J. C. Penney Company, Inc. (NYSE:JCP) is slated to report second-quarter fiscal 2017 results on Aug 11. In the preceding quarter, the company reported earnings beat of 127.3%. Let’s see how things are shaping up for this announcement.

What to Expect?

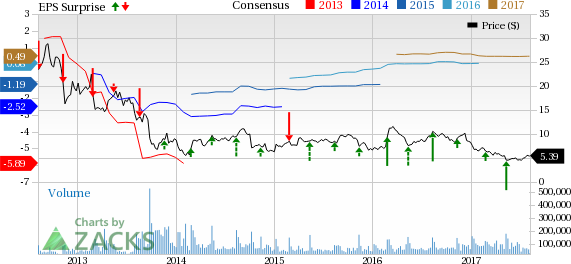

The question lingering in investors’ minds now is whether J. C. Penney will be able to post positive earnings surprise in the quarter to be reported. In the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 50.9%. The Zacks Consensus Estimate for the quarter under review is currently pegged at a loss of 7 cents. In second-quarter fiscal 2016, it had reported loss per share 5 cents. We noted that the Zacks Consensus Estimate has been stable in the past 30 days. Analysts polled by Zacks expect revenues of $2,857 million, down about 2% from the year-ago quarter.

Factors Influencing this Quarter

J. C. Penney has taken up several strategic initiatives to drive traffic and is likely to impress investors with its second-quarter results. Notably in the previous month, the company stated that the sales performance has improved in the second quarter of fiscal 2017. The company expects to post substantial improvement in the top line in the second quarter in comparison with the first quarter.

Moreover, in an effort to lure more customers and ramp up sales performance, it has enhanced the loyalty program which was introduced for the first time in 2008. Per the new reward program, every customer will get $10 reward for every 200 points earned. The company, in order to enhance customer shopping experience, has been focusing on remodeling, renovating and refurbishing stores with special focus on enhancing high-margin center core department that houses handbags, fashion accessories, sunglasses and fashion jewelry.

In a bid to better align stores with its omni channel network and utilize capital resources in locations where it has ample opportunity, J. C. Penney had earlier announced strategic initiatives, wherein it will shut down two distribution facilities as well as nearly 130–140 stores. The closure of stores, which represents nearly 13–14% of store portfolio, is likely to hurt total annual sales by less than 5%. Weaknesses in apparel sales are also affecting the company’s overall sales.

Zacks Model Shows Likely Beat

Our proven model shows that J. C. Penney is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen.

J. C. Penney has an Earnings ESP of +42.86%, as the Most Accurate estimate is pegged at a loss of 4 cents, while the Zacks Consensus Estimate is wider at a loss of 7 cents. A positive ESP combined with the company’s Zacks Rank #3, makes us reasonably confident of a beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks with Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco Wholesale Corporation (NASDAQ:COST) has an Earnings ESP of +0.50% and a Zacks Rank #3.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Original post

Zacks Investment Research