A number of indicators are signalling that the EUR/CHF’s strength is faltering as the pair moves to test the February high. Specifically, the emergence of a Bearish Bat pattern, a possible divergence, and strongly overbought stochastic reading are ostensibly in agreement. When taken together, they hint that recent bullishness could unravel in the next few days. Additionally, important impending indicator releases could push the pair into a freefall.

Firstly, a look at the daily chart shows that a Gartley Bat pattern is nearing completion around the 1.11 handle. Bat patterns such as this typically precede bearish reversals which might take the market by surprise given the strongly bullish daily EMA’s. However, looking at the hourly chart tells a somewhat different story. At this timeframe, the 12 and 20 period EMA’s are on the cusp of a crossover which could be showing that the general bullish trend is about to reverse. This outcome would be in line with what one would expect given the relatively robust Gartley Bat pattern.

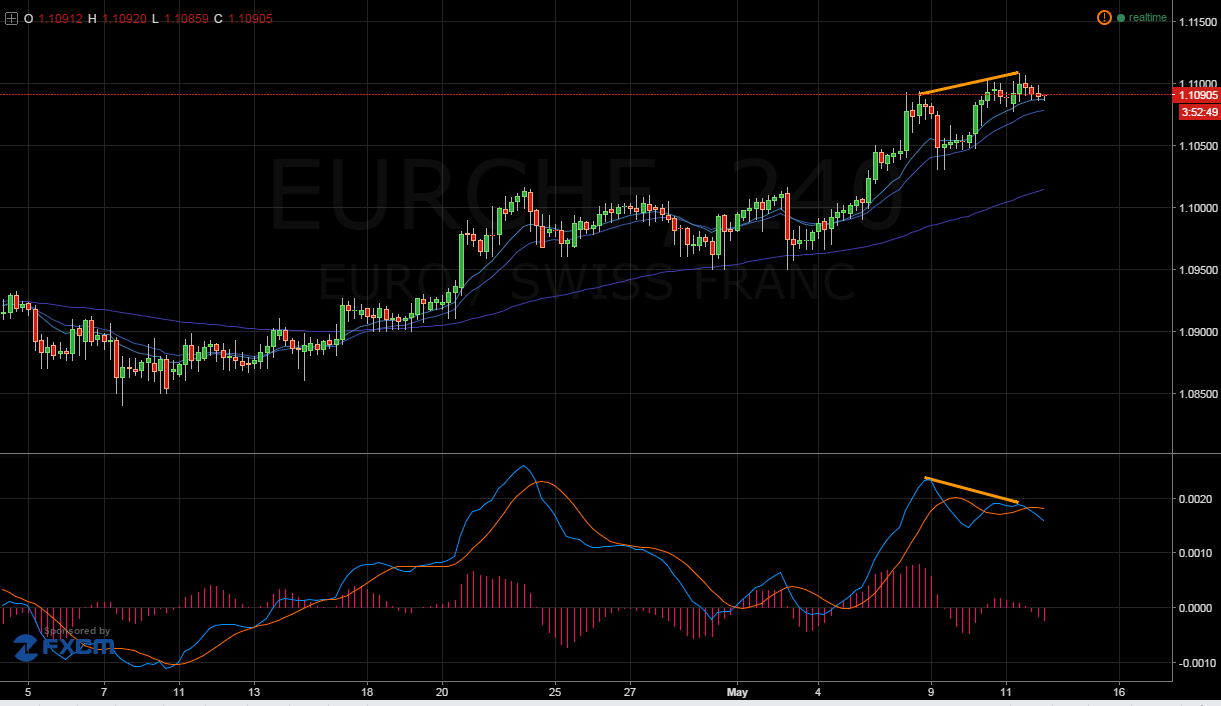

Furthermore, the stochastic oscillator is presently overbought which is providing strong resistance around the 1.11 handle. Consequently, the EUR/CHF is unlikely to extend gains much further unless fundamental result releases interfere with the pattern’s completion. What’s more, momentum appears to be shifting from bullish to bearish as a crossover has occurred on the H4 MACD oscillator.

Also shown on the H4 chart MACD oscillator, a divergence has formed which could be signalling a trend reversal. Additionally, the divergence is present on the H1 chart as well and the price is beginning to trend lower as a result. Moreover, the recent commitment of traders report is showing that large speculators are moving into long positions on the CHF. In fact, a crossover of the large speculators and commercial trader’s positions could be heralding a major reversal event.

Ultimately, there are a number of compelling indications that the EUR/CHF is poised to have a major trend reversal. Primarily, a robust bearish bat pattern has just completed around the 1.11 handle which should begin to exert selling pressure as liquidity increases later in the session. Additionally, stochastics are strongly overbought which will be acting as a strong zone of resistance. Finally, a relatively clear divergence is occurring on the H4 chart and this could be the trigger needed to set the pair plummeting. However, keep watch on fundamental releases in coming days as they could upset the downtrend, this is especially likely if EU GDP figures come in exceptionally strong.