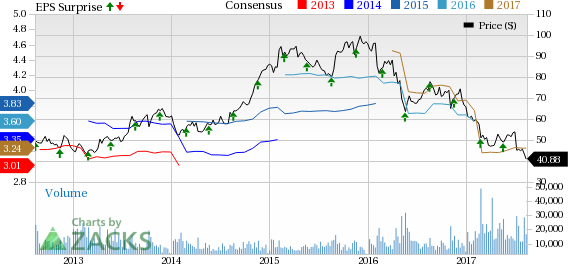

L Brands, Inc. (NYSE:LB) , a specialty retailer of women’s intimate and other apparel, beauty and personal care products, is slated to report second-quarter fiscal 2017 results on Aug 16. In the trailing four quarters, it outperformed the Zacks Consensus Estimate by an average of 11.1%. Let’s see how things are shaping up prior to this announcement.

How are Estimates Shaping Up?

The question lingering in investors’ minds now is whether L Brands will be able to post positive earnings surprise in the quarter to be reported. The current Zacks Consensus Estimate for the quarter under review is 45 cents, reflecting a year-over-year decline of over 35%. We noted that the Zacks Consensus Estimate has increased by 3 cents in the past 30 days. Analysts polled by Zacks anticipate revenues of $2,764 million, down over 4% from the year-ago quarter.

L Brands forms part of the Retail-Wholesale sector. Per the latest Earnings Preview, total earnings for the sector are expected to decline by 0.9%, however, revenue is projected to improve 4.1%.

Factors at Play

L Brands continues to disappoint investors with dismal comparable sales (comps) performance. This specialty retailer of women’s intimate and other apparel, beauty and personal care products reported 7% drop in comps for the four-week ended Jul 29, 2017 following declines of 9%, 7%, 5%, 10%,13%, 4% and 1% in June, May, April, March, February, January and December, respectively.

For the 13-week ended Jul 29, 2017, the company’s comps had declined 8%, while sales decreased 4.7% to $2.755 billion. L Brands’ comps declined 14% at Victoria’s Secret but increased 6% at Bath & Body Works. The exit from the swim and apparel categories had a 6 percentage points and 9 percentage points adverse impact on overall company and Victoria’s Secret comparable sales, respectively.

However, we believe that the company’s operational efficiencies, together with its new and innovative collections may help augment sales. Further, its foray into international markets is likely to provide long-term growth opportunities and generate increased sales volumes. Management now envisions second-quarter earnings to be at the high end of its previously provided guidance range of 40–45 cents a share.

What Does the Zacks Model Suggest?

Our proven model does not conclusively show that L Brands is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

L Brands has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate both are pegged at 45 cents. Although, L Brands’ Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings beat.

Stocks with Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Gap, Inc. (NYSE:GPS) has an Earnings ESP of +3.85% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and a Zacks Rank #2.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +6.00% and a Zacks Rank #2.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

L Brands, Inc. (LB): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research