Risk management has become a high priority for many investors over the past decade. The worst financial crisis and recession since the Great Depression in 2008-2009 clearly has the power to focus minds. Research shops have moved heaven and earth to search for solutions that attempt to limit risk without sacrificing return. The question is whether simplicity is competitive in this quest. As a preliminary investigation, consider a humble strategy that toggles back and forth between two BlackRock (NYSE:BLK) asset allocation ETFs.

The idea here is that in a risk-on climate, the portfolio will be fully invested in iShares Core Aggressive Allocation (NYSE:AOA)). Launched in 2008, this global, multi-asset class portfolio has performed admirably, generating a competitive return that’s tough to beat for a similarly structured strategy. The drawback is that AOA’s aggressive posture has a price tag of sharp declines in the short term when the crowd switches to a risk-off posture.

The goal is to minimize AOA’s worst drawdowns without giving up too much return. A tough challenge, to be sure. Can a simple timing strategy help? Let’s explore the possibility by using two moving averages for a timing signal: When AOA’s 50-day average is above the 100-day average, the strategy is fully invested in AOA. When the 50-day average falls below the 100-day average, switch to a 100% allocation in iShares Core Conservative Allocation (NYSE:AOK)

AOK focuses on the same assets as AOA but with a less-aggressive posture. Notably, AOK’s equity weight is generally lower. For example, AOA’s global equity allocation was recently close to 29% — well below AOA’s nearly 79% worldwide stock weighting, according to Morningstar.com.

Note that our two-fund timing strategy, which we’ll label AOA.AOK, remains fully invested in risk assets at all times – there’s no explicit cash allocation, other than relatively trivial amounts that show up in each ETF at times (roughly 1% for each in recent history). The key difference in the funds is the extent of holding equities relative to bonds.

Since both ETFs have only been around since 2008 there’s limited history to evaluate, which is a caveat. Throwing caution to the wind in this toy example, let’s consider the results, along with two other related iShares ETFs with asset allocation postures that fall between the AOA and AOK extremes:

iShares Core Growth Allocation (AOR)

iShares Core Moderate Allocation (AOM)

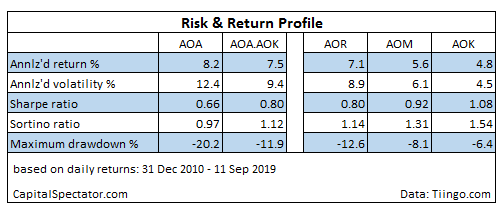

As the table below shows, the AOA.AOK timing strategy generated a return that’s close to AOA’s higher performing results but with a much softer maximum drawdown: -11.9% vs. -20.2%. Note, too, that AOA.AOK outperforms AOR and AOM, although the latter pair have moderately softer maximum peak-to-trough declines.

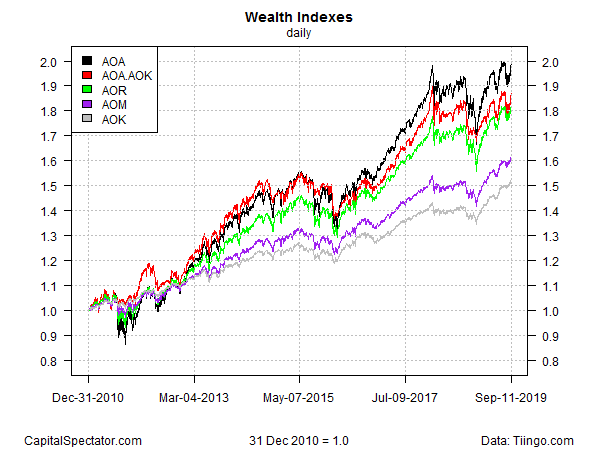

For another perspective, here’s how the wealth indexes stack up:

The profile above is hardly definitive but the analysis suggests some intriguing possibilities in the cause of searching for a simple but reasonably effective process for managing risk while remaining more or less fully invested. Indeed, the AOA.AOK strategy can be customized in countless ways to provide a more palatable risk profile to match a given investor’s expectations, risk tolerance, time horizon, and so on. Two broad fronts for further investigation: 1) changing the timing signals with other moving averages, technical indicators and/or business cycle data; 2) expanding the opportunity set with other ETFs, mutual funds and/or individual securities.

Meantime, investors will want to explore how a similar strategy fared over a longer time period for deeper perspective. But AOA.AOK’s initial results suggest that complexity doesn’t have a monopoly on productive risk management.