After MF Global went bust, most people believe it was an extreme "spectacular recklessness" under Jon Corzine, and that the U.S. banks should have only "moderate" European Exposure. However, banking stocks have been under pressure with increasing investors worries.

Jefferies Group, for example, eventually disclosed detail position it held on European debt earlier this month after its shares plunged more than 20%. But other banks have not followed suit as Bloomberg notes that since it is not required by the U.S. regulation,

"Firms including Goldman Sachs and JPMorgan don't provide a full picture of potential losses and gains in the event of a European default, giving only net numbers or excluding some derivatives altogether."

U.S. stocks took a beating after Fitch Ratings said on Wed. Nov. 16 that Europe’s debt crisis may pose a “serious risk” to U.S. banks, driving investors to safer bets such as U.S. Treasurys. Fitch also notes that although U.S. banks have been reducing their direct exposure for well over a year, but they haven't clearly disclosed the extent of their holdings of European sovereign debt or their trading positions with European counterparties.

There are clues to somewhat quantify the potential exposure on a global basis and of the U.S. banks.

Reuters cited a report by the IIF that European banks hold some $3.5 trillion of euro-zone sovereign bonds and U.S. banks have significant direct exposure to their European peers. U.S. banks had about $180.9 billion of debt from GIIPS on their books at the end of June. Guarantees and credit derivatives added another $586.6 billion, bringing the total to $767.5 billion based on Bank for International Settlements data. But the exposure does not stop there,

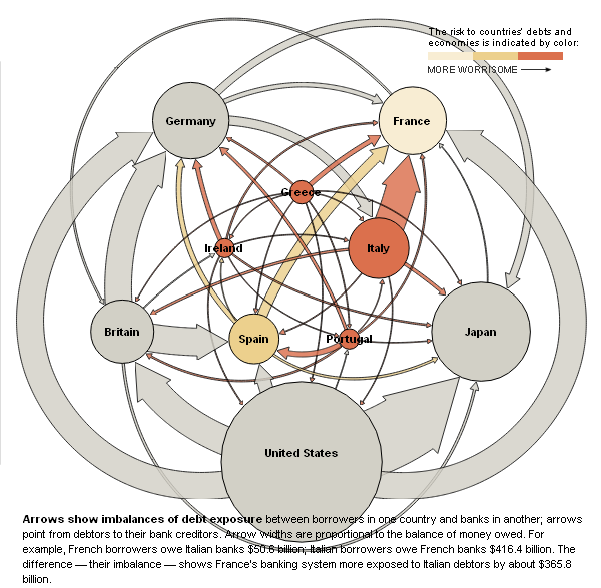

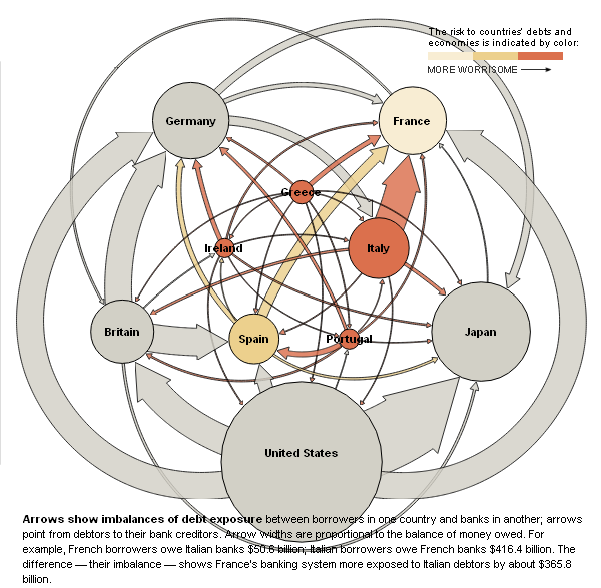

" There is a secondary level of exposure that is potentially more worrying -- through international banks lending to each other. Here the greatest risk stems from Italy and France. International bank claims on Italy total $939 billion, and French banks account for well over one-third of that, BIS data show... If Italian debt slumps even further, causing deeper losses for French banks, international banks could stop lending to France. The losses would ripple through the whole global financial system."

These figures and the fallout from MF Global are enough to put the U.S. regulators and APEC finance ministers on Euro Zone DEFCON 3 alert as Reuters reported

"While the Treasury has been at pains to say that direct U.S. bank exposure to European countries now receiving bailout aid -- Greece, Ireland and Portugal -- is moderate, once the debt of Italy and Spain, plus credit default swaps, and U.S. bank indirect exposure through European banks are added, the potential sum could exceed $4 trillion."

"APEC finance ministers agreed to shore up their economies to protect against any damage and underpin growth."

These accounts suggest that the hit that U.S. banks could take from the European sovereign default could be somewhere from $800 billion up to $4 trillion. However, the greater risk is with some smaller iBanks, similar to MF Global, that have not thoroughly gone through and learned the lessons from the 2008 financial crisis, rather than with the top players like Goldman or JPM.

The post mortem examination by FT Alphaville described "an overnight repo black swan" of MF Global's complex "repo-to-maturity” laddered trades with a doomed steroid-charged 40-to-1 leverage. One reckless speculation could easily lead to a total system meltdown as Bear Stern, Lehman Brothers, et al have taught us.

Meanwhile, this Euro sovereign debt crisis, even if contained and/or resolved in an orderly and timely manner, would most likely bring wide spread austerity programs to almost all developed economies, including the U.S. either by the Super Committee or by the automatic spending cut, which would almost guarantee a global economic slowdown, if not an outright recession.

This is probably part of the reason that the Federal Reserve is going to conduct a fourth round of stress tests in coming weeks to determine if U.S. banks can withstand a recession. So unfortunately, it looks like even if the U.S. and emerging economies could manage to keep the world from a recession, the European sovereign debt and the aftermath would most likely finish the job.

Jefferies Group, for example, eventually disclosed detail position it held on European debt earlier this month after its shares plunged more than 20%. But other banks have not followed suit as Bloomberg notes that since it is not required by the U.S. regulation,

"Firms including Goldman Sachs and JPMorgan don't provide a full picture of potential losses and gains in the event of a European default, giving only net numbers or excluding some derivatives altogether."

U.S. stocks took a beating after Fitch Ratings said on Wed. Nov. 16 that Europe’s debt crisis may pose a “serious risk” to U.S. banks, driving investors to safer bets such as U.S. Treasurys. Fitch also notes that although U.S. banks have been reducing their direct exposure for well over a year, but they haven't clearly disclosed the extent of their holdings of European sovereign debt or their trading positions with European counterparties.

There are clues to somewhat quantify the potential exposure on a global basis and of the U.S. banks.

Reuters cited a report by the IIF that European banks hold some $3.5 trillion of euro-zone sovereign bonds and U.S. banks have significant direct exposure to their European peers. U.S. banks had about $180.9 billion of debt from GIIPS on their books at the end of June. Guarantees and credit derivatives added another $586.6 billion, bringing the total to $767.5 billion based on Bank for International Settlements data. But the exposure does not stop there,

" There is a secondary level of exposure that is potentially more worrying -- through international banks lending to each other. Here the greatest risk stems from Italy and France. International bank claims on Italy total $939 billion, and French banks account for well over one-third of that, BIS data show... If Italian debt slumps even further, causing deeper losses for French banks, international banks could stop lending to France. The losses would ripple through the whole global financial system."

These figures and the fallout from MF Global are enough to put the U.S. regulators and APEC finance ministers on Euro Zone DEFCON 3 alert as Reuters reported

"While the Treasury has been at pains to say that direct U.S. bank exposure to European countries now receiving bailout aid -- Greece, Ireland and Portugal -- is moderate, once the debt of Italy and Spain, plus credit default swaps, and U.S. bank indirect exposure through European banks are added, the potential sum could exceed $4 trillion."

"APEC finance ministers agreed to shore up their economies to protect against any damage and underpin growth."

These accounts suggest that the hit that U.S. banks could take from the European sovereign default could be somewhere from $800 billion up to $4 trillion. However, the greater risk is with some smaller iBanks, similar to MF Global, that have not thoroughly gone through and learned the lessons from the 2008 financial crisis, rather than with the top players like Goldman or JPM.

The post mortem examination by FT Alphaville described "an overnight repo black swan" of MF Global's complex "repo-to-maturity” laddered trades with a doomed steroid-charged 40-to-1 leverage. One reckless speculation could easily lead to a total system meltdown as Bear Stern, Lehman Brothers, et al have taught us.

Meanwhile, this Euro sovereign debt crisis, even if contained and/or resolved in an orderly and timely manner, would most likely bring wide spread austerity programs to almost all developed economies, including the U.S. either by the Super Committee or by the automatic spending cut, which would almost guarantee a global economic slowdown, if not an outright recession.

This is probably part of the reason that the Federal Reserve is going to conduct a fourth round of stress tests in coming weeks to determine if U.S. banks can withstand a recession. So unfortunately, it looks like even if the U.S. and emerging economies could manage to keep the world from a recession, the European sovereign debt and the aftermath would most likely finish the job.