Facebook (NASDAQ:FB) has long held status as a market darling.

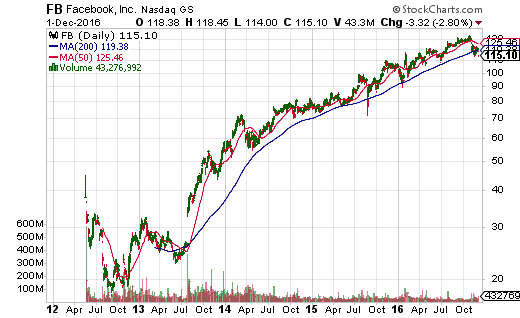

Soon after its IPO in 2012, FB was languishing around $20 when bears like me (at the time) were waiting for the stock to drop below $15. From there the stock launched into a near moonshot to the last all-time closing high of $133.28 on October 24, 2016.

When the stock gapped down on earnings in early November, I assumed that the sell-off would present yet another buy-the-dip opportunity for following the persistent uptrend. Yet, THIS time is looking different. For the first time since its struggles at its 200-day moving average in 2013, FB has not used this critical uptrend support line as a quick springboard to future gains.

FB broke down below 200DMA support in the days after the U.S. Presidential election. Its rebound was short-lived as the last two days brought back heavy selling volume and a fresh 200DMA breakdown. FB closed right at the low from the last 200DMA breakdown. If the stock closes lower, it will confirm the 200DMA breakdown and likely usher in a more extended duration of selling.

An epic run-up in Facebook (FB) has used the 200DMA as a reliable guide and springboard since 2013.

Facebook (FB) is struggling to hold 200DMA support for the first time in three years.

The 50DMA adds to Facebook’s ominous technicals – this trendline is now pointing downward and stands ready to cap any rallies that manage to break above the 20DMA. Note how FB’s last rebound hit a brick wall at the sharply declining 20DMA. If FB breaks below the June low, I will assume a confirmation of some kind of top for FB.

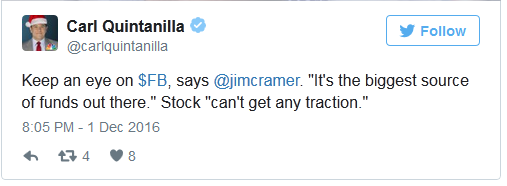

Traders and investors have well-noted the rotation out of technology stocks and into financials, commodities, and industrial stocks since the election. It looks like Facebook could become the poster child of the race out of high-tech.

January is typically a time when short-term traders can flip stocks which were beaten down in December by tax-related selling. I am wondering whether FB will join the list but as a stock sold off for its profits rather than its losses…

Be careful out there!

Full disclosure: no positions