Globally equity volatility is low. For that matter, volatility (both implied and realized) is low across the major asset classes. But aside from a vague notion or rule of thumb that low volatility is a predictor of future higher volatility and vice versa, it's worth exploring some key drivers and issues in the outlook for global stock market volatility.

This article talks about one of the key conclusions from the latest Weekly Macro Themes report, which explored the issue of risk appetites, policy uncertainty, and implied volatility.

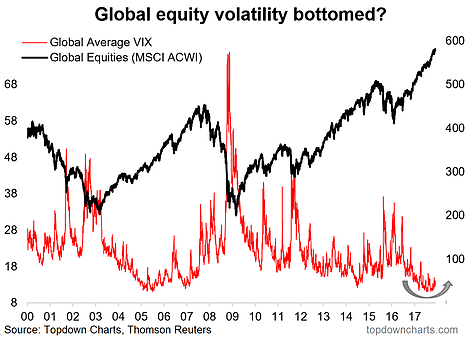

The Chart: global equity volatility visually looks to be in the process of bottoming with the average implied volatility index across the major global equity markets appearing to make a rounding bottom.

While a number of factors impact on implied volatility, if you look at it as a gauge of risk appetite it shows investors are keen and confident. Indeed, this interpretation gels well with some of the gauges of valuations and sentiment that we've been tracking. Yet it runs at odds with some aspects such as elevated policy uncertainty and geopolitical risks.

A simple explanation could just come down to monetary policy. While the improved global macro outlook and earnings rebound has likewise helped, global monetary policy settings remain extremely supportive, whether it's the QE programs in Europe and Japan, or the waves of rate cuts in emerging markets, despite Fed rate hikes and the beginning of QT, the central banks are still clearly on the side of investors. This probably does explain a lot of why risk appetites are so complacent and volatility so low.

And if you wanted to put a fundamental story behind the potential rounding bottom in global equity volatility, the turning of the global monetary policy tides is probably a go-to. The Fed is well underway with policy normalization, and the ECB and BOJ will likely follow in the Fed's footsteps later next year, and already we're seeing signs that the easing cycle in emerging markets is probably about done. While it's often a throwaway line to say "expect more volatility", you could certainly make a case to expect more volatility in 2018, and it's certainly one of the things we'll be looking for.