This is a short summary of some interesting things that caught our beady eye this week. All of these have serious implications … otherwise I’d not consider them, but this is simply a lighthearted look.

In case you missed it … How I was reminded of Trump’s foreign policy strategy from an event nearly 20 years ago when a friend and I nearly got the stuffing kicked out of us.

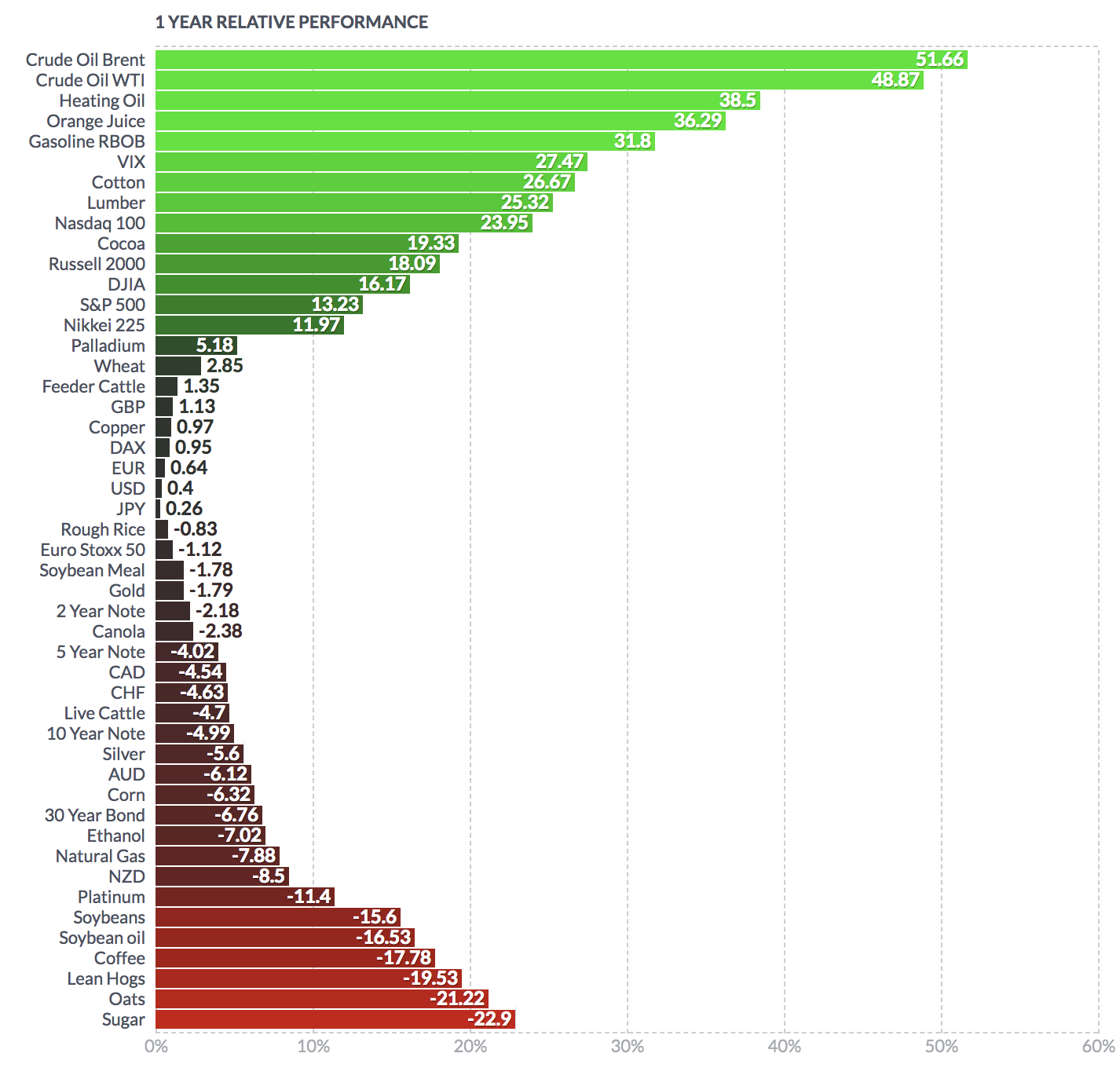

One Year: What Worked … and What Was Meh

Courtesy of Finviz, which I still find pretty cool for certain things.

Dang, it would have been good to be long oil. Oh, wait … we were. Wanna know more? Go HERE and stop mucking about.

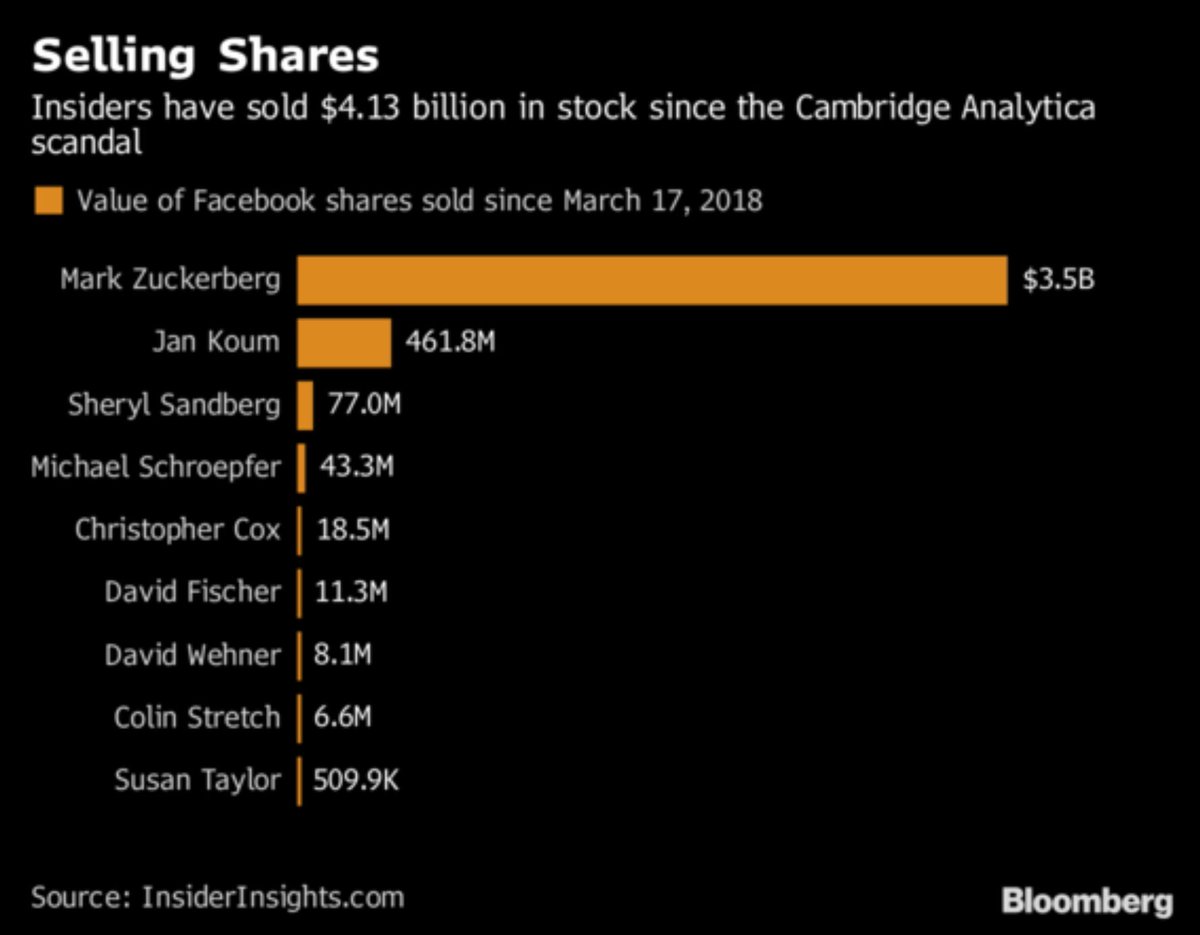

Couldn’t Happen to a Nicer Company

Facebook (NASDAQ:FB) missed earnings — something we pointed out right here. A bug and a windshield is what I called it.

Dang, I wish there was a way to know before hand. Oh, wait…

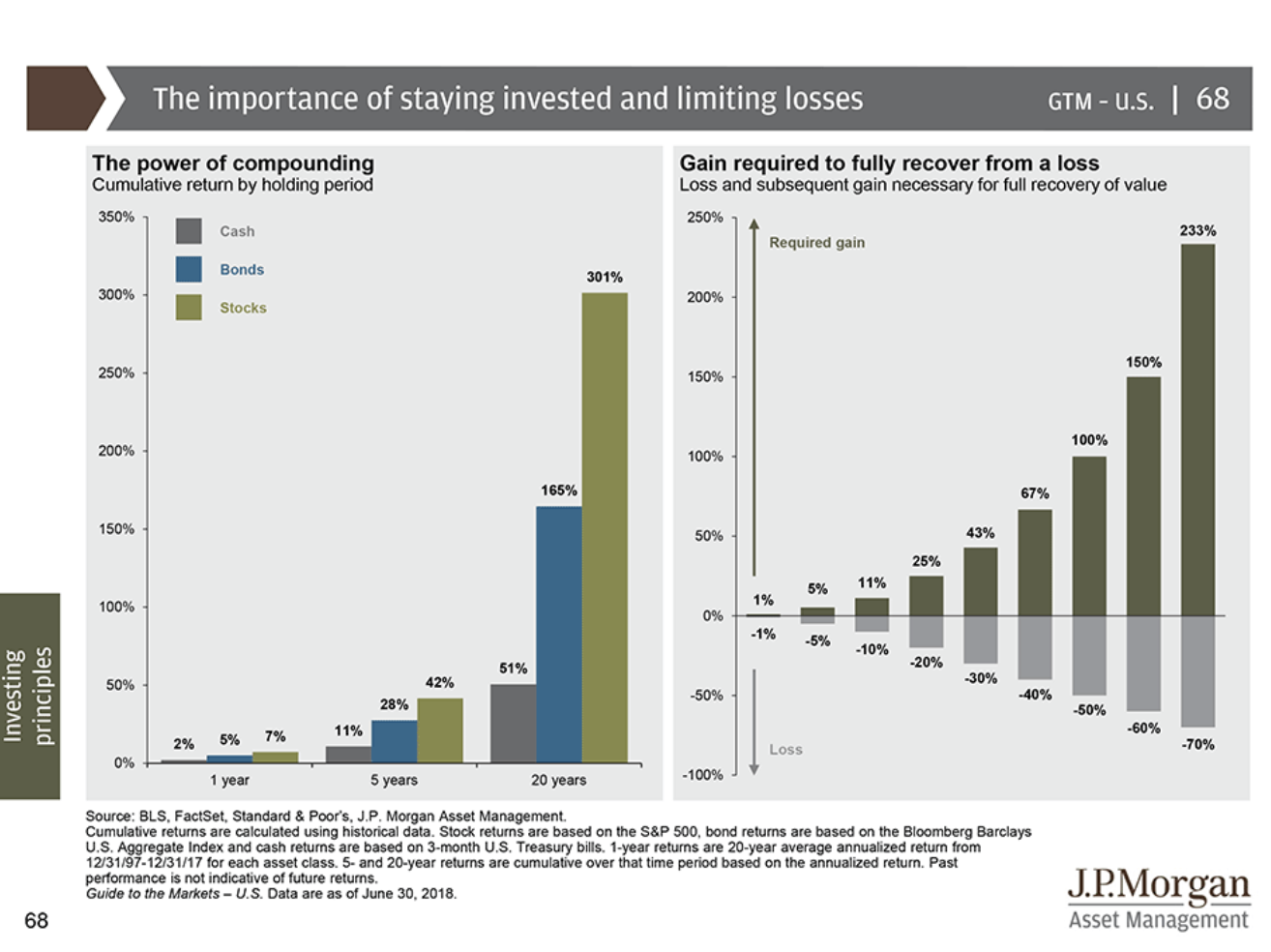

Asymmetry

I’ve always said to focus on two things. Low risk first and foremost… and high potential return, which brings up the point of one of the worst things investors do courtesy of J.P. Morgan.

Takeaway: Don’t be a product of the “must have now” age. Your net worth will thank you… and so will your blood pressure.

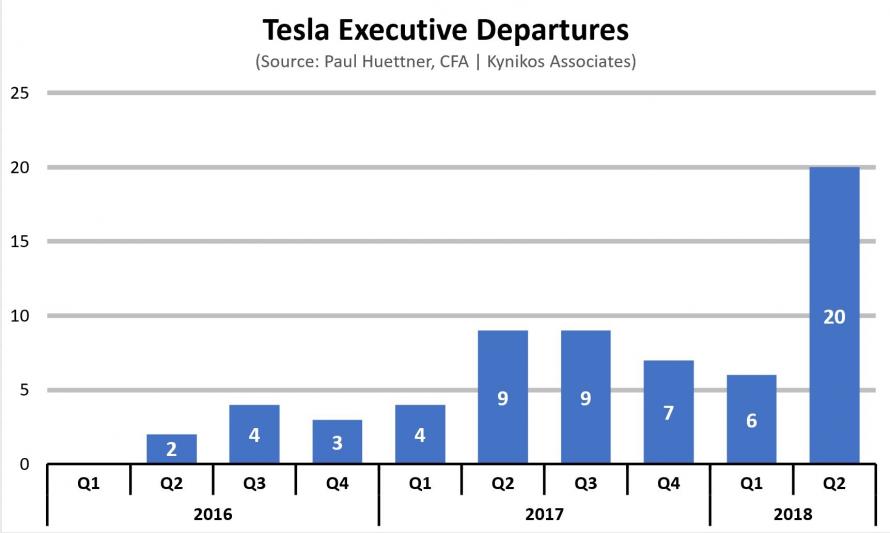

Heading for the Hills

Which brings us to…

Though, I see this just hit my feed as I was about to hit publish:

Another Tesla (NASDAQ:TSLA) energy executive departure: Chris Wahl – Senior Regional Sales Director

And here is a picture taken from the Tesla headquarters:

At least they’re not asking suppliers for “cash back” in order to remain solvent.

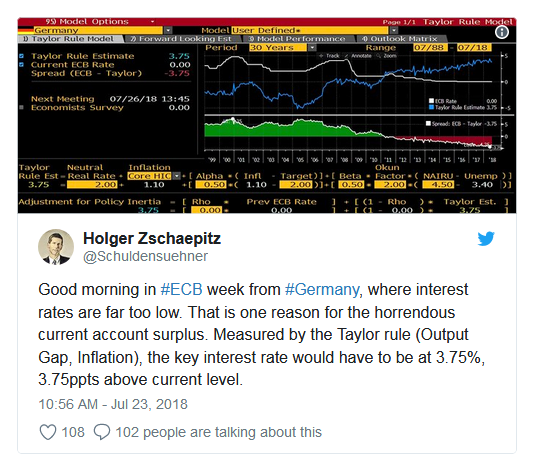

Interest Rate Differentials

They matter. A lot.

I spoke about this in May: when I talked about the dollar and explained our bullish thesis on the dollar. Wanna know how we’re playing it? Check out Insider.

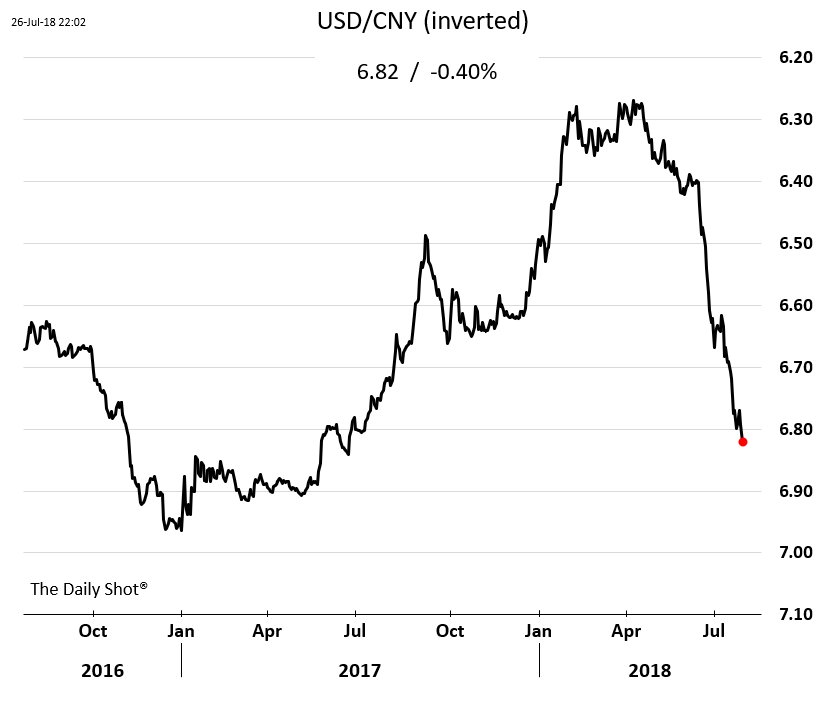

Trade Wars: Not Just Tariffs for Ammunition

This is how China is responding to tariffs.

Gold

And from Brent Johnson a video he put together. Go watch it.