It has to be said that he has a slightly sensationalist reporting style, but his articles are always liberally supported with facts and figures. Even though he seems to argue more often than not that markets about to drop off the edge of a cliff, he has, at times, been right. Yet an article this week titled “Commodities slump on China tremors and OPEC failure,” while making a plausible argument based on the facts and figures presented, could equally have an alternate explanation if one looks over a slightly longer timeframe.

Clyde Russel of Reuters takes just such an approach in an article posted just a day or so later, which all goes to underline the challenge for buyers in interpreting fundamental supply and demand data and extrapolating workable strategies.

The Telegraph looks at a gradually sinking Brent oil price coupled with falling Chinese crude oil imports, and it suggests that the former is in part a result of the latter. Reuters looks at the same data, and whilst the article acknowledges that imports are down in April, it goes on to look at the last 12 months trend line.

Reuters notes that in the first four months of 2017, crude oil imports were up 12.5% from the same period last year to around 8.46 million bpd. The article goes on to point out that this is also substantially higher than the 7.6 million bpd imports averaged for 2016, suggesting that China’s appetite for crude has jumped substantially so far this year, notwithstanding the pullback in April.

Turning to iron ore, The Telegraph points to a slump in imports during April and steadily rising port stocks so far this year. But again, looking at the longer term, Reuters points out that the last eight months have seen four months with imports above 90 million tons, including 95.6 million in March, which was the second highest on record.

With port inventory high and one eye on the price, Chinese mills are likely holding back anything other than unavoidable spot purchases in the expectation of lower prices in the months to come. April’s slump in both crude oil and iron ore could therefore be seen as attributable to canny buying as to a lack of real demand.

Certainly, stimulus measures introduced some 12 to 18 months ago are beginning to wane. But the Chinese economy has proven resilient, and Beijing’s efforts to reign in heavy industry notwithstanding, both domestic consumption and manufacturing have continued to do relatively well.

Record imports at the levels we have seen in late 2016 and the first part of this year were unlikely to continue for commodities where excess global supply is weighing heavily on prices. A reduction in Q2 import levels should therefore probably be seen more as a pullback to normal levels of import than collapse and demand, and depending on domestic growth during the quarter possibly setting the scene for an uptick in H2 demand.

by Stuart Burns