The investment world abounds with research reports. Intelligent and educated people generally benefit from careful study and accrued knowledge.

While it seems unfair, the investment world is different. A little knowledge can be a dangerous thing!

There are many examples of this. I have been stalled on this important topic because I was trying to do a comprehensive analysis. It is often better to just get started! I will start with some of the most egregious and costly temptations for consumers of financial information. I welcome more nominations to the list. This is a great topic for us all to share ideas.

Shifting Indicators

This happens when the “rules” for interpreting data change to fit the pre-conceived conclusion. One recent example by bears related to the divergence of small cap stocks. When the Russell 2K stocks were leading, the market was “frothy.” When they lagged, it was a warning divergence.

Other indicators like sentiment, the Baltic Dry Index, Hindenburg omens, etc. are cited only when they fit.

Bullish analysts do the same. If the monthly report does not fit the story, just look at non-seasonally adjusted data. year-over-year, or something else. Many reports are susceptible to various spins. The only solution for this is to know the agenda of the source. This is rarely provided.

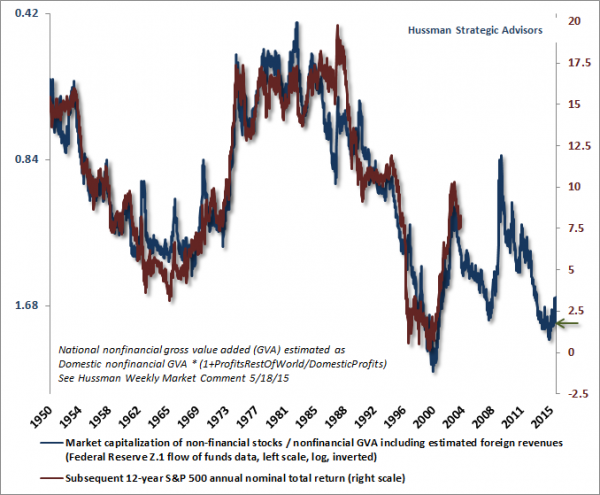

A persuasive chart

Please consider this chart, which is offered weekly as evidence that long-term investors have little to gain in the next decade while facing a lot of risk.

I have a simple question for you: Could you step up in front of a group of people and explain this chart? If not, why do you believe it? A smart and influential guy presents something that you cannot really evaluate. Why is this a sound basis for your decisions?

It is unchallenged because of the lack of peer review in the investment world. It is challenging to explain the errors, partly because so few could appreciate the arguments.

A plausible story

So many investment arguments depend upon simple analogies that are immediately convincing. The frog in the pot story (even though it is not true) is one example. These are stories that enable us to imagine an outcome without any real data.

- Stall speed for the economy. Graphic but wrong. Economic expansions generally do not stall out, despite the intuitive appeal.

- The aged bull market. This is another argument that appeals to intuition but has no supporting evidence. Whenever there is a streak that exceeds normal history — a hitter in baseball, a basketball team winning many games in a row — there is a temptation to say that this must be ending soon. In fact, a winning team or player is actually just as likely to continue the streak. Bull markets and economic cycles that have longer-than-average length are no more likely to end soon. (Nice survival analysis from SF Fed).

Your intuition and the confident-sounding talking heads are both wrong. It is plausible spin. You can take a profitable contrarian position by betting on further economic recovery.

The insightful investor fights spin with data and analysis.