A month has gone by since the last earnings report for Exxon Mobil Corporation (NYSE:XOM) . Shares have lost about 4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Second-Quarter 2017 Results

Exxon Mobil posted an earnings miss in second-quarter 2017 owing to a decline in liquid volumes and lower margin from chemical businesses. This was partially offset by increased price realizations from liquids and gas and improved refinery volumes.

The company reported earnings of $0.78 per share, which missed the Zacks Consensus Estimate of $0.83. However, the bottom line improved from the year-ago quarter level of $0.41.

Total revenue in the quarter increased to $62,876 million from $57,694 million in the year-ago quarter. Moreover, the top line surpassed the Zacks Consensus Estimate of $61,157 million.

Operational Performance

Upstream: Quarterly earnings at the segment were $1.2 billion, up $890 million from the April-to-June quarter of 2016. Increased price realizations from liquids and gas led to the outperformance, partly negated by the decline in liquid volumes.

Production averaged 3.922 million barrels of oil equivalent per day (MMBOE/d), almost in line with the year-ago quarter.

Liquid production fell 3% year over year to 2.269 million barrels per day owing to field decline.

However, natural gas production rose 2% from the year-ago quarter to 9.920 MMCF/d (millions of cubic feet per day). Ramp ups of projects particularly in Australia drove the upside.

Downstream: The segment recorded profits of $1.4 billion. The reported figure is $560 million higher than the April–June quarter of 2016. This improvement was backed by improved refinery volumes and margins from its refining business.

ExxonMobil's refinery throughput averaged 4.4 million barrels per day (MMB/D), up 5% from the year-earlier level.

Chemical: This unit contributed $985 million. This is $232 million lower than the second quarter of 2016. Lower margins along with an increase in turnaround activities from the business unit led to the decline.

Financials

During the quarter, ExxonMobil generated cash flow of $7.1 billion from operations and asset sales. The company returned $3.3 billion to shareholders through dividends. Capital and exploration spending decreased 24% year over year to $3.9 billion.

How Have Estimates Been Moving Since Then?

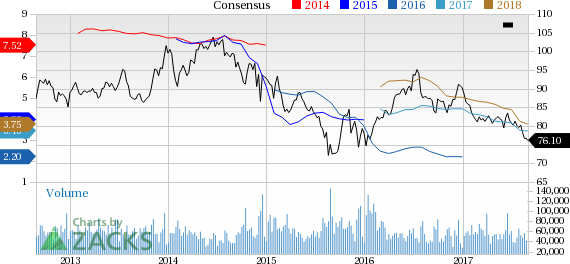

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Exxon Mobil's stock has a nice Growth Score of B, though it is lagging a bit on the momentum front with a D. The stock was allocated also a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for growth investors than those looking for value.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Original post

Zacks Investment Research