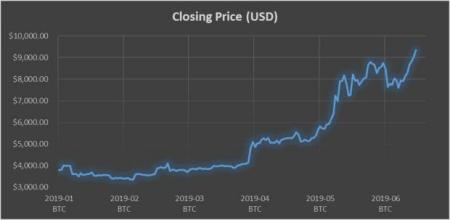

The most visited social media website on earth just revealed its plan to launch its own blockchain-based cryptocurrency. The currency will be called Libra and will be managed by the new Facebook (NASDAQ:FB) subsidiary, Calibra. Calibra’s digital wallet containing Libra is expected to be launched in Messenger, WhatsApp and as a standalone app in the first half of 2020. Cryptocurrencies across the board have been rallying hard in 2019, with Bitcoin gaining over 150% since the first of the year. Rumors of this colossal crypto’s launch have been circulating for months and now finally coming to fruition, fanning the crypto flame once again.

The critical difference between Libra and other cryptocurrencies like Bitcoin, Ethereum, and comparables is that Libra will be backed by a spectrum of international currencies and other investments. An asset-backed digital currency is a key component that I believe will turn crypto skeptics into believers. Being asset-backed will also give this currency stability and a level of security that no other crypto has been able to match.

Facebook is partnering with some heavy-hitters in the financial sector including PayPal (NASDAQ:PYPL) and MasterCard (NYSE:MA) as well as tech titans Uber (NYSE:UBER) and Spotify (NYSE:SPOT) . This consortium of partners will help add to the legitimacy of the currency as well as its reach.

Facebook currently has 2.375 billion monthly active users (MAU) or 57.5% of the world’s humans with internet access, which is a continuously growing figure. This extensive reach will give Libra proper exposure to achieve global traction.

In a press release this morning, Facebook focused on how this new currency will benefit developing countries, quoting that “approximately 70% of small businesses in developing countries lack access to credit and $25 billion is lost by migrants every year through remittance fees.” They are anticipating that Libra will help to mitigate these issues.

Take Away

This new type of asset-back digital currency is going to change the way that investors and regulators view cryptocurrencies. Partnering with widely trusted financial service firms, PayPal and MasterCard adds to the perceived legitimacy of Libra.

The crypto-craze that we saw peak at the end of 2017 might have just been the tip of the iceberg. Cryptocurrencies are making new 52-week highs but is Libra good or bad for the broader crypto market. In my eyes, Libra is bad news for the rest of digital currencies because at the end of the day only the most usable currencies will make it out alive.

Libra will allow anyone with a cheap smartphone to have access to banking and the ability to use their funds with no more than a touch to their screen. The extensive international exposure, ostensible ease of use, and stability is expected to propel Libra’s usage beyond any crypto before it. This could be a huge step into the next generation of banking and digital finances.

FB is up over 44% year-to-date despite regulatory issues involving privacy and the anti-trust probe that has been combing the tech space. Calibra is going to be set up as a nonprofit organization and it is still unclear how Facebook is planning on monetizing Libra, though I am sure it will involve transaction fees. Look for further updates on how this new currency is expected to affect FB’s financials.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Facebook, Inc. (FB): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Spotify Technology SA (SPOT): Free Stock Analysis Report

Uber Technologies Inc. (UBER): Free Stock Analysis Report

Original post

Zacks Investment Research