Per media reports, Facebook, Inc. (NASDAQ:FB) is now being investigated by the U.S. Internal Revenue Service (IRS) over assets transferred to its subsidiary based in Ireland in 2010. The U.S Department of Justice has filed a lawsuit “seeking to enforce summonses” made by IRS on Facebook to produce a range of documents that will help the probe.

Media reports further add that in 2010, Facebook had transferred rights to its “online platform” and “marketing intangibles” of its entire business except for the U.S and Canada to its Ireland based subsidiary. IRS has been investigating whether the company "understated" its U.S income by selling rights at very low-prices to the Irish subsidiary. Ernst & Young (EY) was the tax advisor to Facebook for this transaction. EY wasn’t available for comment.

Notably, EU has become a tax haven for U.S companies. In Ireland, corporate tax rates are 12.5% whereas domestic corporate tax rate is at least 35%. Many companies have resorted to complicated tax computations that facilitate transfer of funds to tax havens causing decrease in U.S taxable income. The government has cracked down hard on such practices by big companies.

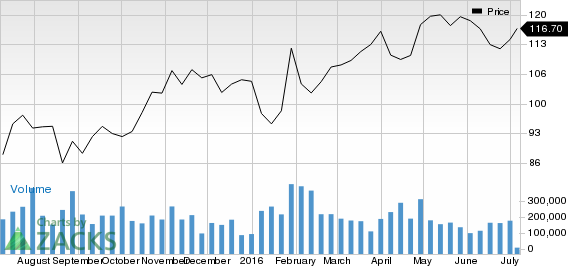

FACEBOOK INC-A Price

However, Facebook denies usage of any such malpractices. The company spokesperson said "Facebook complies with all applicable rules and regulations in the countries where we operate."

At present, Facebook carries a Zacks Rank #3(Hold).

Better ranked stocks in the tech space include Better-ranked stocks worth considering are NetEase, Inc. (NASDAQ:NTES) , Globant S.A. (NYSE:GLOB) and Imprivata, Inc. (NYSE:IMPR) . All of these sport a Zacks Rank #1 (Strong Buy).

NETEASE INC (NTES): Free Stock Analysis Report

GLOBANT SA (GLOB): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

IMPRIVATA INC (IMPR): Free Stock Analysis Report

Original post

Zacks Investment Research