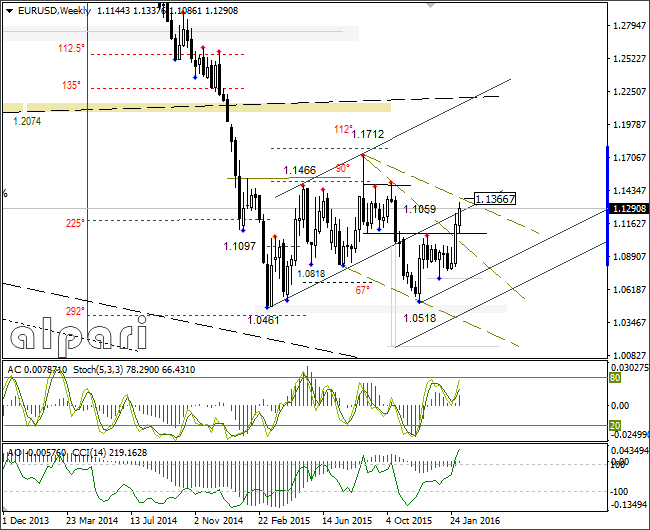

EUR/USD 1H

Yesterday’s Trading:

Falls in the stock and oil markets again offered support to the euro and yen. Brent fell to $30.26 and the euro/dollar fell to 1.1337. When the US indices stopped falling, a rally on the euro began: the euro weakened against the dollar to 1.1280.

Oil fell after the IEA (International Energy Agency) published a report in which the media saw the agency’s view as sceptical:

“With the market already awash in oil, it is very hard to see how oil prices can rise significantly in the short term."

Oil is trading at around $31 on Wednesday. The growth is 0.85% which isn’t much, but enough to stop the European indices from falling.

Main news of the day (EET):

- 11:30, UK industrial production and production in the manufacturing sector for December;

- 17:00, UK GDP from NIESR for January;

- 17:00, Yellen speaks;

- 17:30, US Ministry for Energy oil reserve figures.

Market Expectations:

Market participant attention on Wednesday will be on Janet Yellen’s two-day speech before the banking committees of the Senate and the House of Representatives. Many expect her words to be neutral and not cause a spike of volatility on the financial markets. We expect to see a fall of the euro to 1.1256 before the US session opens. I have not taken Yellen’s speech into account in my forecast.

Technical Analysis:

- Intraday target maximum: 1.1311 (current Asian), minimum: 1.1256, close: 1.1295;

- Intraday volatility for last 10 weeks: 102 points (4 figures).

In the first half of Wednesday I expect the euro to fall to the LB at 1.1256. Brent is trading up (+0.85%). The euro/pound is at the upper limit of the MA channel. The conditions are ripe for a correction.

Traders are used to the daily fall of the stock indices so I reckon that the indices will switch into a growth at market opening (a correction). This will have a negative effect on the euro. The US oil reserve report from the Ministry for Energy is out this evening. If Brent holds above $30, it’s likely the euro/dollar will begin a downward correction.

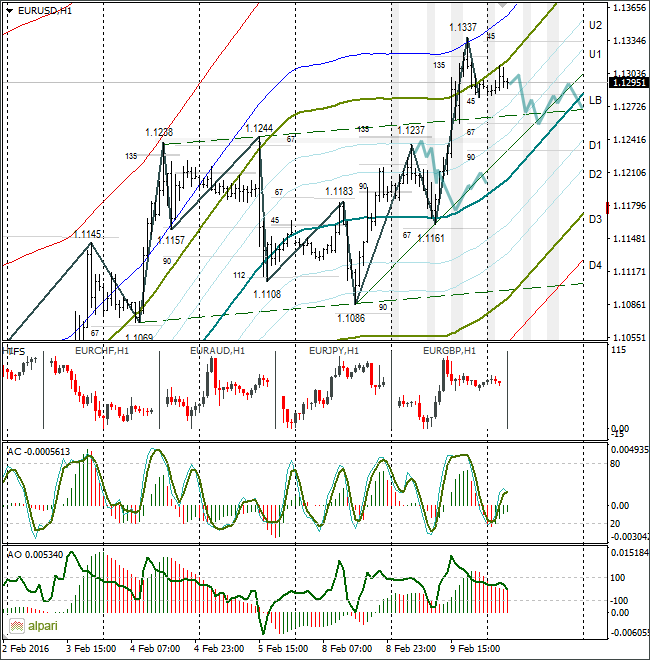

EUR/GBP 1H

The running from risk was caused by a rise in demand for euro throughout the market. After a fall to 0.7730. the euro/pound lifted above the U4. The price is now below the U3. The market is considered balanced when the price is at the LB. Due to this I expect a weakening of the euro to 0.7770 against the pound. A fall of the cross will put negative pressure on the euro/dollar.

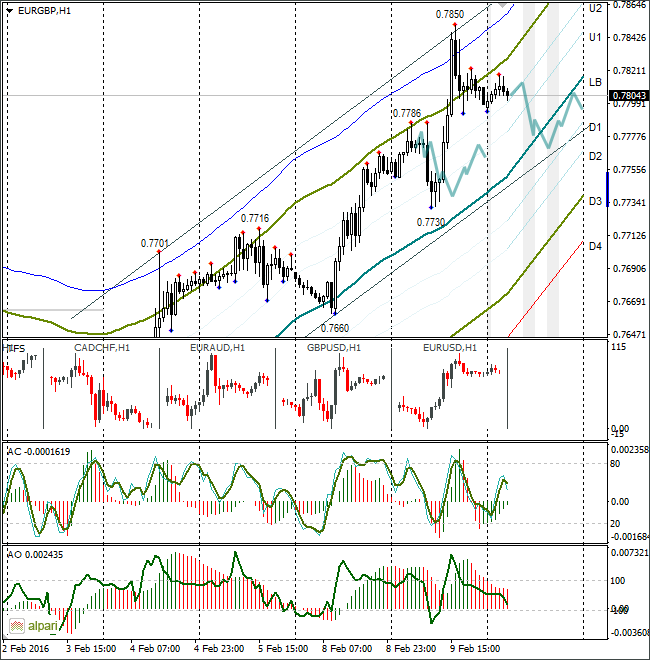

Daily

The stock indices’ fall hastened and the euro/dollar rose to 1.1337. I set the target at 1.1370. A correction may start without reaching this target. All the more so since no one knows what Yellen is to come out with.

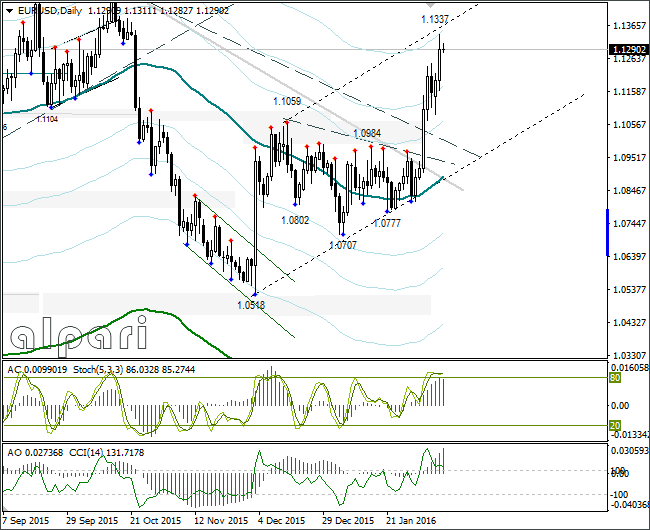

Weekly

The euro/dollar has neared the upper limit of the channel. The target is still 1.1366/70. The daily fall of the stock indices is supporting the buyers.