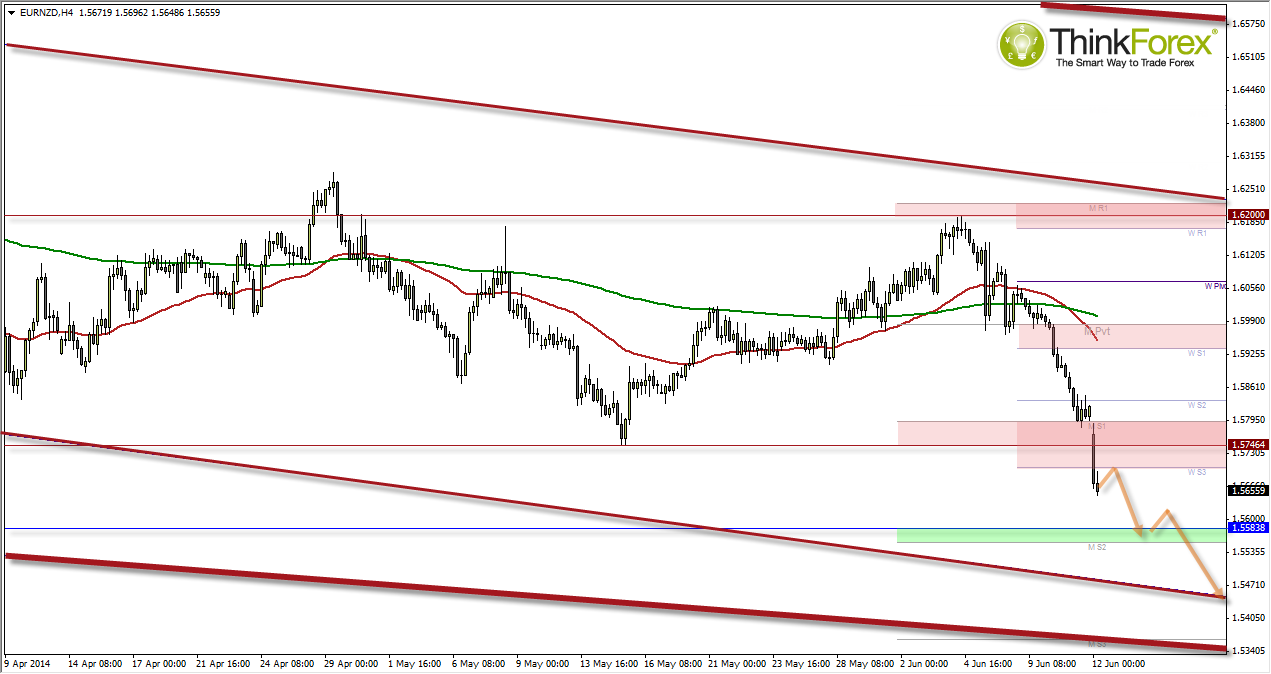

EUR/NZD broke to a 1-year low following today's rate hike from the RBNZ. But when you think about the cash rate between these two (and they have gone opposite ways) this shouldn’t come as too much of a surprise.

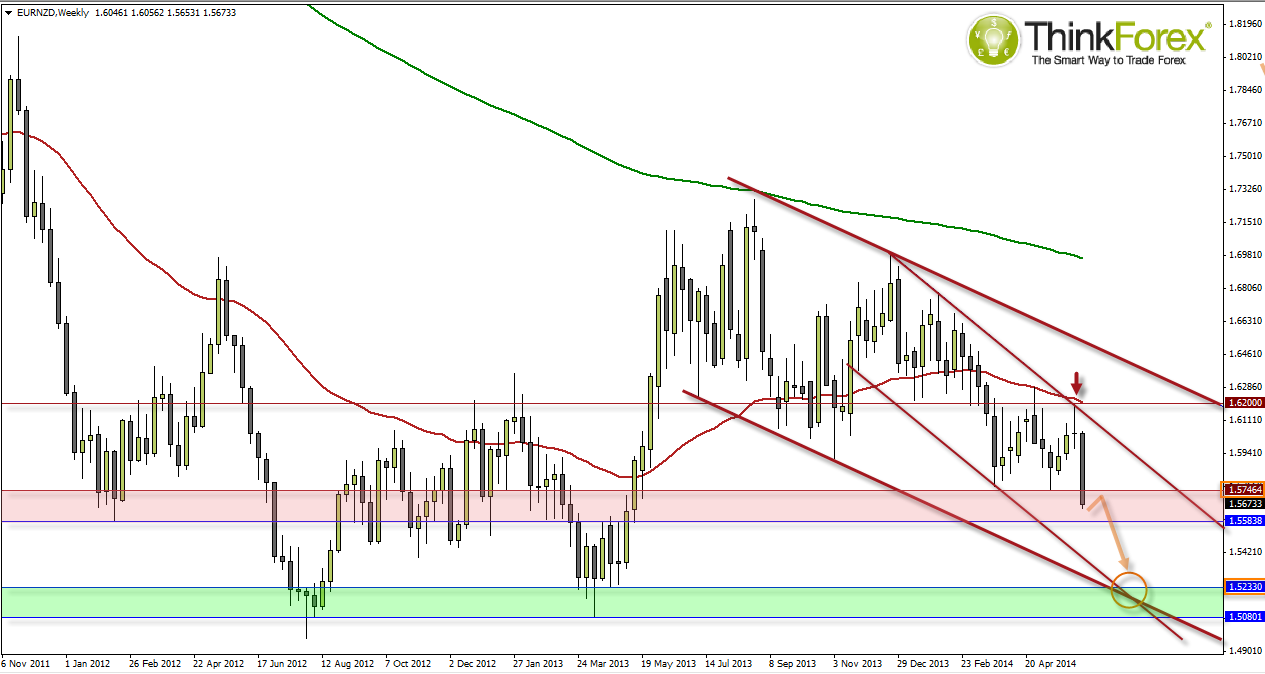

With the ECB paying 0.15% and the RBNZ paying 3.25% we can expect money to continue flowing from Europe to New Zealand to cash in on the differential. With EUR/NZD breaking key support at 1.575 and sitting at annual lows, I expect this key level to cap as resistance as price trades in line with 2 bearish channels.

We have key support levels at 1.523 and 1.508, with the projection from the 2 channels targeting around 1.52. For now, I'll take the conservative target of 1.523 over the coming weeks.

Due to the velocity of the downside break there is a good chance we may not see a particularly deep pullback before losses resume. We could just see sideways trading with 1.570 holding as resistance, but if we do see a deeper pullback then I expect 1.575 to hold.

As long as we remain below 1.575 then next targets remain 1.558-60 and 1.545