Social media giant Facebook Inc (NASDAQ:FB) is slated to report its first-quarter earnings after the close tomorrow. The stock is currently swooning in sympathy with fellow FAANG member Alphabet's (NASDAQ:GOOGL) earnings reaction, and amid reports that Facebook hosted ads for stolen identities. Shares of FB were down 3.5% at $160.00, at last check -- likely to the delight of recent options buyers.

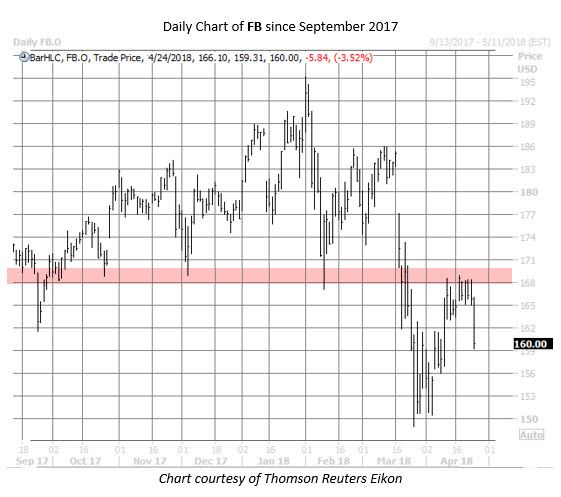

It's been a rough couple of months for Facebook. Following the Cambridge Analytica turmoil, FB stock fell to an eight-month low south of $150 in March. The stock's subsequent rebound attempts have stalled in the $168-$170 area -- a former region of support.

Digging into its earnings history, FB has finished higher the day after reporting in four of the past eight quarters, and popped 3.3% following its last report. The stock's average post-earnings daily price move is 3.1%, regardless of direction, looking back two years. This time around, the options market is pricing in a 9% next-day move -- almost triple the norm -- in either direction, per Trade-Alert.

Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows Facebook stock with a 10-day put/call volume ratio of 0.76, ranking in the 96th percentile of its annual range. This low absolute ratio indicates that more calls have been purchased over puts in the past two weeks, but the high percentage reveals that FB options buyers have been picking up bearish bets over bullish at a much faster-than-usual clip.