Last week I showed that Facebook (NASDAQ:FB) would reach around $155 and start correcting from there: see here. On Friday it reached $155.54 and dropped 5.8% intra-day, to end the day down 3.28%. It's largest intra-day drop since November 2016.

To illustrate: if you'd bought FB late-April your gains would effectively be $0... So much for buy, hold and hope. Clearly accurate Elliott Wave analyses combined with solid technical analysis and executing a proven trading system provides for much more reliable and profitable trading: see here.

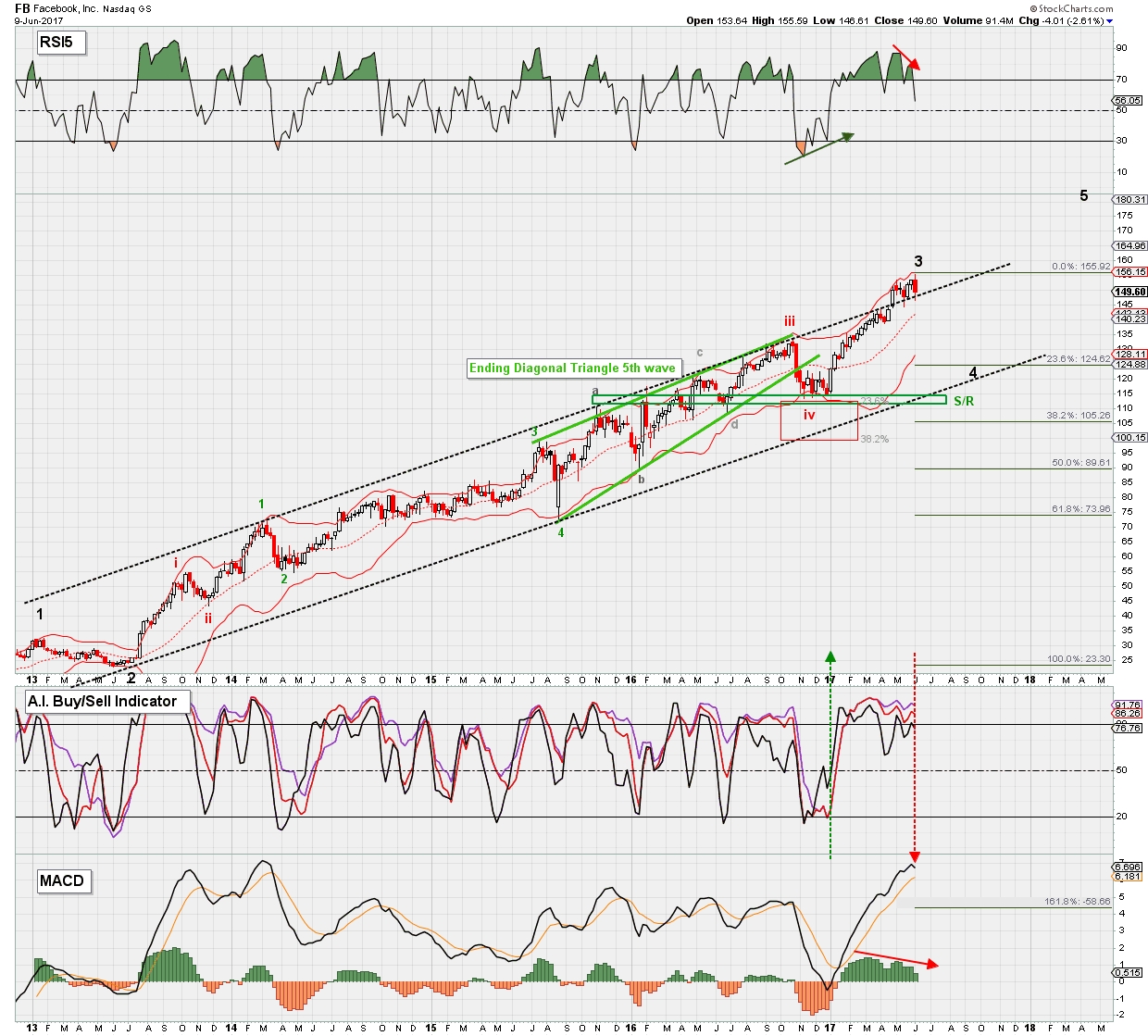

That said, where's FB heading next? The weekly chart below tells the most likely story. Please note this chart has barely changed from what I already showed December last year here on Investing.com, when I correctly forecasted FB was becoming a low risk/high reward buy: see here.

Although one more push higher can not yet be excluded until price drops below the mid-May low @ $144ish, so please keep an eye on that level, the number of waves up can be counted as an complete impulse (5 waves) off the December 2016 low, and thus the risk/reward is to the downside, not the upside.

I now expect FB to retrace 23.6 to 38.2% of its entire advance off the price low made in 2013: $125-$105 should be the ultimate target. This retrace levels are typical for a 4th wave and therefore the most reasonable to forecast. In addition, the $110-$115 level is now a good support zone and the rising dotted black trend line is currently within that region as well.

Please note that 4th waves are notoriously difficult to forecast and trade as there are no set rules. They can turn into high-level consolidations (bull flag), or fast steep drops. Regardless, FB, like many other large-cap tech stocks is getting closer to the end then the beginning of their long multi-year uptrends and it would not be unwise for long-term traders to start to re-evaluate their holdings and positions in these names.