Facebook, Inc. ( (NASDAQ:FB) ) just released its fiscal fourth-quarter financial results, posting adjusted earnings of $2.21 per share and revenues of $12.972 billion.

Currently, FB is a Zacks Rank #2 (Buy) and is down 4.29% to $179.00 per share in trading shortly after its earnings report was released.

Facebook:

Beat earnings estimates. The company posted adjusted earnings of $2.21, beating the Zacks Consensus Estimate of $1.96 per share. Changes to the U.S. tax code impacted earnings by $0.77 per share. Factoring in these costs, Facebook reported earnings of $1.44 per share.

Beat revenue estimates. The company saw revenue figures of $12.97 billion, beating our consensus estimate of $12.58 billion.

Daily active users reached an average of 1.40 billion in December. Monthly active users were 2.13 billion at the end of the quarter, an increase of 14% year-over-year.

Mobile advertising revenue represented approximately 89% of advertising revenue for the fourth quarter of 2017, up from approximately 84% of advertising revenue in the year-ago period.

"2017 was a strong year for Facebook, but it was also a hard one,” said CEO Mark Zuckerberg. "In 2018, we're focused on making sure Facebook isn't just fun to use, but also good for people's well-being and for society."

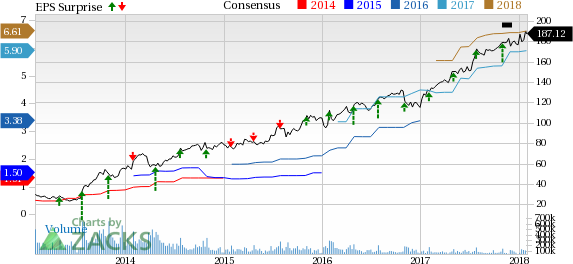

Here’s a graph that looks at Facebook’s recent earnings performance:

Facebook Inc. operates a social networking website worldwide. The company's products for users are free of charge and available on the Web, mobile Web, and mobile platforms, such as Android and iOS. Its website enables users to connect, share, discover, and communicate with each other. The Facebook Platform is a set of tools and application programming interfaces that developers can use to build social apps on Facebook or to integrate their Websites with Facebook. The company also owns and operates Instagram and WhatsApp.

Check back later for our full analysis on Facebook’s earnings report!

Want more analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Facebook, Inc. (FB): Free Stock Analysis Report

Original post

Zacks Investment Research