The bulls certainly made a strong run yesterday but didn't finish the day on a strong note in the least. That's an understatement, actually. They've given up almost all of their gains, closing below the many important resistances they've eyed to break above. Heavy selling followed earlier today, and the question is whether we can expect more downside...

Let's take a closer look at the charts below (charts courtesy of www.stooq.com ).

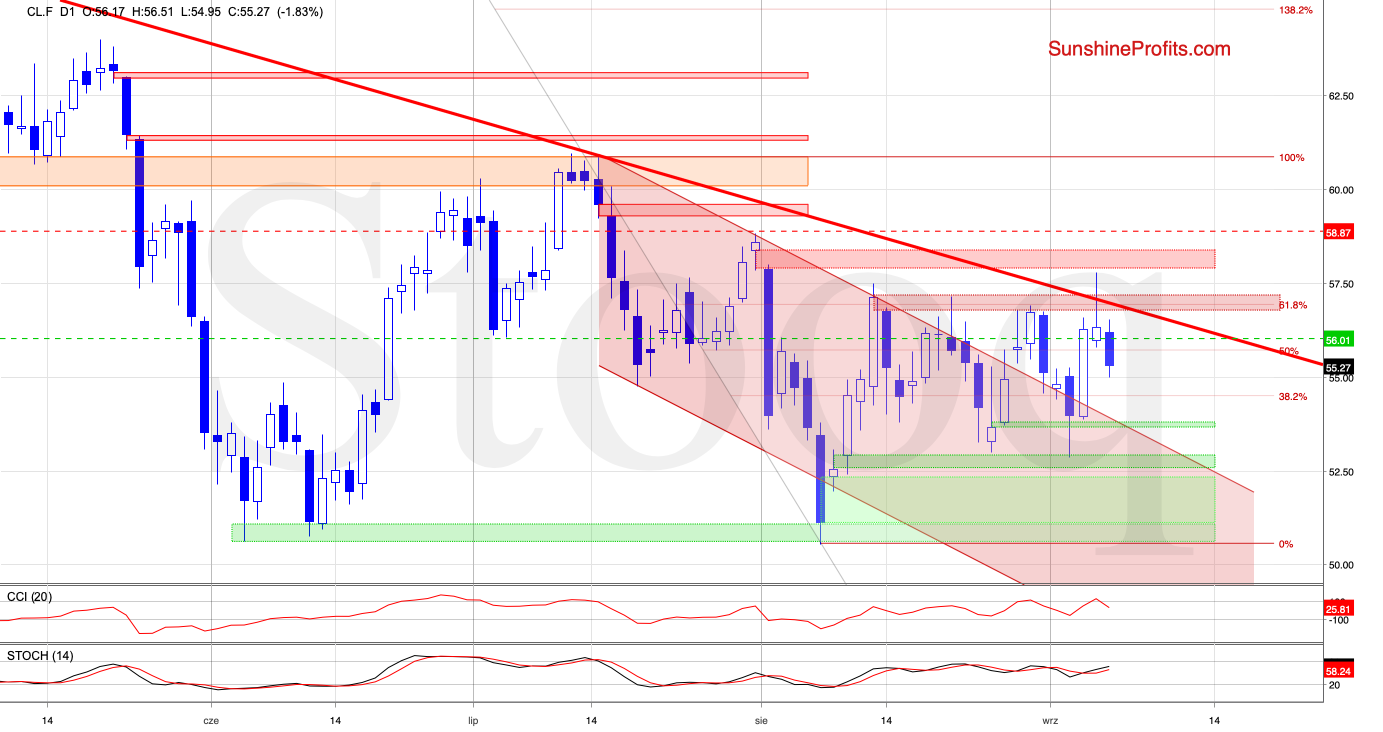

Yesterday, crude oil futures tested the resistance zone created by the red gap, the previous peaks and further reinforced by the 61.8% Fibonacci retracement. This combination proved strong enough to stop the bulls once again.

The breakout attempt has been invalidated, and prices moved lower as evidenced by the long upper knot. It clearly shows the area of increasing involvement of the bears.

The futures also tested the declining red resistance line, invalidating the breakout above it in the process. This has brought further deterioration earlier today.

And that hasn't been the only bearish developments. On the 4-hour chart below, you'll see that the breakout above the upper border of the purple declining trend channel has also been invalidated.

Connecting the dots, lower prices of crude oil futures are likely ahead of us. If this is the case, the lower border of the purple trend channel and our downside target will be in play in the following days.

Summing up, yesterday's oil rebound has mostly fizzled out and reversed lower. The many important resistances have stopped the bulls again, and further decline followed earlier today. Our downside target will be likely in play next week, and our short position remains justified.