Abstract: In a bold move, social networking giant Facebook (NASDAQ:FB), has challenged the traditional finance and ETF industry, with its “Libra coin”, or as we call it the “Libra ETF”. We note that there are many unanswered questions about Libra, which may lack transparency, when compared to traditional ETFs. Another key disadvantage of Libra is that unlike with legacy ETFs, investment income is not distributed to unit holders. We conclude that although Libra has significant disadvantages when compared to traditional ETF products, Facebook’s wide consumer reach with platforms such as Whatsapp and Instagram could give Libra a key commercial advantage.

Overview

The structure of Libra is analogous to the popular Exchange Traded Fund (ETF) model, where unit holders are entitled to the financial returns of a basket of financial assets. The units are tradable on exchanges and a select group of authorised participants are able to create and redeem units using the underlying assets.

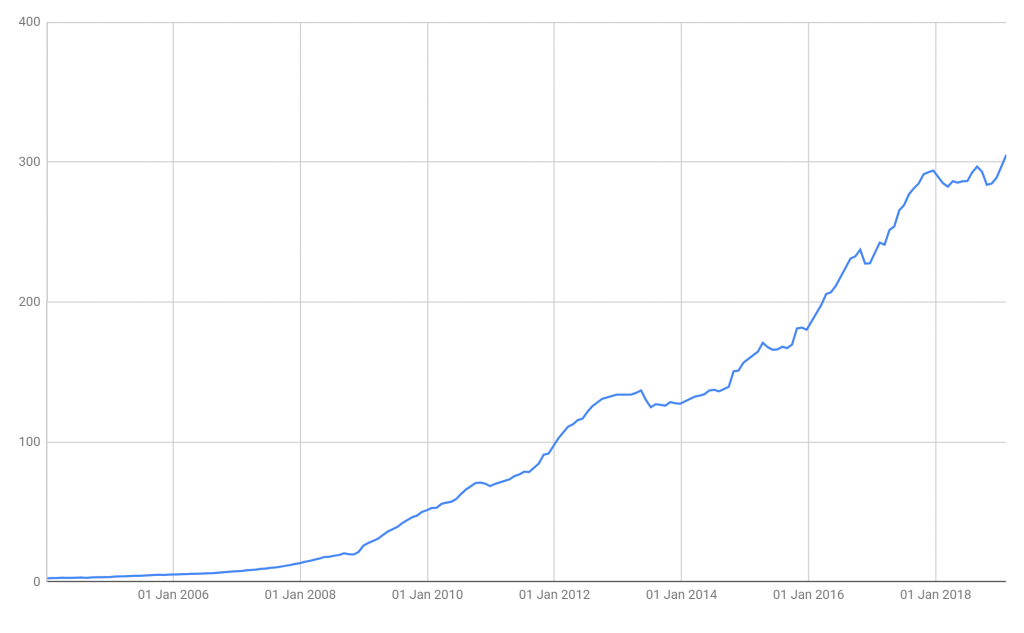

As we pointed out in our February 2019 piece, the ETF industry has enjoyed considerable growth in the last decade or so, in particular in the area of fixed income (See figure 1 below). In June 2019, in a bombshell moment for the ETF industry and challenge for the established players such as Blackrock (NYSE:BLK) and Vanguard, social media and internet conglomerate Facebook, entered the game. In a direct challenge to Blackrocks’s “iShares Core U.S. Aggregate Bond ETF” (AGG), Facebook announced plans to launch a new ETF, the “Libra ETF”, also focused on fixed income and government bonds.

Figure 1 – Size of the Top Bond ETFs Targeting US Investors – US$ Billion

(Source: BitMEX Research, Bloomberg)

(Note: The chart represents the sum of the market capitalisations of the following bond ETFs: iShares Core U.S. Aggregate Bond ETF, Vanguard Total Bond Market ETF, iShares iBoxx $ Investment Grade Corporate Bond ETF, Vanguard Short-Term Corporate Bond ETF, Vanguard Short-Term Bond ETF, Vanguard Intermediate-Term Corporate Bond ETF, iShares J.P. Morgan USD Emerging Markets Bond ETF, Vanguard Total International Bond ETF, iShares MBS Bond ETF, iShares iBoxx $ High Yield Corporate Bond ETF, PIMCO Enhanced Short Maturity Strategy Fund, Vanguard Intermediate-Term Bond ETF, iShares Short-Term Corporate Bond ETF, SPDR Barclays High Yield Bond (NYSE:JNK) ETF, iShares Short Maturity Bond ETF)

Comparing the new ETF structure with the traditional space

In figure 2 below, we have analysed and compared the new innovative Libra ETF to a traditional ETF, Blackrock’s iShares Core US Aggregate Bond ETF (AGG). Our analysis shows that, although the Libra product is new, much of the relevant information, such as transparency of the holdings and frequency of the publication of the NAV, has not yet been disclosed.

The analysis also highlights that Libra may suffer from unnecessary complexity with respect to portfolio management. The fund appears to be managed by the Libra Association, which consists of many entities in multiple industries across the globe. These same entities are responsible for issuing the ETF and the list of companies is set to expand further. At the same time, the investment mandate is unclear. In contrast Blackrock’s fixed income ETF product has a clear investment mandate, to track the Bloomberg Barclays (LON:BARC) U.S. Aggregate Bond Index, which is managed independently of the ETF issuer.

Perhaps the most significant disadvantage of the Libra product, is that unit holders do not appear to be entitled to receive the investment income. This contrasts unfavourably with Blackrock’s product, which focuses on an almost identical asset class and has an investment yield of around 2.6%. Defenders of Libra could point out that the expenses need to be covered from somewhere and that the Libra’s expense fee is not yet disclosed. However, the ETF industry is already highly competitive, with Blackrock charging an expense fee of just 0.05%. This expense fee is far lower than the expected investment yield of the product, at around 2.6% and therefore the Libra ETF may not be price competitive, a key potential disadvantage for potential investors.

Figure 2 – Libra ETF vs iShares Core U.S. Aggregate Bond ETF (AGG) – Detailed Comparison

| Libra ETF |

iShares Core U.S. Aggregate Bond ETF (AGG) |

|

| Launch date | June 2019 | September 2003 |

| Issuer | The Libra Association/Facebook | Blackrock |

| Assets Under Management | Unknown |

US$63.5 billion |

|

Asset class |

Fixed Income

Bank deposits and government securities in currencies from stable and reputable central banks |

Fixed income – Investment grade government and corporate bonds |

| Underlying Index | Unknown/Not applicable | Bloomberg Barclays U.S. Aggregate Bond Index |

|

Portfolio managers |

The Libra Association, based in Switzerland will manage the reserve. The investment mandate is not currently disclosed. The current members are as follows:

|

James Mauro and Scott Radell, with a clear constrained mandate to track the index |

|

Fees |

Unknown |

0.05% |

|

Investment yield |

Unknown |

2.6% |

|

Use of investment income |

Unit holders are not entitled to investment income Investment income will:

first go to support the operating expenses of the association — to fund investments in the growth and development of the ecosystem, grants to nonprofit and multilateral organizations, engineering research, etc. Once that is covered, part of the remaining returns will go to pay dividends to early investors in the Libra Investment Token for their initial contribution |

Attributable to ETF unit holders |

|

Available exchanges |

Currently None The Libra Association will encourage the listing of Libra on multiple regulated electronic exchanges throughout the world |

NYSE |

|

Creation/redemption basket size |

Unknown |

100,000 units |

|

Authorized Participants (entities able to create and redeem units) |

Authorized resellers, not currently disclosed |

Investment Banks |

|

Fund auditor |

Unknown |

PwC |

|

Information about holdings and Net Asset value (NAV) |

Unknown |

Full disclosure (Published daily) |

We have also analysed the two alternatives from a technical perspective. As figure 3 below indicates, the key difference is that control of Libra tokens may in part be managed by digital signatures. As long as no whitelist of addresses is implemented, this may provide some advantages:

- Pseudonymity

- A limited amount of censorship resistance

- Relatively easy integration with cryptocurrency exchanges

However, as we mentioned in our Tether report in February 2018, history has shown that these characteristics can cause platforms to ultimately face a choice between implementing KYC or face being shut down by the authorities. Facebook has already censored politically controversial figures on its main platform, therefore it may appear likely the extent to which Libra ETF units are managed by public private key cryptography is significantly constrained or eventually becomes phased out.

Figure 3 – Technical and cryptographic considerations

|

Libra ETF |

iShares Core U.S. Aggregate Bond ETF (AGG) |

|

|

Consensus system |

Not applicable (An ETF does not require a consensus system) |

|

|

Blockchain |

Not relevant (Grouping records of ETF transactions into a chain of blocks linked together by hashing, is inconsequential for ETFs) |

|

|

Control of units based on digital signature |

Possibly:

The Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity |

No |

Conclusion

Despite the key disadvantage, namely that Libra unit holders are not entitled to the investment income, many industry analysts are carefully examining the impact Libra could have on the traditional ETF industry and existing electronic payment systems.

While our comparison to ETFs is a bit tongue and cheek, it does highlight that the structure of the product has similar attributes to existing financial products. We therefore think it is an appropriate comparison, and if Libra wants to be competitive, it should emulate some of the governance and fee characteristics of traditional ETFs.

However, Libra could attract clients due to integration with platforms such as Facebook, Whatsapp and Instagram. If Libra does retain the property of allowing coins to be controlled by private keys, this is an interesting development and the coin is likely to gain share from tokens such as Tether. However, in our view, in the long run, it is likely Libra either disables this feature or makes it technically difficult, such that only a tiny minority of users have these “non-custodial” wallets. If that happens, Libra is nothing more than a high fee ETF.