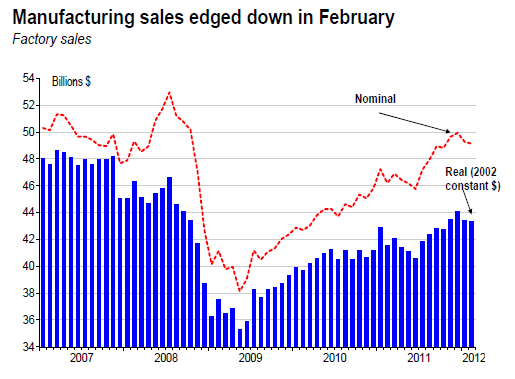

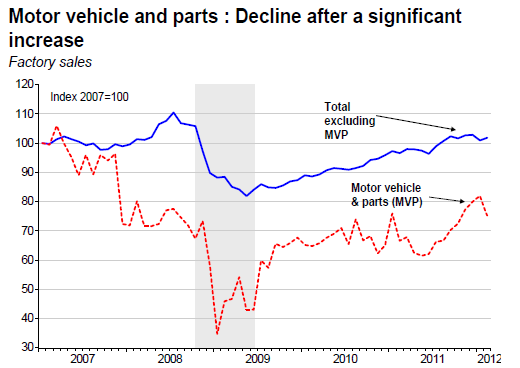

Factory sales dropped 0.3% in February after a 1.3% decrease in January. Sales declined in 11 of 21 industries. Durable goods increased 0.2% and non-durable goods sales declined 0.8%. Transportation equipment, the heavyweight in durable goods, dropped 3.1% m/m with major losses coming from motor vehicle manufacturing (- 8.7%) and motor vehicle parts manufacturing (-7.2%).

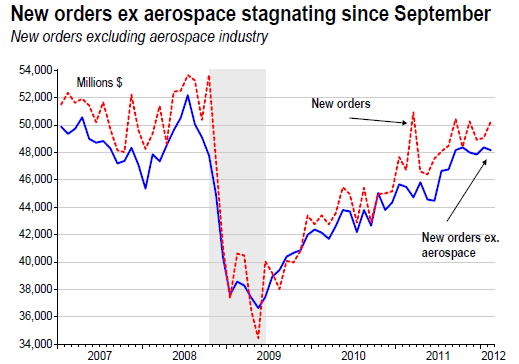

New orders jumped 2.5% in February, after edging up 0.3% onemonth earlier. The increase in orders largely reflects gains in the aerospace and machinery industries. Unfilled orders rose 1.9%, a first increase in 3 months. Inventories increased 0.3% and given this month’s sales pullback, the inventory-to-sales ratio increased to 1.34 from 1.33 a month earlier. In constant dollars, manufacturing sales were barely down (-0.1%) after decreasing 1.6% in January.

Opinion

This morning’s report is in line with consensus expectations. A second monthly consecutive drop may look disturbing. However, data since the beginning of the year must put in context. This decline occurs after a 19.1% annualized surge in the second half of 2011, its best 6-month performance in 2 years, when a cyclical rebound took place following the recession. This impressive performance was due to a sharp rebound in sales of motor vehicle and parts industries. Those two sectors were however responsible for February’s weaknesses.

Otherwise, new orders were on the rise but core new orders (which excludes aerospace) a better gauge of future short-term activity is essentially stagnating since September. That said, a rebound can be expected in subsequent months given the uptick in US demand. For instance, auto assemblies south of the border are quite active to say the least and with US inventories to sales relatively low, we expect demand for Canadian autos and parts to pick up. All in all, in real terms, manufacturing activity is essentially stagnating so far in Q1 (-0.5% annualized), after being a strong contributor to growth in 2011Q4 (+10.4%).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Factory Sales Were Down 0.3% In February: April 18, 2012

Published 04/18/2012, 09:23 AM

Updated 05/14/2017, 06:45 AM

Factory Sales Were Down 0.3% In February: April 18, 2012

Facts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.