In the absence of the really juicy data points that are due later in the week, markets have remained glued to developments in Hong Kong. While the protest in the city has remained very much a peaceful one, I certainly awoke this morning with fears that Beijing will have rolled in and put the demonstration to an end in their own inimitable way. Tomorrow’s October 1st holiday – celebrating the National Day of the People’s Republic of China – is an obvious flashpoint. The local equities market has continued lower overnight with fears that a crackdown that would cause news editors to dig out the Tiananmen Square footage will irrevocably damage Hong Kong’s image as one of the financial centres of Asia.

HKD has made back some of its recent losses overnight against its USD peg, but remains close to the levels not seen since 2012.

China’s manufacturing PMI was shown to have picked up last week at the preliminary estimate. Last night’s actual number cancelled out that pick-up to leave the sector only marginally expanding through September. Output and new orders components both slipped lower. As we wait on the news from the rest of the world – most countries publish their manufacturing PMI runs on the first day of the month – it is clear that conversations around China’s position will rely heavily on the need for additional monetary and fiscal stimulus.

Japanese data found some good news to concentrate on in the form of the latest round of wage data. Japanese wages rose by 1.4% in the month to August, the sixth consecutive month of gains and the third at 1% or above. Obviously this has the ability to lay the groundwork for increased consumer confidence and eventually spending. While the economy has a long way to go to start marginalising the sales taxes effect on Japanese consumers’ pocket, this will go some way to make things a little easier. Yen is slightly stronger on the session with some haven flows from the Hong Kong situation no doubt helping matters.

Yesterday’s German inflation measure showed CPI remaining close to 0.8% and I believe that the overall Eurozone number will remain at 0.3% in September. Policy is set up to address this issue but will not have had time to have an effect just yet. The market’s new favourite indicator for Mario Draghi and the European Central Bank’s thought process is the 5yr5yr swap rate – a measure for estimating medium-term inflation – has continued to decline below the 2% level. As it stands, with that swap rate below 2%, the ECB will need to do more.

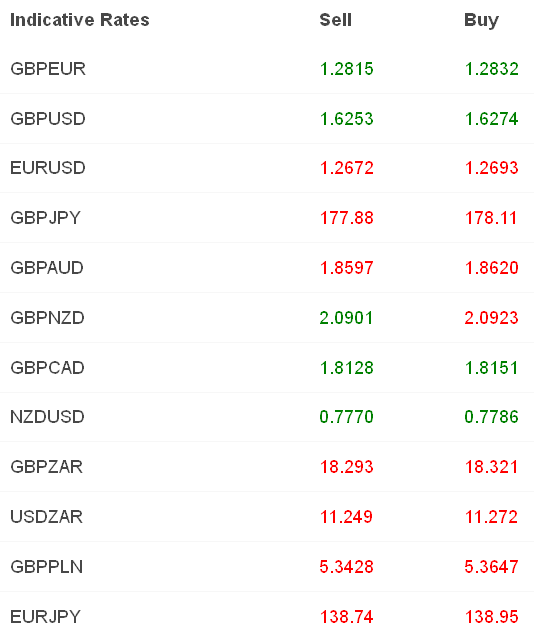

With the recent USD outperformance we are starting to question whether this run of strength is particularly overdone. Gains of 7% on the quarter and 6% on the year against the G10 basket are remarkably impressive and we would expect to see some covering of short positions, particularly against the commodity currencies of AUD, CAD, NOK and NZD in the coming days.

This week’s data calendar is quiet in the UK but we will be going through the typical run of PMIs as we open up the new month. Today’s GDP final release for the second quarter is unlikely to rock the boat too much – I anticipate that expansion of the UK economy will continue to be shown at a 0.8% Quarter-on-Quarter rate. Final measures have a habit of staying the same as the first revision and we have not seen any monthly industrial or retail numbers that would cause us to change this. 0.8% still represents one of the strongest growth rates in the G10. Whether it has lasted into Q3 is another matter entirely.