Expedia (NASDAQ:EXPE) stock is down 25% today after the company’s Q3 results missed expectations. GAAP EPS fell 57 cents short of analysts’ estimates. The revenue figure was anticipated to be $10 million higher than reported, as well. On top of that, Expedia cut its full-year guidance which annoyed Wall Street even more.

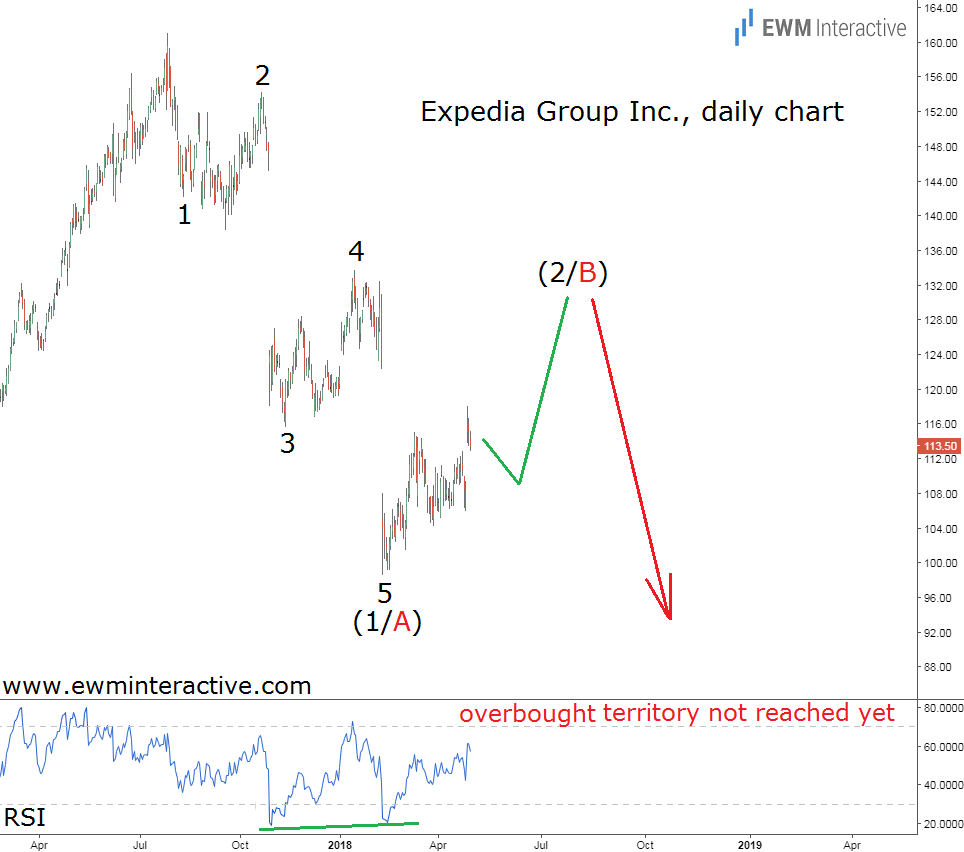

That is the official explanation for today’s slump, which of course makes perfect sense. But there is one other possible way to look at things and it involves the Elliott Wave chart below. It was published in May 2018, when we warned our readers that “ Expedia (NASDAQ:EXPE) investors cannot feel safe yet.”

A year and a half ago, Expedia (NASDAQ:EXPE) stock was hovering around $113 following a plunge from $161 to $98. The structure of this selloff formed a textbook five-wave impulse, labeled 1-2-3-4-5 in wave (1/A). To an experienced Elliott Wave analyst this pattern meant one thing: the larger trend is down, but a three-wave recovery should first occur.

Expedia (NASDAQ:EXPE) Crash was Long Overdue

With that in mind we concluded that a recovery to roughly $130 can be expected, but as long as the stock trades below $161, Expedia (NASDAQ:EXPE) investors cannot feel safe. It took a little more time than anticipated, but now it looks like it was a correct conclusion.

Wave (B) took the shape of a w-x-y double zigzag correction which eventually lifted Expedia (NASDAQ:EXPE) to $144 in late-July, 2019. At that point the negative 5-3 wave cycle was complete and all the bears needed was a catalyst.

After the company’s weak earnings report on Wednesday, there was nothing left to wait for. The current sharp plunge fits in the position of wave 3 of (C), assuming no bigger bearish pattern is going to develop. If this count is correct, we can prepare for waves 4 up and 5 down to complete the decline from $161. Targets near $80 remain plausible.