Facebook, Inc. (NASDAQ:FB) has sat out a broader rally in FAANG stocks this week, as new privacy concerns surfaced. Most recently, the social media concern said it unintentionally made public the private statuses of 14 million users due to a glitch in the website's audience selector tool. While Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Netflix (NASDAQ:NFLX) hit record highs, FB stock is pacing for a 3% weekly drop -- its biggest since late March -- but options traders aren't worried.

In fact, over the past five sessions, the July 205 call has seen the biggest rise in open interest in FB's options pits, with more than 16,000 contracts added. Data from the major options exchanges confirms mostly buy-to-open activity here, meaning speculators are targeting a break out to new record highs by the close on Friday, July 20 -- when the back-month options expire.

More broadly, it's been put buyers who have been unusually active in recent months. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHXL (PHLX), the stock's 50-day put/call volume ratio of 0.73 ranks in the 100th annual percentile, meaning long puts have been initiated relative to calls at an accelerated clip.

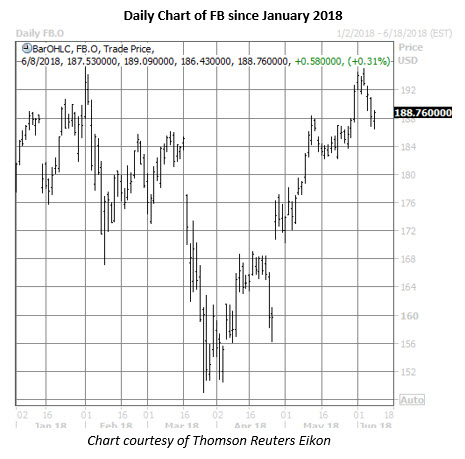

Looking closer at the charts, FB stock sold off sharply in late March, when news of the Cambridge Analytica scandal first hit. Since then, the shares have climbed 26% -- and came within a chip-shot of taking out their Feb. 1 record high of $195.32 on Tuesday. Against this backdrop, some of the recent put buying could be at the hands of shareholders hedging against any downside risk.