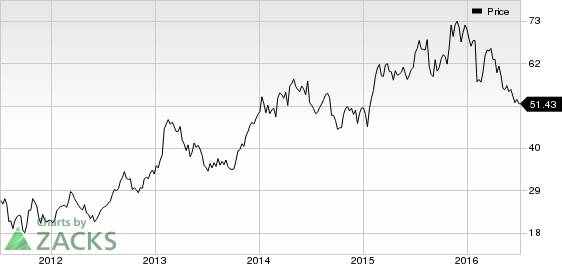

Shares of ExxonMobil Corp. (NYSE:XOM) hit a 52-week high of $93.98 on Jul 1, 2016. Shares closed at $93.84, reflecting a solid return of 12.8% over the past three months. The average trading volume for the last three months aggregated 10,792,700 shares. The energy major has a market cap of $389.12 billion. Over the past 52 weeks, the company’s shares ranged from a low of $66.55 to a high of $93.98.

Crude Rally Drives ExxonMobil

Since the beginning of April, shares of this Zacks Rank #2 (Buy) stock have been witnessing a gradual uptrend. ExxonMobil’s exposure to crude price volatility is resulting in its steady rise. The West Texas Intermediate (WTI) crude fell to a 12-year low mark of $26.21 per barrel in February. Now, this commodity is hovering around $49 per barrel, reflecting a whopping jump of as high of approximately 90%. The surge in crude is being driven by a potential workers strike in Norway and disruption in Venezuela. The upward pressure in oil prices also reflects the U.S. Energy Department's recent inventory releases that show a lower crude stockpile.

Also, upward estimate revisions over the last 90 days added to ExxonMobil’s attractiveness. Analysts have become bullish on the company’s growth prospects, thereby leading to the rise in estimates. The Zacks Consensus Estimate for 2016 rose to $2.66 from $2.36 per share over the last 90 days. A persistent rise in oil prices is therefore a major boon for ExxonMobil.

Notably, ExxonMobil is the world’s best run integrated oil company given its track record of superior return on capital employed. As the largest publicly traded oil company, ExxonMobil has long been a core holding for investors seeking a defensive name with continued dividend growth.

Other Stocks to Consider

Other well-placed stocks from the broader energy sector include CVR Refining, LP (NYSE:CVRR) , World Fuel Services Corp. (NYSE:INT) and Tallgrass Energy GP, LP (NYSE:TEGP) . Each of these stocks sports a Zacks Rank #1 (Strong Buy).

WORLD FUEL SVCS (INT): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

TALLGRASS ENRGY (TEGP): Free Stock Analysis Report

CVR REFINING LP (CVRR): Free Stock Analysis Report

Original post

Zacks Investment Research