The shares of Facebook, Inc. (NASDAQ:FB) are sinking ahead of the social media giant's fourth-quarter earnings report, due after the close tomorrow, January 30. At last check, FB is down 2.2% at $144.25, and the options market is expecting a more volatile-than-usual swing for the FAANG stock in Thursday's trading.

Most recently, Trade-Alert placed Facebook's implied earnings deviation at 10.5%, nearly double the 5.3% next-day move the stock has averaged over the last two years. Looking back, just one of those post-earnings reactions was large enough to match or exceed what the options market is pricing in this time around -- FB's historic 19% plunge last July.

Ahead of earnings, the February 140 call and put are home to peak front-month open interest levels of 34,914 contracts and 32,967 contracts -- pointing to the possible pre-earnings straddles. Today, meanwhile, options volume is running at a lighter-than-usual clip, with roughly 102,000 contracts on the tape. The February 150 call is most active, while the weekly 2/1 155-strike call is also popular, with buy-to-open activity detected at both.

The sentiment is bullish toward FB outside of the options pits. While 27 of 34 analysts maintain a "buy" or better rating, the average 12-month price target of $184.01 is a 27.6% premium to the FAANG stock's current price.

Plus, short sellers started cashing out after FB hit a nearly two-year low of $123.02 on Christmas Eve, with short interest dropping 22% in the January 1-15 reporting periods -- a time frame in which the shares added 13.6%. However, the 26.88 million shares now sold short represent just 1.1% of the equity's float, suggesting this source of buying power could be dried up.

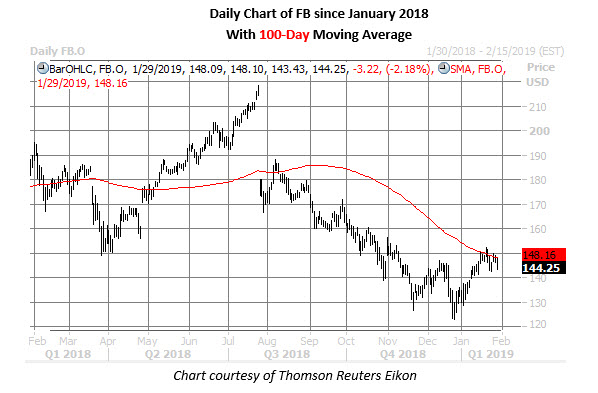

What's more, FB stock is struggling against resistance at its 100-day moving average -- a descending trendline that's kept a tight lid on the equity's upside so far this year. Longer term, the shares are down 22% year-over-year.