Extra Space Storage Inc. (NYSE:EXR) is scheduled to report second-quarter 2017 results on Aug 1, after the market closes.

In the last reported quarter, this Salt Lake City, UT-based self-storage real estate investment trust (“REIT”) delivered a positive surprise of 5.10% in terms of funds from operations (“FFO”) per share. Results indicated an improvement in same-store net operating income (NOI).

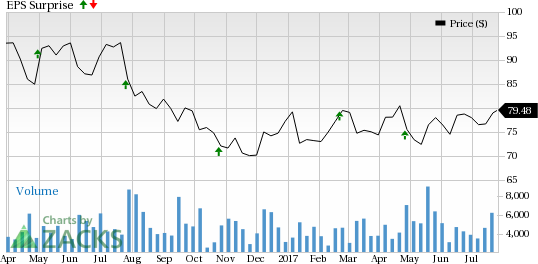

The company has a decent surprise history. In fact, over the trailing four quarters, the company exceeded the Zacks Consensus Estimate in each of the quarters, with an average beat of 4.12%. This is depicted in the graph below:

However, Extra Space Storage’s shares have climbed 2.9% year to date compared with the industry’s gain of 3.4%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Extra Space Storage is a notable name in the self-storage industry. The company offers a wide array of well-located storage units to its customers, including boat storage, recreational vehicle storage and business storage. In addition, the self-storage industry is anticipated to experience solid demand, backed by favorable demographic changes and events like marriages, shifting, death and even divorce. As such, in the to-be-reported quarter, the company is anticipated to benefit from steady demand in the self-storage industry, and witness growth in same-store revenues and NOI.

However, there is an increasing supply of storage units in certain MSAs, which can adversely affect its pricing power. In fact, Extra Space Storage operates in a highly fragmented market in the U.S., with intense competition from numerous private, regional and local operators. Amid this, occupancy levels are also likely to remain nearly flat in the quarter under review.

Amid these, prior to the second-quarter earnings release, there is lack of any solid catalyst. As such, the Zacks Consensus Estimate of FFO per share for the to-be-reported quarter remained unchanged at $1.05 over the past seven days.

Earnings Whispers

Our proven model does not conclusively show that Extra Space Storage will likely beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP for Extra Space Storage is 0.00%. This is because the Most Accurate estimate of $1.05 matches the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Extra Space Storage’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of an earnings beat.

Stocks That Warrant a Look

Here are a few stocks in the REIT space that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this time around:

CyrusOne Inc. (NASDAQ:CONE) , likely to release earnings on Aug 2, has an Earnings ESP of +2.70% and a Zacks Rank #2.

Piedmont Office Realty Trust, Inc. (NYSE:PDM) , expected to release earnings on Aug 2, has an Earnings ESP of +2.27% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

AvalonBay Communities, Inc. (NYSE:AVB) , likely to release second-quarter numbers on Aug 2, has an Earnings ESP of +0.94% and a Zacks Rank #3.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Original post

Zacks Investment Research