I was confronted at my tennis club last night by a guy who associates anyone who invests in gold with an obsession with doom and gloom. I guess he thinks that people who move their phony fiat U.S. dollars into gold are trying to get rich at the expense of general despair. Nothing could be further from the truth in terms of what I would like to be doing vs. what I am doing. Hell, during the 1990's I was a junk bond trader on Wall Street. Alan Greenspan's magic money printing press was my best friend. This particular guy is a real estate broker and his income is a "third" derivative benefit of money printing. Anyone who works on Wall Street in the type of job I had is not only a direct beneficiary of a promiscuous Federal Reserve printing press, but also skims 90% of that benefit - i.e. a first derivative beneficiary.

The funny thing is, anyone who is receiving any benefit from the hyperbolic money printing going on right now is doing so at the expense of others. So the real estate broker who has seen a "pop" in commissions because the half trillion dollars the Fed has tossed at the real estate market over the last year is benefiting from a temporary and very artificial "pop" in home prices and the related temporary increase in sales volume. But what about the people who, looking back, will have significantly overpaid for their dream home when this mini-housing bubble collapses? It's starting to drop pretty quickly already. Prices from June to now in both new and existing homes have dropped every month since June (See My Article For The Data). This means that everyone who bought a home in June with a 3.5% FHA down payment mortgage is now underwater on that mortgage. I have been receiving emails from all over the country from readers describing the same kind of mess that I see all around Denver: high end homes sitting for months on the market, "for sale" and "coming soon" signs popping up like zits on a teenager and reports from real estate agents that activity has dropped off a cliff in their city.

And guess what? Interest rates are moving higher and the FHA, in a move that was not widely broadcast, is lowering the size of mortgage it will guarantee in 650 counties across the country. In some cases this reduced mortgage size will be significant, especially in the mini-bubble areas. As an example, in Clark County Nevada (Las Vegas) the limit is being reduced from $400k to $287,500. The FHA finances over 20% of the real estate market, up from about 2% in 2008, and it has filled the void created when the big junk mortgage lenders like Countrywide and Wash Mutual went bust in the big housing bubble. The FHA move will significantly curtail housing market activity. FNM/FRE are also getting ready to put the squeeze on loose lending standards, but the changes have been temporarily deferred. FNM/FRE have their own hidden landmines accumulating.

I'm not a prophet of doom and gloom, I'm trying to pull back the curtain of lies and deceit that has become endemic to our system at all levels, especially as it emanates from Wall Street, the Fed and the Government.

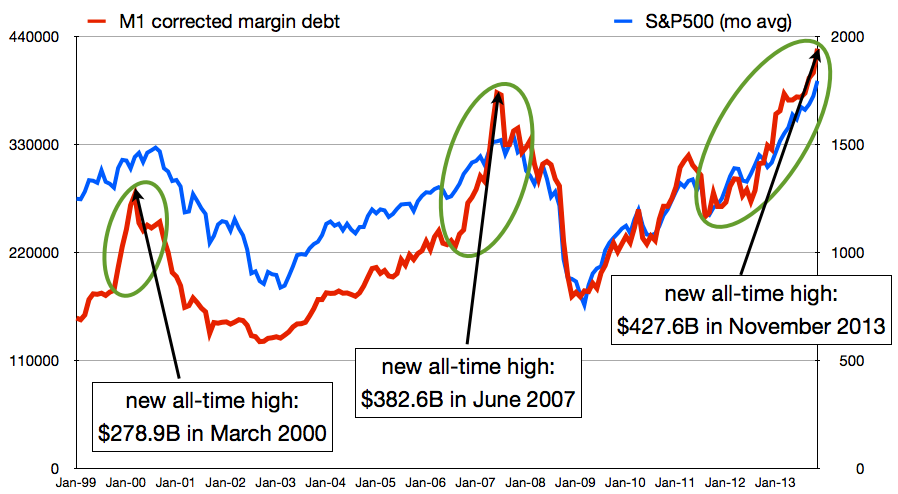

How about the stock market? This gentleman mocked me by asserting that the stock market was hitting all-time highs while gold was going lower. Notwithstanding all of the provable facts about the degree the Fed now intervenes in the all of the markets, let's take a look at some surface facts. 1) Every time the stock market hits an all-time high, it ultimately suffers a massive drop; 2) margin debt recently hit a new all-time high - let's see how that worked out the previous two times in the new millennium:

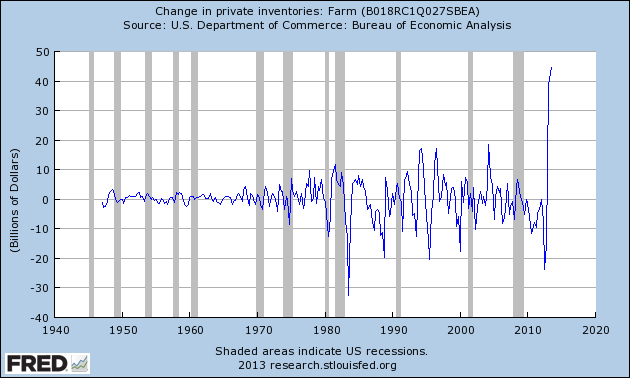

That doesn't look so promising, does it? Let's layer on top of that the fact that p/e ratios are currently at all-time highs. If you strip out the phony mark to market accounting games being played by the financial sector - which represent 25% of the S&P 500 - the p/e ratios are on Pluto; 3) How about that economy? 4.1% GDP growth in Q3, eh? Well, those who bothered to look beyond the headline nonsense saw that 40% of the headline number is attributable to the massive inventory build that is going on. This inventory build up is historically unprecedented:

Not only is this inventory build-up 200% greater than at any time in the last 70 years, but it's nearly 400% greater than the average change in inventory. Even worse, every time the inventory build has spiked up like this, it's been followed by a cliff-drop decline. There are several other problematic aspects with that latest GDP report which I plan on writing about soon.

My point here is that the stock market is not only at an all-time high and at an all-time level of overvaluation, but it also reflects the extreme fraud and manipulation going on behind the headlines and rhetoric. Just a few more points of fact: The U.S. Government debt hits a new all-time everyday; the number of people receiving welfare hits a new all-time high every day; the percentage of people who are actually employed on a full-time basis as a percentage of the total population declines every day.

One last point about the economy. I had forecast back in November that we would have very disappointing retail sales this holiday season: Holiday Sales Will Disappoint. I didn't put that out there because I thrive on doom and gloom, contrary to my acquaintance's assertion. I put that out there because based on the facts that I was looking at, our economy is dropping off a cliff. Well guess what? We already know that retail sales were a bust over the Black Friday weekend. It turns out that last week through Sunday retail sales dropped 3.1% - that's before stripping out inflation - and shopper traffic dropped 21%: Retail Sales Tank Before Christmas. Just one note of observation: to the extent that online sales might be "cannibalizing" mall traffic, it's a fact that online e-commerce is only 6% of total retail sales. So don't expect a big contribution from online sales reports even though the year over year percentage headline gains will be big. As I've discussed ad nauseum, the year over year comparisons right now are exceedingly deceptive.

The point of all of this is that I don't feed and thrive on doom and gloom. What I do thrive on is trying to expose as many people as possible to the truth as supported by the facts about what is really going on in this country. What is really going on is that our system is collapsing in every aspect: economically, politically, ethically, spiritually. And I don't advocate gold because it's a way to make money off of this collapse. I advocate gold because it's the only I can see that people have a chance of surviving the economic meteor coming at our system. Anyone who superficially reads the headline business reports or looks at the stock market and thinks things are getting better is not looking at the facts as they exist and the truth as it is. My only goal is to help people see those facts and then they can draw their own conclusions about the truth.

One last point of fact: the U.S. dollar is slowly and subtly being vacated by the global monetary system while gold is slowly being re-introduced. The Chinese are leading this effort but they have a wide array of economic allies supporting the changes being implemented. Anyone who moves dollars into gold is going to be better off when the transition to the new global monetary system accelerates. The U.S. dollar, like all paper fiat currencies before it throughout all of history, will be nothing but a museum relic.

Merry Christmas to all who celebrate the holiday - to everyone else who will be going out for Chinese food tonight (a big Xmas Eve tradition in NYC) have a great day off tomorrow.