Despite a hot January CPI, the long-term economic outlook supports lower interest rates in the months ahead.

As the inflation hysteria ramps up on Wall Street, bonds and Fed Funds futures (FFF) were battered once again. And after a resilient U.S. nonfarm payrolls release last week, the Fed’s dual mandate suggests higher-for-longer interest rates are here to stay.

To that point, Fed Chairman Jerome Powell maintained the Committee is in no rush to cut the FFR, and the crowd has pushed the December 2025 FFF contract back near the lows.

As a proxy, I’m long December 2025 SOFR futures and bought during the payrolls dip. I’m in at 95.95, and the contract was trading near 95.88 after this morning’s sell-off.

Despite that, I like the risk-reward, and I’ll explain why the fundamentals, positioning, and sentiment support a rally back near 97.

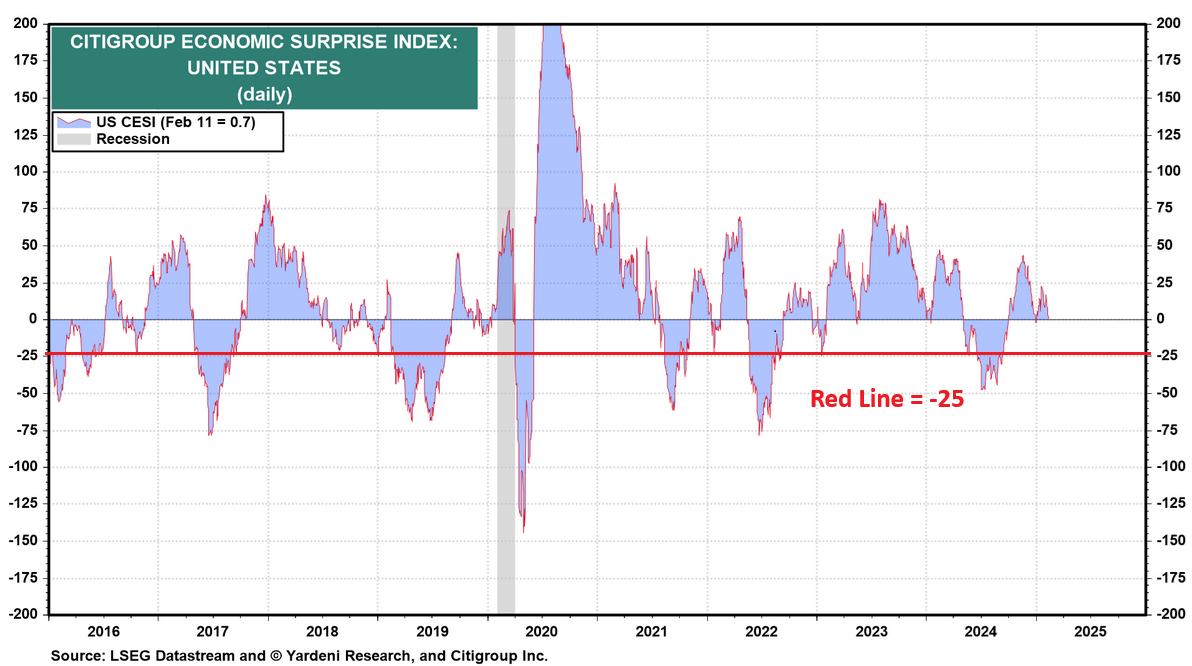

If you dig beneath the surface of the recent economic data, you’ll see it’s mainly employment and inflation that has outperformed expectations. And yes, I’m aware this is literally the Fed’s dual mandate. However, dismissing the underlying weakness is a fool’s errand, and history suggests the current ‘no rush’ narrative could morph into ‘behind the curve’ complaints in due time. For example, while Citigroup’s U.S. Economic Surprise Index has declined materially, more downside should be on the horizon.

To explain, the horizontal red line highlights how Citigroup’s U.S. Economic Surprise Index has hit -25 or lower every year since 2016. Furthermore, with the metric already near zero (before the CPI print), today’s rise in bond yields should only amplify the underperformance the longer rates remain high.

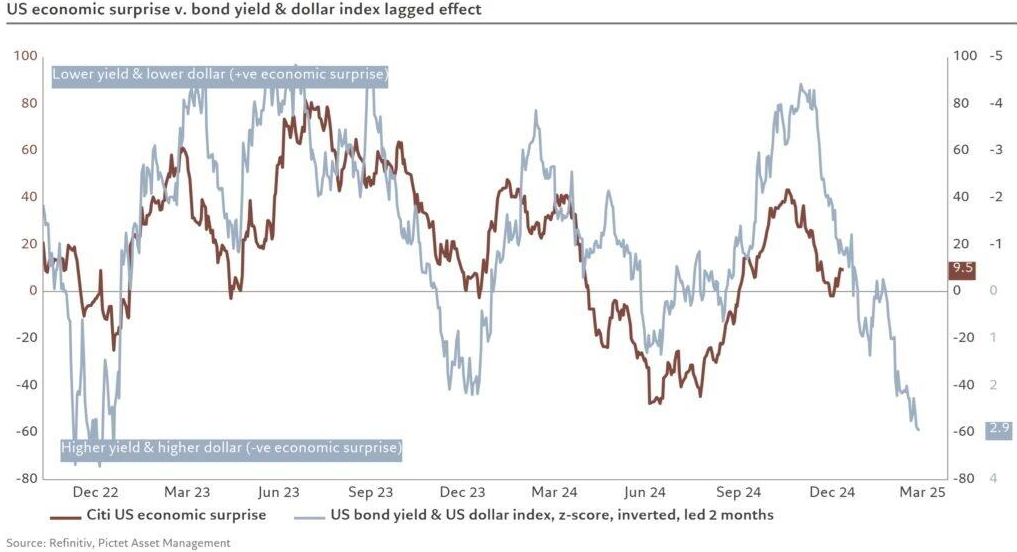

Speaking of which, with long-term Treasury yields and the U.S. dollar (mostly) rising as the index falls (which should be the opposite), the lagged effect implies weaker economic data in the months ahead.

To explain, the brown line above tracks Citigroup’s U.S. Economic Surprise Index, while the gray line above tracks the inverted (down means up) two-month forward combined rise and fall of the U.S. dollar and bond yields.

If you analyze the connection, you can see that when the gray line falls (stronger USD and higher yields), the brown line follows (lower economic surprise index). Furthermore, the position on the right side of the chart implies a Citi ESI near -60.

Yet, we’re only playing for a historically expected drop to -25. As such, the current narrative may sound a lot different as the months pass.

***