The Credit Market and the Stock Market are in agreement and being competing claims in the capital structure — that seems like an unlikely set of words. But the reality is both equity and credit investors have bid their respective asset valuations rare heights.

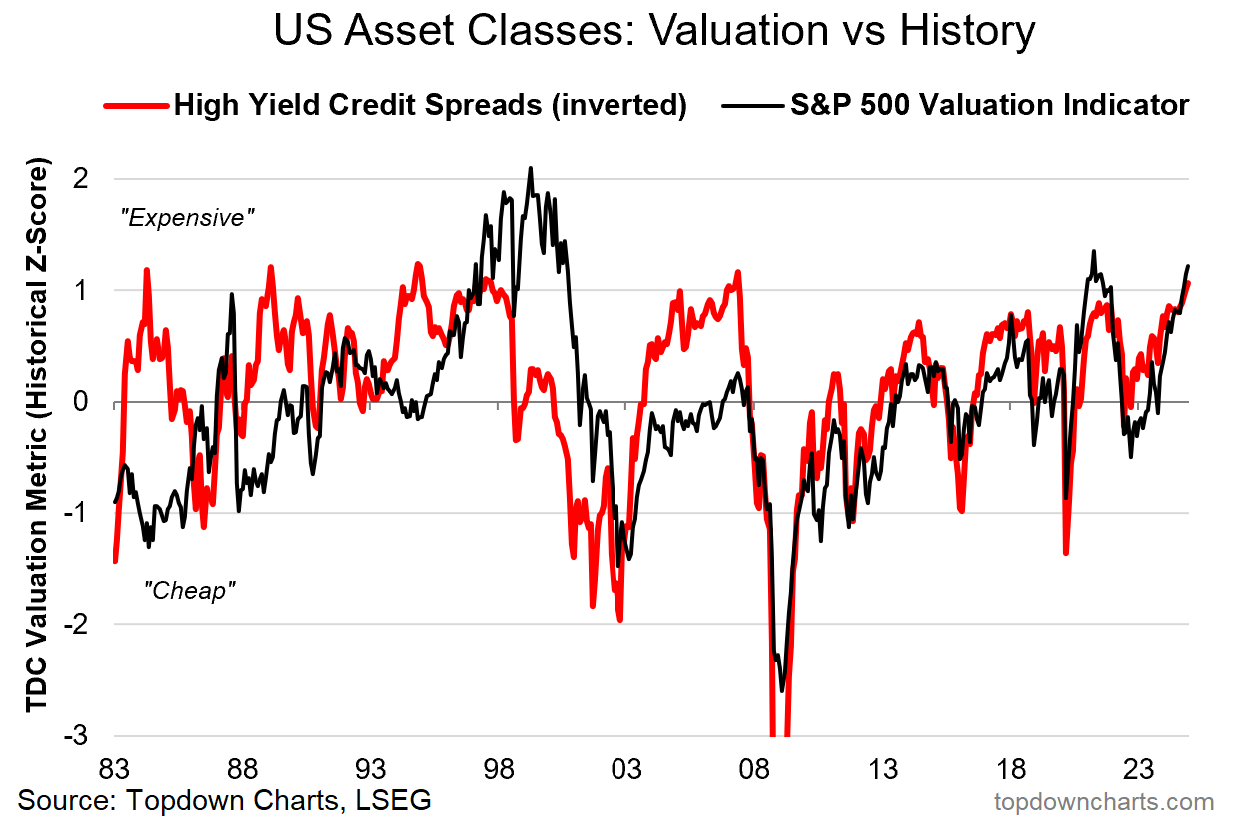

The chart below shows both Credit Spreads + Stock market Valuations are more than 1 Standard Deviation expensive.

If you eyeball the chart it becomes pretty obvious pretty quickly what that means.

You don’t see many readings at that level, and whenever you do it’s either late in the cycle or just before something bad happens.

Being a contrarian indicator, when valuations reach extremes it tells you everyone is thinking the same. That means there are not many more minds left to join that consensus and add to buying flows, but in contrast — there are many many minds that are already all-in and could be easily be changed if presented with the right evidence or catalyst.

And when equity investors change their minds on the stock market, they sell: stock prices go down. When credit investors change their minds on credit markets, they either sell (if they can), stop lending, and/or bump up their required margin of safety. This can become self-reinforcing, and there are many such cases of this kind of thing playing throughout history.

So what? When everyone else’s minds are made up, that’s the time to be most mindful. Mindful of the risks, mindful of your asset allocation —and mindful of what you’d need to believe to stay on the bandwagon vs what would need to happen for the many minds to change (and whether or not you are prepared for that).

Key point: Credit spreads and stockmarket valuations are extreme expensive (risky).