GBP/USD Daily" title="GBP/USD Daily" height="303" width="668">

GBP/USD Daily" title="GBP/USD Daily" height="303" width="668">

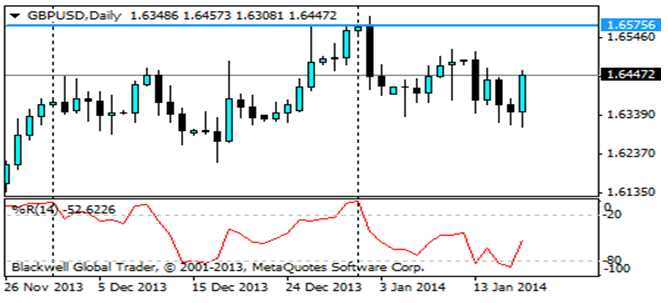

TheUK just released their most impressive annual retail sales data in over nine years, with sales accelerating 5.3%. This resulted in a surge of sterling buyers. Next Wednesday, the latest UK jobless claims, unemployment rate and BoE minutes will be released and I expect this bullish turn to continue, pushing through the 1.6575 resistance level.Additionally, there remains to be an air of caution regarding whether the Federal Reserve will taper QE on the 29th–30th January. This could inspire risk appetite and further elevate the Cable.

UK jobless claims have decreased for 13 consecutive months. With the UK services sector continuing to expand and employing 80% of the UK workforce, there is valid reason to believe that this trend will remain.Economists predict that on Wednesday, the UK unemployment rate will be announced as 7.3%, edging closer to the BoE’s 7% threshold to review monetary policy. The latest BoE minutes may provide updated clarity on when the BoE may target increasing their interest rates. If this happens,Iexpect to see a flurry of sterling buyers.

Equally, there might be some risk appetite in the currency markets for the next 10 days, while there remains to be uncertainty regarding whether the Federal Reserve will taper QE in January. This month’sAdvance Retail Sales and Durable Goods Orders have impressed, but January’s Non-Farm Payroll weakened the USD. Although the disappointing NFP can be pointed towards the poor weather conditions the United States faced in December, there are concerns that the Federal Reserve may use the poor NFP to delaytapering QE.

In terms of technical observations for this currency pair, I can see a clear resistance level set at 1.6575, just 130 pips away from the Cable’s current value. When looking at my monthly chart, I can see a future resistance level at 1.6708. Right now, the latter resistance level is slightly ambitious, unless next week’s UK data is impressively bullish, or the USD dramatically weakens.When looking at the William’s Percent Range, I can see that the Cable is not yet in any danger of being overextended, and can certainly push higher.

To conclude, today’s impressive UK retail sales data have provided the Cable with renewed strength. Next week’s UK jobless claims will be highly anticipated, with the UK claimant count falling substantially over the past year. Another impressive Jobless Claimant result will put renewed pressure on the BoE to increase their interest rates.

Likewise, the markets remain unclear regarding whether the Federal Reserve will taper QE at the next FOMC. As time approaches the 29th-30th January and the markets continue to deliberate over the possibility of another taper, future risk appetite may be in the works. Risk appetite would likely encourage the Cable to push the resistance levels above.

Overall, I see breaking the 1.6575 resistance level as achievable within the near future. Additionally, if my fundamentals prove to be correct, and we do witness a period of risk appetite in the markets, then there is a possibility that the Cable could reach 1.6708 at a later time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Expecting The Cable To Break Through Resistance

Published 01/20/2014, 02:55 AM

Updated 05/14/2017, 06:45 AM

Expecting The Cable To Break Through Resistance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.