Falkland Oil and Gas (FOGL.L) completed its two well drilling programme in the Falklands in December 2012. The second well Scotia encountered hydrocarbon bearing sands, thereby proving the play and demonstrating that the stratigraphic trap is present and working. However, the reservoir quality was poor and the campaign has ended with the presence of oil in the basin still a key unknown. The company has begun a programme of 3D seismic acquisition across its southern area licences with two further surveys to be carried out in 2013. FOGL hopes to return with a rig to the area by H214.

Scotia proves play

A 50m gas bearing reservoir has demonstrated the presence of hydrocarbons in the mid Cretaceous fan play at Scotia. The sands were fine grained and had porosities up to 20%, but had low permeability and failed to flow hydrocarbons on test. 2013 will be taken up with 3D seismic acquisition. A survey across the northern area licences in Q413 will be crucial in identifying areas of better quality reservoir across the prospects. A 3D campaign across the southern area licences has commenced and will target Diomedia, another very large mid Cretaceous aged fan complex. Details of a third 3D survey will be announced when the vessel arrives on location in Q113.

Target next drilling in H214

FOGL now plans to return to the area in H214 with a three to four well drilling programme. The wells will target better quality reservoir and more oil prone prospects, not that the seismic amplitude anomalies (AVO) responses are better understood. The company hopes to identify these based on 3D seismic, and the 2012 well data will be used to calibrate this data. FOGL is also carrying out a study on the source rock which will help define the oil bearing potential of the area, with the results due in Q113.

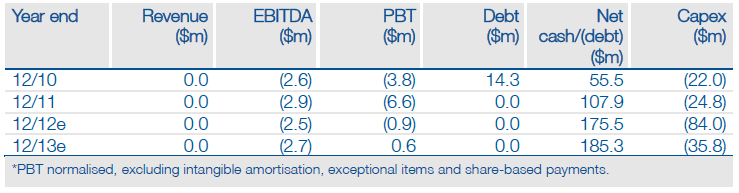

Valuation: Trading significantly below cash

With no drilling now due in the region until at least 2014, we do not ascribe a value to FOGL at this time. We would expect to reintroduce our valuation once the seismic programme is completed and well locations are confirmed. We estimate a cash position of $175.5m at year end, rising to $220m when the 2013 payments due from Noble and Edison are included. A further cost carry of $35m expected from Noble for future drilling, gives a valuation on this basis alone at 50p/share. With the involvement of partners Noble and Edison we believe that FOGL has the backing to progress its programme and achieve a return to drilling in 2014.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Falkland Oil & Gas Ends Drilling Campaign

Published 12/17/2012, 04:41 AM

Updated 07/09/2023, 06:31 AM

Falkland Oil & Gas Ends Drilling Campaign

Scotia completes campaign

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.