The S&P 500 traded in a 20-point range on Thursday, 12/27. And most of that activity was consistent with risk-off, “sell-it-all” fretfulness.

What have investors been fretting? What else… the fiscal stand-off.

Early on Thursday, Senate Majority Leader Harry Reid sent broader indexes 1% lower on statements suggesting that a budget deal could not be reached before year-end. Later in the day, Republicans in the House of Representatives agreed to reconvene in Washington D.C. on Sunday (12/30), encouraging markets to rally back to the flat line.

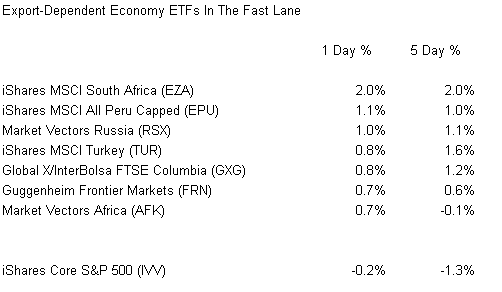

In spite of the cliff drama, international and emerging market ETFs with strong export economies held firm. In fact, many materials-rich country funds were flirting with 52-week highs.

What explains the lust for exotic locales such as Peru, Columbia, Malaysia and South Africa? Many of these emerging/frontier markets are driven by their ability to export to rapidly growing nations like China. And the world’s second largest economy is beginning to look like its old self again.

Specifically, Peru’s primary exports are copper, gold and zinc, all of which are in significant demand by emergers like China and India. Similarly, South Africa is the second largest producer of palladium, third largest coal exporter and a significant exporter of corn as well as wool. Its trading partners? China, Germany and the U.S.

The thinking goes something like this: Sooner or later (and even if its later), the U.S. government will get its collective act together. The shenanigans may have a temporary impact on sentiment, but not a lasting impact on world demand for raw goods, unfinished products and natural resources. Ergo, 7.5% growth in China coupled with modest 2% GDP in the U.S. should bolster exporters previously hindered by weak Chinese demand and European stagnation.

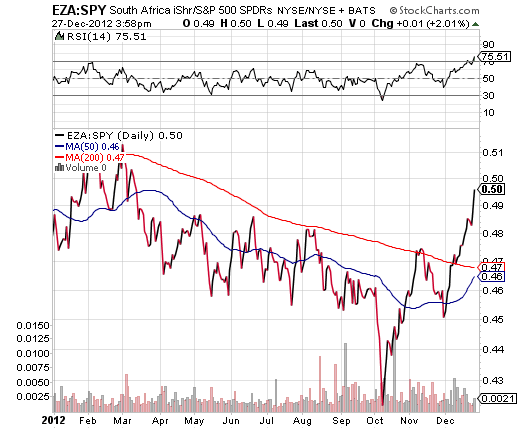

The power of the exporting nation/region premise is easily identified in relative strength price ratios. For example, the current price of the iShares MSCI South Africa (EZA):SPDR S&P 500 (SPY) price ratio is well above its long-term 200 day trendline for the first time since March. What’s more, its Relative Strength Index (RSI) value is at the top of its typical range.

This is not to suggest that you should load up on emerging market and frontier market exporters this minute. On the contrary. You need a bit of a pullback and a sound investing plan of action for putting new money to work.

That said, ETF enthusiasts who had forgotten about foreign investments may wish to reacquaint themselves with a variety of overseas possibilities. Not only are a number of these markets trading at P/Es of 10-12, but they boast technical uptrends that had eluded them for the better part of the last 2 years.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Exporter ETFs Unfazed By U.S. Political Drama

Published 12/28/2012, 01:52 AM

Updated 03/09/2019, 08:30 AM

Exporter ETFs Unfazed By U.S. Political Drama

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.