VALUATION WATCH: Overvalued stocks now make up 50.14% of our stocks assigned a valuation and 19.52% of those equities are calculated to be overvalued by 20% or more. Ten sectors are calculated to be overvalued.

Facebook Inc. (NASDAQ:FB) operates a social networking website worldwide. The Company’s products for users are free of charge and available on the Web, mobile Web, and mobile platforms, such as Android and iOS. Its website enables users to connect, share, discover, and communicate with each other. The Facebook Platform is a set of tools and application programming interfaces that developers can use to build social apps on Facebook or to integrate their Websites with Facebook. It offers products that enable advertisers and marketers to engage with its users. Facebook Inc. is headquartered in Menlo Park, California.

Facebook is under pressure this week due to a series of scandals that have rocked the social media giant. The company was implicated in the various scandals surrounding the US election of 2016 when ties to Cambridge Analytica–a firm which does political consulting and data mining for campaigns across the globe–were confirmed last week.

The company has not protected the privacy of users as promised and in fact has allowed many companies to use that personal data for far more nefarious purposes than cat video viewing, face swapping with famous people, and other pursuits.

Today, it was reported that the company is under investigation by the US Federal Trade Commission for data privacy violations. This news could have huge implications for the company since they had entered into a consent decree with the US government for past violations of privacy laws. Under this decree, the company could face penalties of up to $40k for each new violation. In the Cambridge Analytica scandal alone, the firm is estimated to have mishandled the private data of 50 MILLION users.

At issue is the fact that users who consented to a psychological profile test on Facebook also ended up providing the data on their “friends.” This was not how the data was supposed to be shared between app users and others.

Additionally, it is now reported that the company was monitoring the texts and phone conversations of Android users and retaining that information as well. The firm claims it had “consent” from users, but one wonders how explicit this was made when it was “authorized.”

If you do a little research on these scandals, you will be shocked at how much of your personal data is currently being tracked, retained, and sold by companies such as Facebook and Google (NASDAQ:GOOGL). In response, there are numerous anecdotal reports of users deactivating their accounts–or at least deactivating the app platform on Facebook which allows this functionality.

However, it remains to be seen whether or not the company will face any financial penalties or if a loss of sustained loss of users will effect ad revenue, user growth and engagement, etc.

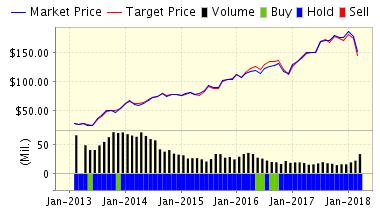

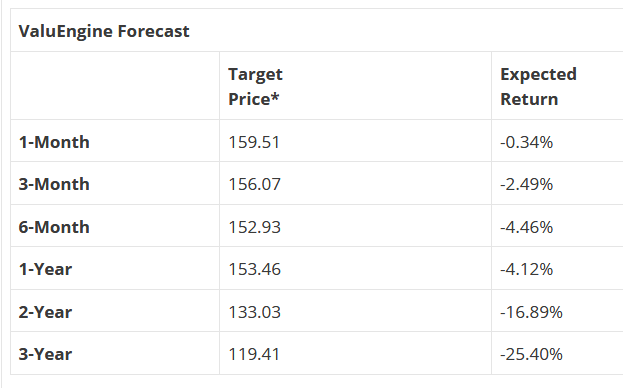

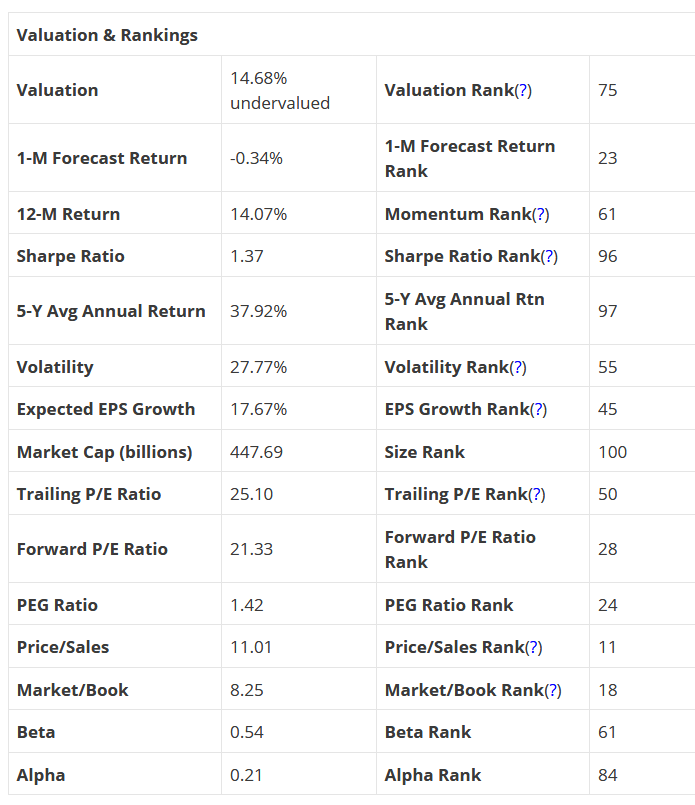

ValuEngine continues its HOLD recommendation on Facebook for 2018-03-26. Based on the information we have gathered and our resulting research, we feel that Facebook has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Price Sales Ratio.

You can download a free copy of detailed report on Facebook (FB) from the link below.