Integrated energy giant ExxonMobil Corporation (NYSE:XOM) recently announced that its affiliate Esso Exploration and Production Guyana Limited found more oil in the Payara reservoir offshore Guyana. This new find increases the company's total discovery in Payara to around 500 million barrels of oil equivalent (BOE). As a result of the latest development, gross recoverable resource in the Stabroek Block has increased to 2.25 - 2.75 billion BOE.

The company has found 18 meters oil-bearing sandstone of high grade in the Payara field while drilling Payara-2 well to 5,812 meters in about 2,135 meters of water. In this context, we would like to remind investors that the company had found 29 meters of high-quality, oil-bearing sandstone reservoirs in the Payara-1 well in Jan 2017. The well was drilled to 5,512 meters in 2,030 meters of water.

The Payara-2 well - considered to be the second giant field discovered in Guyana - is located 20 kilometers northwest of the Liza phase 1 project on the Stabroek Block that was funded in Jun 2017. It is located more than 209.3 kilometers offshore Guyana.

ExxonMobil expects the discoveries in Payara, Liza and the satellite finding in Snoek and Liza Deep to increase its production in the future significantly. This will also lead to some major benefits for Guyana. In Mar 2017, the company encountered 25 meters of high-quality, oil-bearing sandstone reservoirs in its Snoek well that is located in the southern part of Stabroek.

Investors should know that the Stabroek Block spans 26,800 square kilometers, wherein Esso Exploration and Production Guyana Limited holds 45% operating interests. Hess Corporation (NYSE:HES) and CNOOC Limited (NYSE:CEO) hold 30% and 25% interest in the area, respectively.

About the Company

Irving, TX-based ExxonMobil is one of the world’s largest publicly traded oil companies, engaged in oil and natural gas exploration and production, petroleum products refining and marketing, chemicals manufacture, and other energy-related businesses. Approximately 83% of Exxon’s earnings come from its operations outside the U.S. The company divides its operations mainly into three segments: Upstream, Downstream and Chemicals.

Price Performance

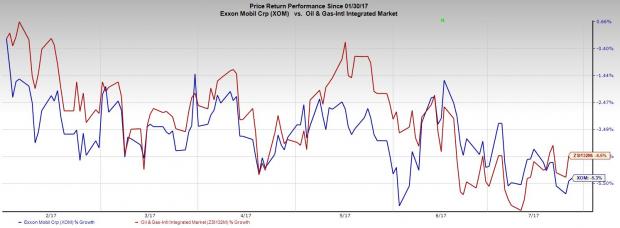

In the last six months, ExxonMobil’s shares decreased 5.3%, underperforming the industry’s loss of 4.5%.

Zacks Rank and Stock to Consider

ExxonMobil presently has a Zacks Rank #4 (Sell).

A better-ranked stock in the oil and energy sector is Braskem S.A. (NYSE:BAK) . It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Braskem’s sales for 2017 are expected to increase 11% year over year. The company delivered an average positive earnings surprise of 107.8% in the last four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

CNOOC Limited (CEO): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

Hess Corporation (HES): Free Stock Analysis Report

Original post

Zacks Investment Research