We have been through another volatile week, with the loonie losing 200 points against the greenback. This surge in the U.S. dollar was caused by Ben Bernanke’s comments following the Federal Reserve Board of Governors meeting on Tuesday. Mr. Bernanke laid to rest any rumours of a third round of quantitative easing. In response, risky assets such as stocks, gold, oil and our dollar dropped considerably. The euro also fell against the U.S. dollar this week, losing over 300 points. As always, when the markets are awash with fear and uncertainty, the U.S. dollar and U.S. Treasury bonds are the big winners. Here are some highlights of the economic news expected this week.

Canada

We have a busy week on the data front in Canada. On Monday we expect the wholesale sales figures for the month of October. Tuesday, we will receive the numbers from the Consumer Price Index. At last reading, it was 2.9%. On Wednesday, retail sales figures will be announced for the month of October. It is an important measure of consumer sentiment. But the most important number will be released on Friday, when we will know GDP figures for the month of October. Expectations peg it at 3%.

United States

This week’s economic data south of the border begins on Tuesday with the release of housing starts in November. Recent data have been encouraging, so anything above the expected figure of 630,000 housing starts would be seen as very positive news about the state of the U.S. economy. Also on Tuesday we will have statistics of building permits for the month of November. On Thursday, GDP results for the third quarter will be revealed. This will be the week’s most important indicator, and analysts expect it to be unchanged from last time. On Thursday we can also expect release of the University of Michigan’s Consumer Sentiment Index. The week will close with some high-profile news: November durable goods orders. Analysts are expecting the good news to continue, with this indicator up 2.9% from October.

International

In international news, on Tuesday we are awaiting both the German Producer Price Index and Japan’s Trade Balance. On Wednesday, Japan’s central bank will announce its decision on the key lending rate and the Bank of England will release the minutes of its last meeting. Mervyn King, Governor of the Bank of England, has said that he is very pessimistic about the future of the euro, and he has been very outspoken on the subject. It will therefore be interesting to read his comments. Have a good week!

The Loonie

A tough week for the euro: Why now and where do we go from here? Although the euro had shown surprising resilience since the beginning of the year, it fell sharply on the heels of the most recent economic summit of European leaders. Why is this happening now, and where do we go from here?

There may be several factors explaining why investors have (finally) decided to punish the euro this week:

1) Given the combination of renewed strength in the U.S. economy and a slowdown in Europe, the contrast in monetary policies no longer supports the euro. It should be recalled that the European Central Bank recently changed strategies, easing interest rates, while in the first six months of the year ECB policy sought to slow economic activity and fight inflation.

2) While S&P lowered the United States’ credit rating last summer, there is now a threat to the rating for European governments (and institutions). In fact, the risk of a downgrade has reached the very heart of Europe (France and Germany).

3) Despite the many meetings of European leaders and all their efforts, few concrete solutions have been proposed. The ECB’s interventions to date remain modest (compared to the Fed’s interventions during the 2008 financial crisis), the financing rates paid by many countries have reached unsustainable levels, and the project to issue European debt is, at least for now, on hold. Even though the fiscal pact proposed at the last summit is certainly a step in the right direction, its impact will only be felt over the long term, and, as always, it will be difficult to implement. Similarly, adjustments made to financial support mechanisms were modest, particularly as the funding of this new structure appears shaky.

4) The emerging countries, which appeared to be Europe’s last hope, are now totally absent from the discussions.

So, even though the problems in Europe are not new, the context is such that markets are reacting now. Where do we go from here? Despite the fact that the Fitch rating agency has confirmed France’s AAA status, a possible downgrade from one of the other two agencies would be felt immediately in the markets. On the other hand, Germany’s reticence about getting more involved in saving Europe may subside. Since all this turmoil began, Germany has refused to do more since it—rightly—believes that it would be more expensive to shore up other European countries than let the situation deteriorate. As the other countries take measures to control their spending, it will be in Germany’s interests to intervene by agreeing that the ECB should take a greater role or that Europe should issue debt. Even though the situation may appear desperate, a last-minute turnaround is still possible. And as we hear so often these days, given the greater role played by politicians, anything can happen!

Last Week at a Glance

Canada – In October, manufacturing shipments fell 0.8% with 13 of the 21 manufacturing industries slumping. A 4.3% decrease in petroleum and coal products was the main driver of the decline, but several other sectors slipped as well, including transportation equipment (-0.6%) led by autos and the volatile aerospace category (- 9.7%). In volume terms, shipments were down 0.9%. The inventory-to-sales ratio rose to 1.33, its first increase in four months. The contraction in shipment volumes does not bode well for GDP, which is on track to posting its worst monthly showing since May. So, after a strong Q3, the expected softening of the Canadian economy in the final quarter of the year seems to be materializing.

Still in October, foreigners continued purchasing Canadian securities, albeit at a slower pace, adding C$2bn of Canadian assets to their portfolios. More than half of that ($1.2bn) was in bonds. Purchases of federal government bonds topped $4.2bn, the largest amount since May. So, as we had expected, the drop in Q3 investment in federal government bonds was just temporary. Canada's AAA status suggests there will be demand for our government debt, particularly compared with that of other countries in difficult fiscal positions. The increase in government bond buying by foreigners more than offset the $3bn net selling of corporate bonds in October, which was in fact the largest monthly cut on record going back to 1988. The sharp drop in corporates might have had something to do with flight to safety in a month when risk aversion was fed by bad news out of Europe. However, as monthly data can be quite volatile in any event, we do not believe the October selloff of corporates signals the beginning of an exodus.

United States – Last week was a busy one in terms of data releases with key indicators generally confirming the acceleration of the U.S. economy in the final quarter of the year.

Weekly initial jobless claims fell to 366K, beating consensus expectations of 390K. This was the lowest level of initial claims since May 2008, providing further evidence of a labour market on a clear uptrend.

In November, U.S. retail sales grew 0.2% for both the total and ex-autos. The ex-auto sales increase was driven by strong gains in clothing, electronics, and furniture, which more than offset declines in food, building materials and gasoline. Discretionary spending (i.e., excluding gasoline, groceries, health/personal care) was up 0.4% after climbing 0.8% the month before. October and September retail numbers were revised upward. Two months into Q4, real retail spending is tracking at +6.3% annualized, its highest level since 2010Q4. In addition to the improving labour market and less of a negative wealth effect from housing, a slowdown in the pace of deleveraging seems to be boosting U.S. consumption spending.

The Philadelphia Fed and the New York Fed both released their indices of manufacturing activity for December and both were quite strong. The Philly index sprang to 10.3 with the new orders component jumping to 9.7, which were both the highest readings since April. The New York (Empire) index shot up to 9.53, its highest mark since May. Again in November, U.S. industrial production slid 0.2% on drag from manufacturing and more moderate growth in mining. However, the month’s weak results must be put into perspective, coming as they did on the heels of a strong 0.7% advance in October. As the drag came primarily from autos, we expect production to rebound soon in light of just how strong retail auto sales have been recently. Dealerships will need to rebuild their inventories eventually. Despite the weak November reading, IP growth is tracking at a healthy 2.6% annualized in the final quarter of the year.

Still in November, the U.S. National Federation of Independent Business (NFIB) index rose for a third straight month, reaching 92, it highest reading since February. The "expect higher sales" index turned positive (i.e., positive respondents outnumbered negative respondents) for the first time since May. Respondents also found it less difficult to get credit and expected credit conditions to ease further in future. In addition, they planned to increase capital expenditures, with this index rising to its highest level since March. Business optimism is clearly on the rise in the United States thanks to better credit and improved sales.

Consumer prices (CPI) were unchanged in November as lower energy prices offset increases elsewhere. Food prices rose only 0.1% for the second month in a row, continuing to moderate after a string of hot months. The flat monthly headline CPI pulled the annual inflation rate down one tick to 3.4%. Excluding food and energy, prices edged up 0.2%, pushing the year-on-year core CPI higher a notch to 2.2%. Apparel prices rose 0.6%, computers 0.7% and medical care 0.4%. However, on a 3-month annualized basis, core CPI came in at a subdued 1.5%, its lowest mark since January. Vehicle prices sank for a third consecutive month, indicating that shortages are clearly resolving following production disruptions.

Still in November, the Producer Price Index (PPI) rose 0.3%, pulling the year-on-year rate down two ticks to 5.7%. Excluding food and energy, prices eked up 0.1% on the month, pushing the year-on-year core PPI one tick higher to 2.9%.

Both the CPI and PPI reports confirm that price pressures are moderating in the United States. To no surprise, the Fed left interest rates unchanged at zero. The FOMC acknowledged the improvement in the labour market but remained concerned about “strains in global financial markets", which continued to pose a significant risk to the economic outlook. The Fed will go on: extending the average maturity of its holdings of securities; reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities; and rolling over maturing Treasury securities at auction. The only note of dissent against the no-change decision came again from Charles Evans, who argued instead in favour of rendering monetary policy even more accommodative. While the accelerating U.S. economy means that QE3 will not be dispatched for now, the softening of prices affords the Fed some leeway to act, if needed.

Technical Analysis: USDCAD

USDCAD: The medium-term trend line is always a good benchmark for continued rise in the USDCAD. The 0.9887, 1.0034, 1.0181 and 1.0363 Fibonacci levels in the movement from 0.9410 to 1.0656 are important. 1.0180 is now the level to watch as a major support this week. In addition, 1.0363 has been broken through several times, a strongly indication of an upward trend. Moreover, 2 key elements are now against the Canadian dollar: The commodity index CRB just broke its long term trend line and Gold is now trading below its 200-d moving average (charts available on demand).

Resistances

1.0585

1.0525

1.0510

1.0423

Supports

1.0363

1.0264

1.0181

1.0141

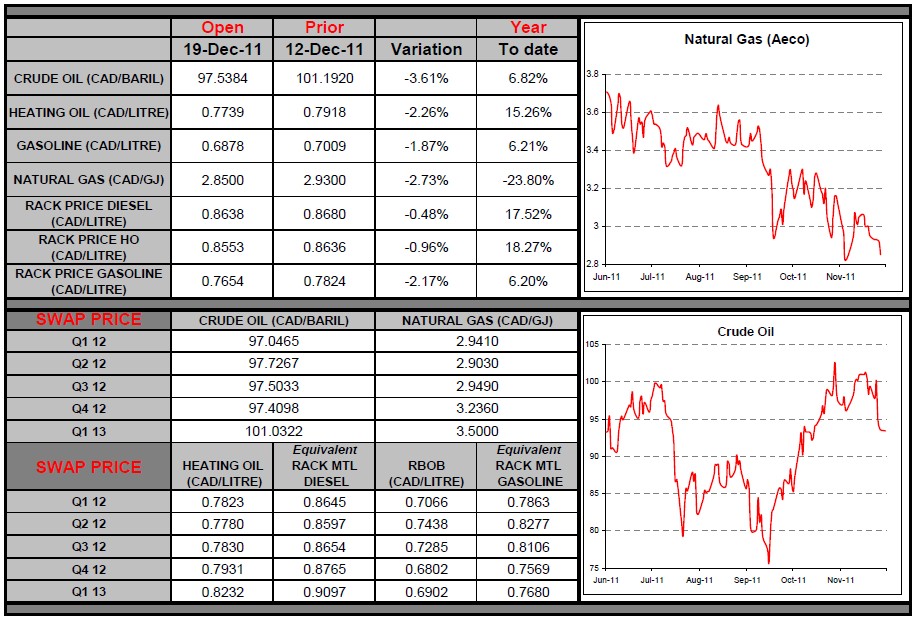

Commodities

Last week proved to be particularly difficult for energy prices, with major drops in the prices of WTI and Brent, as well as all refined products. Despite the economic fears over events in Europe, the situation in Iran provided some support. Many of our clients took advantage of the opportunity presented by these lower prices to hedge part of their fuel needs for 2012. It should also be noted that this last week also proved to be the worst week for the price of gold in close to three months. The meeting of OPEC members received considerable media attention and helped drive down prices. The main oil producing countries reached their first production agreement in three years. A new objective has been set at 30 million barrels per day, but the issue of country quotas was not addressed. Analysts believe that the lack of individual quotas may lead to production overruns. These concerns helped drive down prices. The issue should be taken up at the group’s next meeting, planned for June 14, 2012.

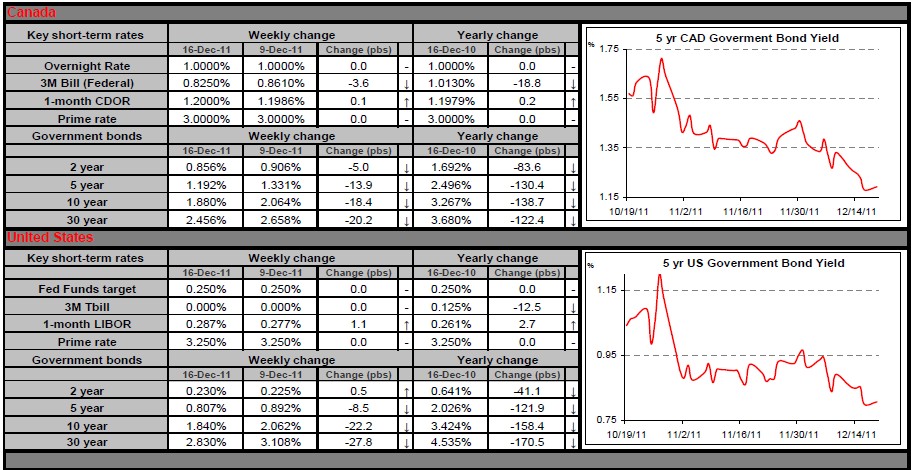

Fixed Income

Canadian bond and swap rates were pushed lower once again last week, this time reaching historical lows on many points of the yield curve. Many markets, including Canadian bonds, have been driven recently by European politics and rating agencies’ assessments. Here are some of the key highlights explaining these low yields:

Brussels summit: Rating agencies said last Monday that the European Union summit, hosted by Belgium on December 9th, had failed to provide a tangible near-term solution to Europe's debt crisis.

Two key decision makers: Both Germany and the European Central Bank reiterated their opposition to boosting the size of Europe's rescue fund last week, despite countries’ borrowing costs rising to records.

Credit downgrades: Fitch lowered its outlook for France on Friday, and Moody’s followed by cutting its Belgium’s credit rating by two notches.

On the bright side however, it seems that more and more Canadian corporations are following Bank of Canada’s advice: invest in new projects to boost economic growth. Indeed, many companies can currently borrow or refinance existing debt at very cheap long term rates.

This week, ahead of the holidays, Canadian inflation numbers are expected on Tuesday, and GDP data in the US and in Canada will be respectively published on Thursday and Friday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Experiencing Another Volatile Week

Published 12/20/2011, 07:58 AM

Updated 05/14/2017, 06:45 AM

Experiencing Another Volatile Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.