Draghi gave himself the flexibility to keep QE going beyond Sept 2018 and the market sent EUR/USD to the lowest since July. The US dollar was the top performer Thursday while the euro lagged. Japanese CPI is due up next.

We warned ahead of the ECB decision that Draghi would want to preserve the option of continuing QE beyond September. “The market could interpret the flexibility as dovish and send the euro lower,” we wrote. “In addition, the large net-long EUR position could be waiting to 'sell the fact' on a taper announcement.”

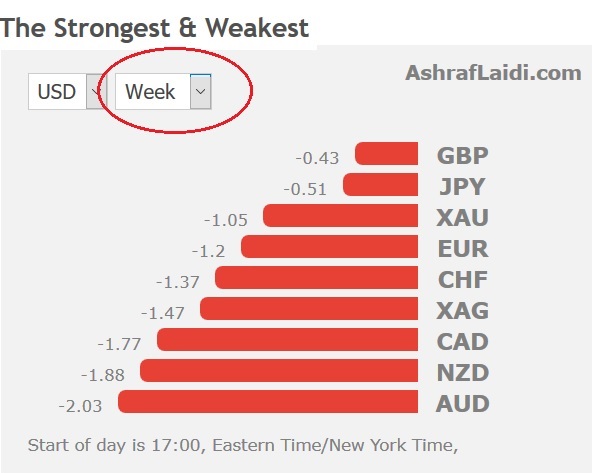

That's what happened as EUR/USD broke the October and August lows to break the neckline of a well-defined head-and-shoulders pattern. It would be wrong to give all the credit to the euro, the US dollar was broadly stronger and finished at the highs of the day. Commodity currencies weakened substantially and cable reversed virtually all of Wednesday's climb.

Pefect USD Storm?

A driver of USD strength is the bond market as 10-year yields consolidate above 2.40%. A soft 7-year auction added to the bond move, along with the House passing a budget motion that brings a tax cut closer. A report from Politico also said Yellen is out of the running for the Fed chair and that it's now between Taylor and Powell.

The yen will be in focus in the hours ahead with September CPI numbers due at 2330 GMT. The consensus is for a 0.7% y/y rise on the headline and +0.2% y/y on ex-fresh food and energy. Abe is rumored to have asked for a extra budget as he restarts efforts to get the economy moving and inflation higher.