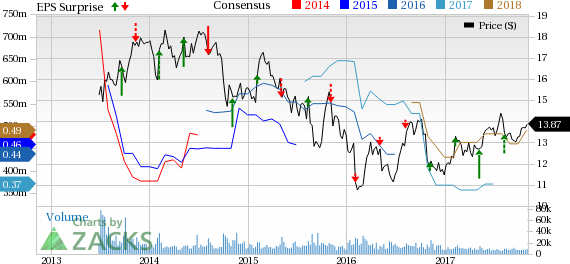

News Corporation (NASDAQ:NWSA) , the diversified media conglomerate, is slated to report first-quarter fiscal 2018 results on Nov 9. The question lingering in investors’ minds is whether the company will be able to deliver a positive earnings surprise in the quarter to be reported. In the trailing four quarters, News Corporation outperformed the Zacks Consensus Estimate by an average of 25.7%.

Which Way Are Estimates Treading?

Let’s look at earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company prior to the release. The current Zacks Consensus Estimate for the quarter under review has increased by a penny in the last 30 days and is currently pegged at 2 cents. This reflects an improvement over a loss of one cent reported in the year-ago quarter. Analysts polled by Zacks expect revenue of $1,978 million compared with $1,965 million reported in the prior-year period.

Factors Influencing This Quarter

News Corporation is in a transitionary phase looking to diversify revenue streams through strategic acquisitions and operational enhancement. The company is expanding its digital offerings, along with greater emphasis on real estate businesses and augmenting digital subscriber base. Further, it has been concentrating on cost cutting.

However advertising, which forms a major part of total revenue, remains highly vulnerable to the economic conditions. Advertising revenue at the News and Information Services segment tumbled 12% during the fourth quarter of fiscal 2017 due to sluggishness in the print advertising market, reduced in-store product revenue at News America Marketing and adverse foreign currency fluctuations. As a result, revenue from the News and Information Services segment declined 10% year over year.

Analysts surveyed by Zacks now anticipate revenue from News and Information Services division to decline 1.6% during the first quarter but envisions growth of 7.8% and 9.7% across Cable Network Programming and Digital Real Estate Services segments, respectively. Book Publishing division is expected to witness revenue growth of 1%.

What the Zacks Model Unveils

Our proven model shows that News Corporation is likely to beat estimates this quarter. A stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

News Corporation carries a Zacks Rank #2 and has an Earnings ESP of +3.70%. This makes us reasonably confident that bottom line is likely to outperform the estimate.

Other Stocks with Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

DISH Network Corp. (NYSE:DIS) has an Earnings ESP of +1.68% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Walt Disney Company (NYSE:DIS) has an Earnings ESP of +1.37% and a Zacks Rank #3.

MSG Networks Inc. (NYSE:MSGN) has an Earnings ESP of +0.31% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Walt Disney Company (The) (DIS): Free Stock Analysis Report

DISH Network Corporation (NASDAQ:DISH): Free Stock Analysis Report

MSG Networks Inc. (MSGN): Free Stock Analysis Report

News Corporation (NWSA): Free Stock Analysis Report

Original post

Zacks Investment Research